Gold, XAU/USD, Treasury Yields, Real Yield, US Dollar, Fed, Debt Ceiling – Talking Points

- The gold price has succumbed to US Dollar strength of late with the Fed in focus

- Treasury yields and real yields continue to elevate and might add to dollar demand

- If Washington resolves the debt ceiling issue, where will XAU/USD end up?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The gold price slid to a 2-month low to start the week as concerns around the US debt ceiling appear to be subsiding at the same time that US yields are ticking higher.

Treasury yields have been steadily climbing throughout the last few weeks across the curve, but the most notable changes have been seen at the short end of the curve.

The benchmark 2-year bond made a run above 4.60% on Friday after having dipped to 3.66% earlier this month.

The 1-year note also made a 23-year high on Friday when it nudged 5.30%. It touched 4.03% in early March and the higher rate of return reflects the markets’ perception that the Federal Reserve is less likely to be cutting rates this year. Interest rate swaps and futures markets have kicked that concept into 2024.

The higher return from US Dollar denominated debt seems to have broadly supported the ‘big dollar’.

It is making multi-month peaks against many currencies and the commodity complex is generally lower but silver managed to notch up a decent rally on Friday. Although it still finished down for last week and it is steady to start this week near US$ 23.30 an ounce.

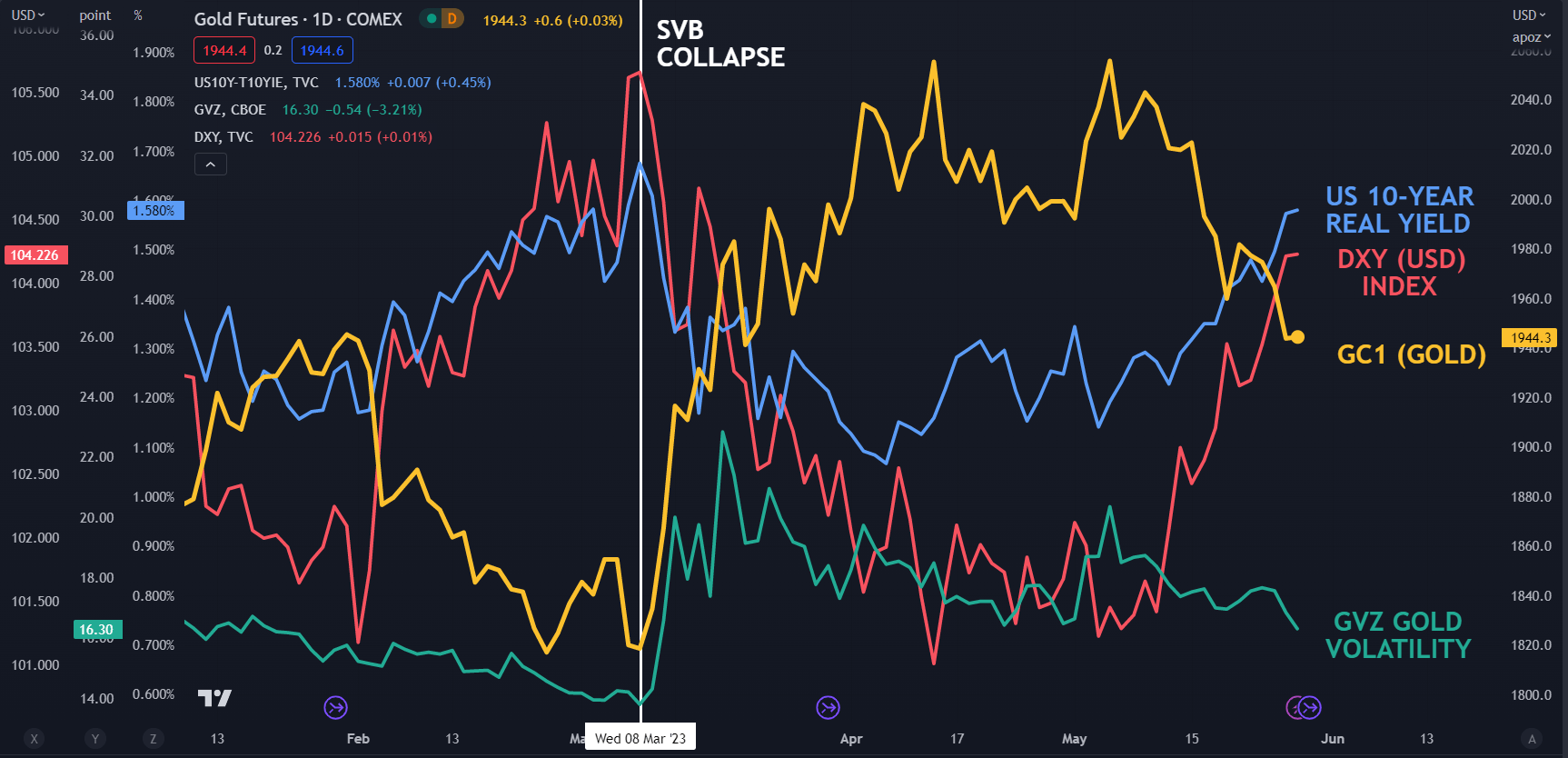

Undermining the yellow metal is the rise in US real yields. The real yield is the nominal yield less the market-priced inflation rate derived from Treasury inflation-protected securities (TIPS) for the same tenor.

The widely watched US 10-year real yield is approaching 1.60%, a level not seen since the regional banking crisis unfolded back in March. When the inflation-adjusted return is rising, investors are left to ponder the outlook for non-interest-bearing commodities such as gold.

The US Dollar has been on a steady run higher of late and the direction in the DXY (USD) Index might lead the precious metal on its next move. At the same time, gold volatility has been slipping and this may indicate that the market is at ease with the current pricing.

Recommended by Daniel McCarthy

How to Trade Gold

GC1 (GOLD FUTURES), US 10-YEAR REAL YIELD, DXY (USD) INDEX, GVZ (GOLD VOLATILITY)

Chart created in TradingView

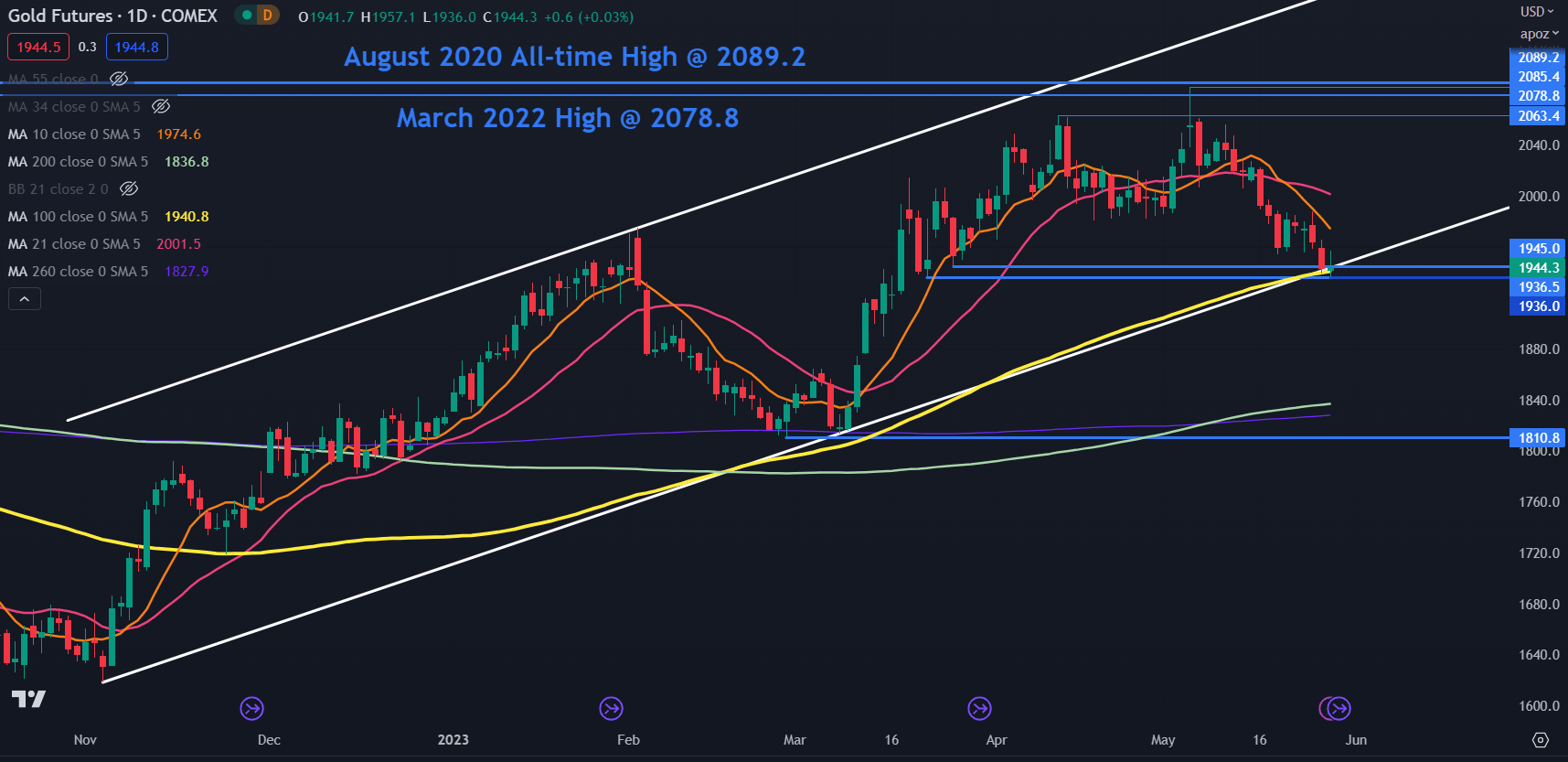

GC1 (GOLD FRONT FUTURES CONTRACT) TECHNICAL ANALYSIS

Gold remains in an ascending trend channel that began in November last year but is currently testing the lower bound of that channel.

The early May high of 2085.4 eclipsed the March 2022 peak of 2078.8 but was unable to overcome the all-time high of 2089.2. This failure to break new ground to the upside has created a Triple Top which is an extension of a Double Top formation.

This has set up a potential resistance zone in the 2080 – 2090 area but a snap above those levels may indicate evolving bullishness. The next level of resistance could be at the upper ascending trend channel line that is currently near 2160.

On the downside, the price is at an interesting juncture with the ascending trend line being questioned. At the same time, there are two prior lows near that trend line as well as the 100-day Simple Moving Average (SMA).

A clean break below 1930 might see a bearish run unfold but if these levels hold, it may suggest that the overall bull run could continue. In this regard, the price action in the next few sessions might provide clues for medium-term direction.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter