Gold, XAU/USD, US Dollar, Bank Deposits, Fed, Liquidity, Real Yields – Talking Points

- The gold price has maintained its position above USD 1,900 today

- The deliverance of deposits for First Republic has calmed markets for now

- If a crisis has been averted, will Fed hawkishness resume to test gold’s resolve?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The gold price is steady so far on Friday as traders take stock of a whirlwind week that has favoured the precious metal. The maelstrom engulfing other markets has led to demand for perceived haven assets such as gold.

News overnight saw First Republic Bank receive USD 30 billion in deposits from a consortium of 11 other banks.

JP Morgan, Citibank, Bank of America and Wells Fargo deposited USD 5 billion each while Goldman Sachs and Morgan Stanley placed USD 2.5 billion each. Other banks will contribute a smaller amount. It is being reported that these larger banks have seen a surge in deposits as clients exited exposure to small and regional banks.

Recommended by Daniel McCarthy

How to Trade Gold

Markets also seemed to find some comfort in the news of a huge run-up in US banks going to the Federal Reserve’s discount window.

In the week ended Wednesday 15th March, banks borrowed USD 152.85 billion from the lender of last resort, up from less than USD 5 billion for the week prior. It eclipsed the previous all-time high of USD 111 billion seen in the 2008 global financial crisis.

Additionally, the new Bank Term Funding Program (BTFP) which was announced last weekend, was tapped for almost USD 12 billion.

On the one hand, this serves to reassure depositors and shareholders that the banks have enough liquidity at hand to see out the storm. On the other hand, it reveals the extent of the crisis of confidence within the industry.

For gold, an increase in anxiety around the depth of problems within the banks might lend support. If the rescue packages already are enough to stem the tide then the market could go back to focussing on other factors that may impact the yellow metal.

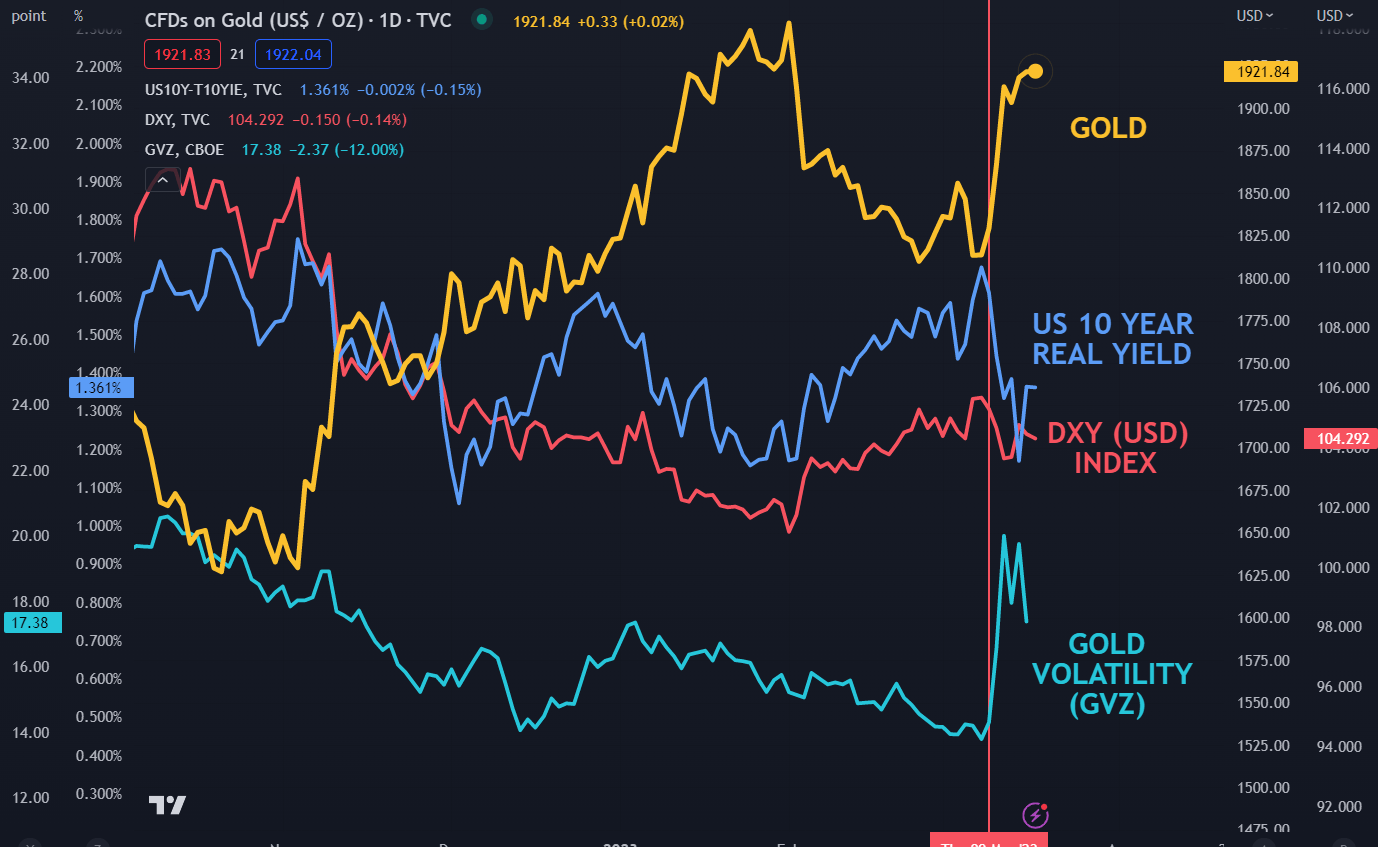

US real yields recovered on Friday after tanking earlier in the week. This might reflect the perception that the liquidity measures announced so far may have restored some calm.

With inflation still way above target, the aggressive downward revision in the Fed’s rate hike cycle might reverse if that is the case.

A resumption of higher US yields could support the US Dollar, potentially undermining gold in that scenario.

GOLD AGAINST US DOLLAR (DXY), US 10-YEAR REAL YIELDS AND VOLATILITY (GVZ)

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter