Gold (XAU/USD) Analysis

- US dollar and yields remain central ahead of US CPI print

- Gold set for weekly decline as price action hovers around key 200 DMA

- US CPI remains the key risk in the week ahead as the Fed prepares for next meeting

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

US Dollar and Yields Remain Central Ahead of US CPI Print

Gold continues to reflect a considerable negative correlation with USD and US treasury bond yields in a week that may pose little challenge to the greenback’s recent gains. A hotter services PMI print alluded to the continuing momentum of the US economy despite early signs in last months print (lower new orders and business activity/production in July).

With Citigroup’s economic surprise index remaining elevated compared to its peers, the US appears likely to see further surprises to the upside which bodes well for the US dollar. The US 10-year treasury yield has also pressured gold this week and despite a late dip, appears set to record a weekly advance – weighing on gold.

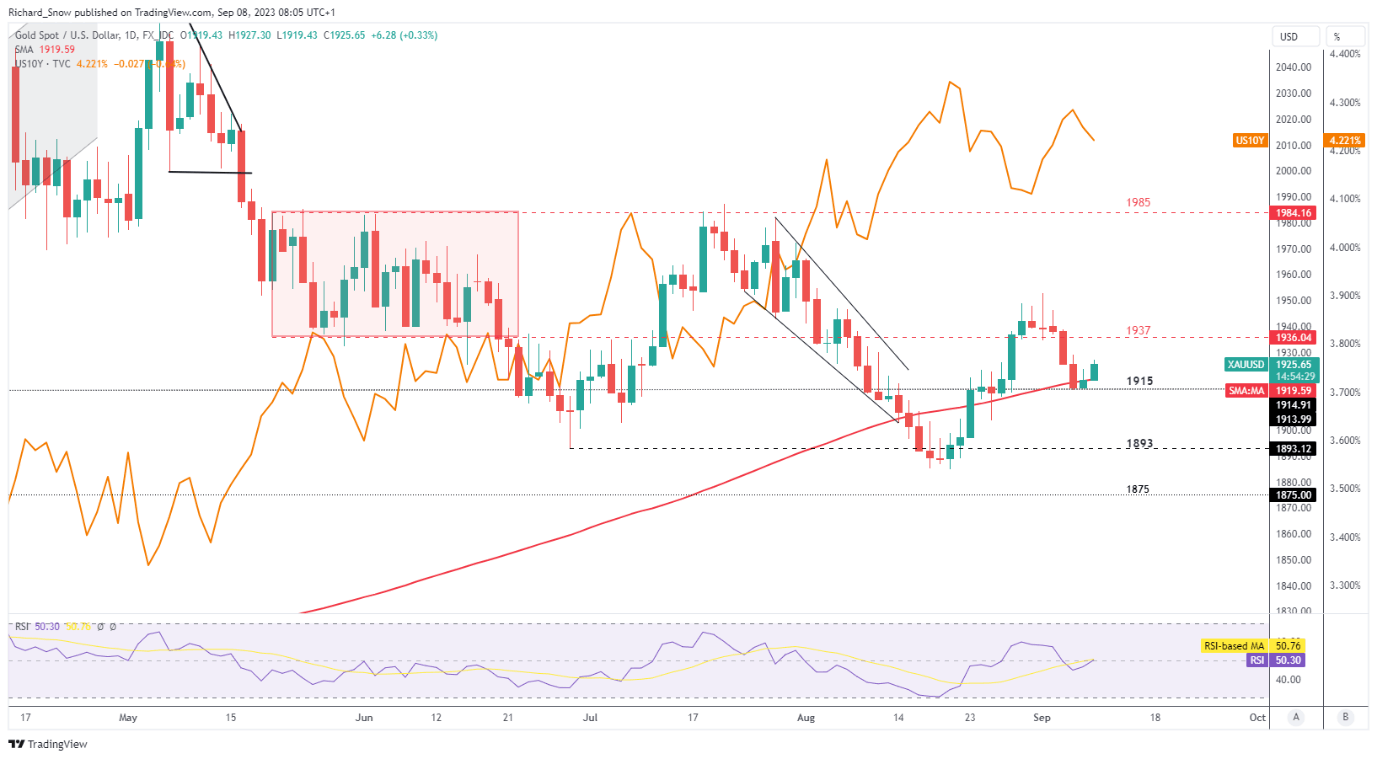

Gold has respected the $1915 level of support and currently trades marginally above the 200-day simple moving average (SMA). Gold’s shorter-term direction is likely to remain sensitive to incoming data as the Fed gets closer to reaching peak rates, assuming we aren’t already there. If CPI posts a beat to the upside, markets may to look more favourably towards the possibility of that final 25-bps hike before the Fed is likely to reach its interest rate peak. The opposite holds the same logic where a lower print reduced the urgency to restrict financial conditions further, providing temporary relief for gold.

Gold Daily Chart with US-10 Year Yield (orange line)

Source: TradingView, prepared by Richard Snow

There are many factors that influence the price of gold making it one of the most interesting asset classes to study. Get to know the ins and outs of gold trading by reading our comprehensive guide below:

Recommended by Richard Snow

How to Trade Gold

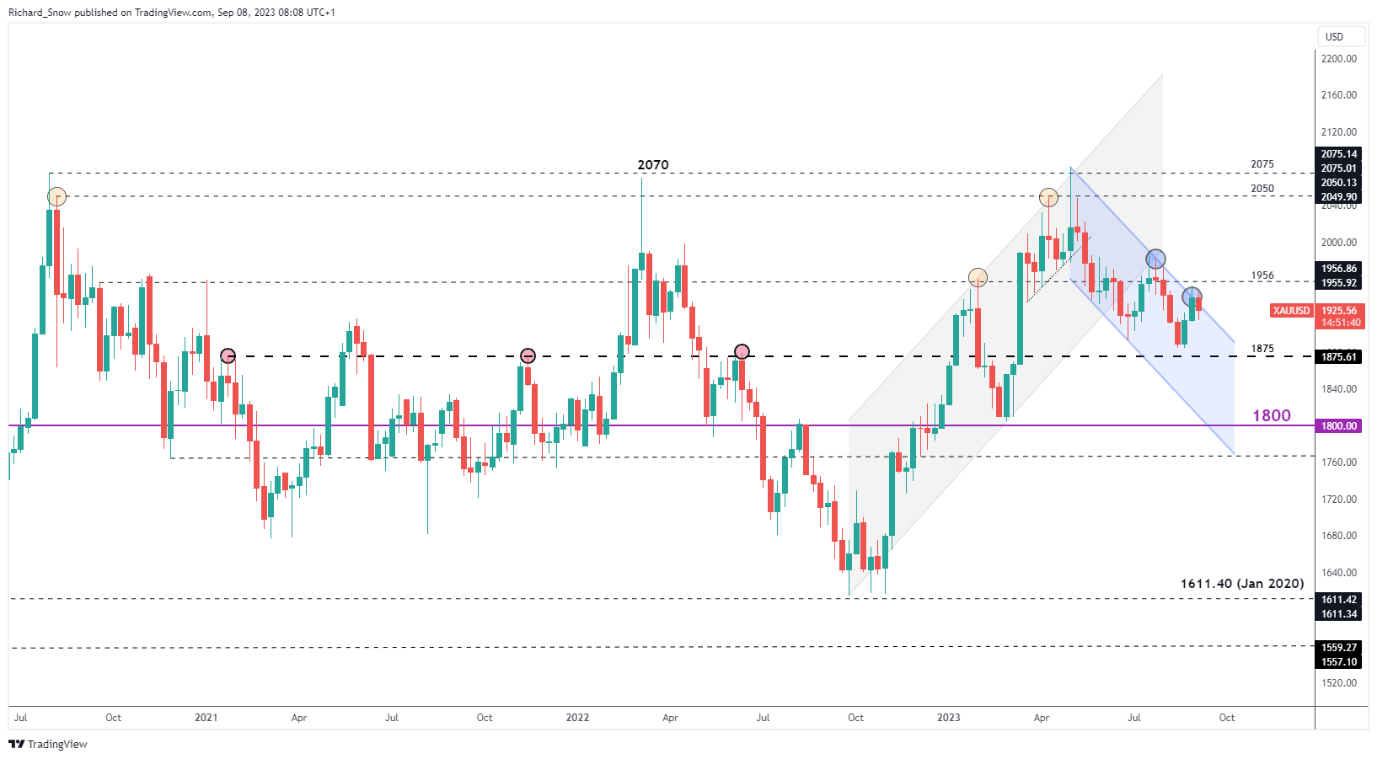

The weekly chart reveals the threat of an upside breakout after prices started this week above channel resistance but has since traded lower. The descending channel suggests that gold prices may find it difficult to see large moves to the upside. $1956 remains the level to watch if a longer-term bullish move is to develop. In the absence of that, $1875 is the level of support to the downside.

Gold Weekly Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Traits of Successful Traders

Major Dollar-Focused Risk Events Ahead

Today represents the last day for Fed officials to provide an opinion on policy matters ahead of the media blackout period beginning tomorrow. Yesterday Chicago Fed President Austan Goolsbee was hopeful of achieving a ‘golden path’ but stressed inflation is too high and that the Fed’s broad view is that interest rates will need to remain high for a relatively extended period. His colleague John Williams pointed to a more balanced labour market and slowing wage growth as signs that current policy is having an effect but reiterated that more data is still to come (US CPI next week).

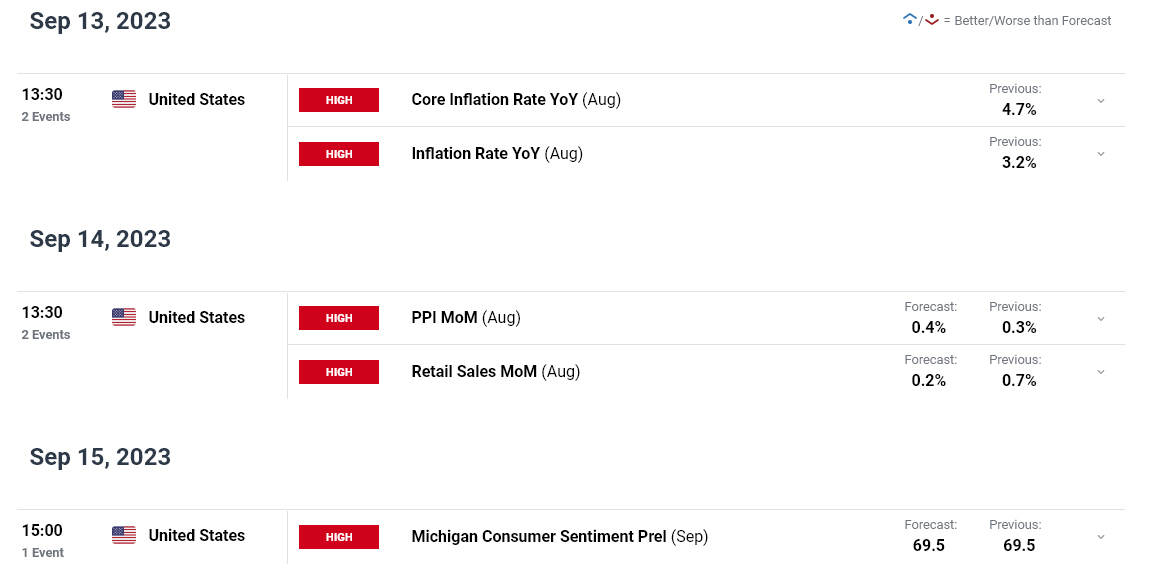

Next week Wednesday is the big one where we get further insight into US inflation a week before the Fed meeting. PPI data has also been known to cause dollar repricing in the past as PPI dynamics tend to lead CPI trends. US retail sales for August will then provide more insight into the strength of consumer appetite at a time when higher interest rates are meant to constrain spending. However, with an unemployment rate of under 4%, there is still a lot of money changing hands.

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX