Gold Technical and Fundamental Forecast: Neutral

- Waning volatility favours the current trading range as gold ETF receives inflows

- Event risk ahead: FOMC, services PMI and NFP data could all provide the catalyst needed to breakout of the current trading range

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Find out what the precious metal has in store

The neutral outlook for gold this week centers around the fact that the commodity has been trading within a range for two weeks now, showing little sign of breaking out. Significant event risk like the FOMC meeting and NFP data could however provide the impulse needed to breach the range. Ultimately, in the absence of a pick up in volatility, gold prices appear content to oscillate ack and forth for the time being.

Waning Volatility Favours the Current Trading Range as Gold ETF Receives Inflows

Gold’s price action over the last two weeks has the precious metal trading within a broad range between $1970 and $2008. With expected volatility – measured by the CBOE volatility index (GVZ) – on the decline, it would appear that the current consolidation shows no signs of changing. That is of course unless next week’s event risk has anything to say about that – more on this later.

CBOE Gold Volatility Index (GVZ)

Source: TradingView, prepared by Richard Snow

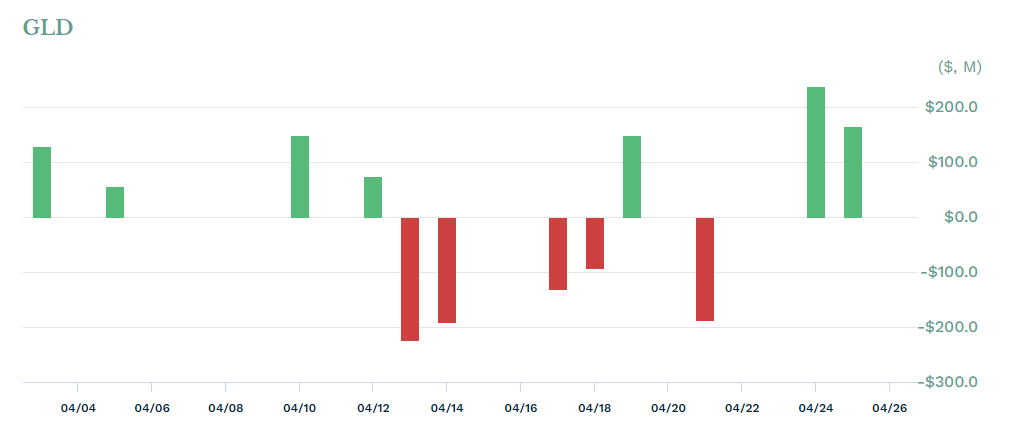

While gold shows little sign of attempting to trade back towards the April high of 2048.80, it has nonetheless benefitted from inflows into the world’s largest ETF, SPDR Gold Trust (GLD).

SPDR Gold Trust (GLD) ETF Inflows

Source: TradingView, prepared by Richard Snow

Gold Technical Analysis

On the weekly chart, gold has clearly traded lower ever since tagging the upper bound of the ascending channel and now appears to be holding up, above the medium term trendline support. The longer-term uptrend however remains bullish as price action is yet to reveal indications of a reversal. Resistance appears at $2050 with support at around $1956.

Gold (XAU/USD) Weekly Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

The daily chart helps to view the range that prices have largely traded within over the last two weeks. The consolidation zone spans from $1970 to $2008. Any close outside of the range would warrant closer attention in the event of a breakout/breakdown. Support comes in at $1960, while a breakout above $2008 brings the swing high of $2048.80 into focus.

Gold (XAU/USD) Daily Chart

Source: TradingView, prepared by Richard Snow

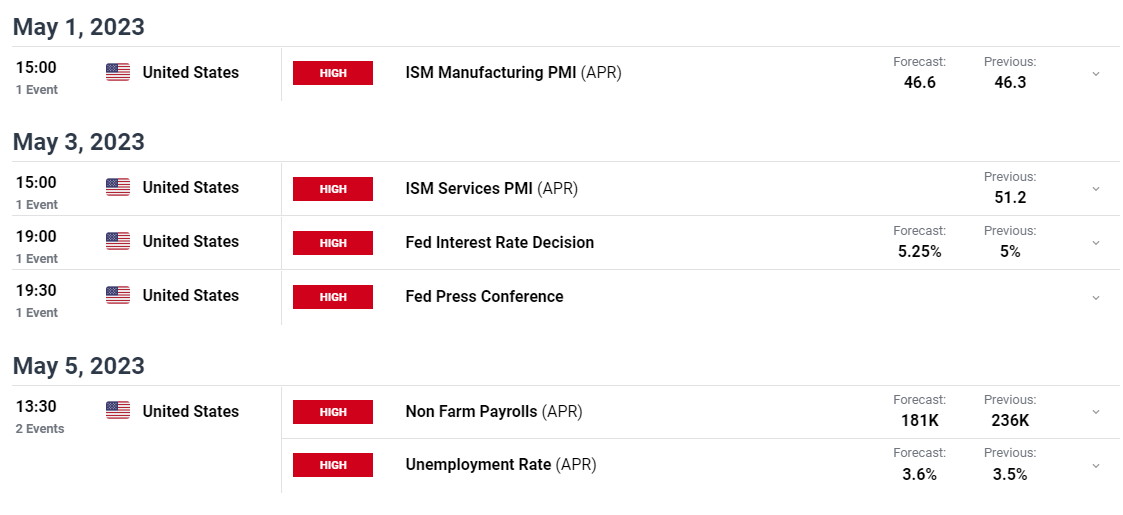

Important Event Risk for the Week Ahead

Seeing that gold has a correlation to dollar prices, it is only prudent to consider the high impact event risk next week as there as certainly a lot of it. The most crucial of these will be the FOMC rate decision where market perceptions of a hawkish message could weigh on the precious metal’s price. Given the forward-looking nature of market participants, I find it unlikely that the Fed will categorically state that they will effectively pause interest rates if we are indeed going to see a 25-basis point hike. Instead, it appears more likely they’ll decide to maintain an open mind when it comes to further hikes which will depend on incoming data.

In addition, US non-manufacturing (services) ISM data will be monitored closely after the rather disappointing Q1 GDP data, even if the underlying data within the report wasn’t as bad as it seemed on the surface. The services sector has been one of the shining lights within the US economy so any signs of stagnation could drive the dollar lower and the opposite holds true to a lesser degree. Then finally on Friday we get Non-farm payroll data as the labour market continues to grow.

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Stay up to date with the latest moves in major assets

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX