Gold Weekly Forecast: Neutral

- Gold price shaped by Middle East Conflict to end the Week

- The prospect of de-escalation and the potential for positive earnings may allow a brief reprieve from overbought conditions

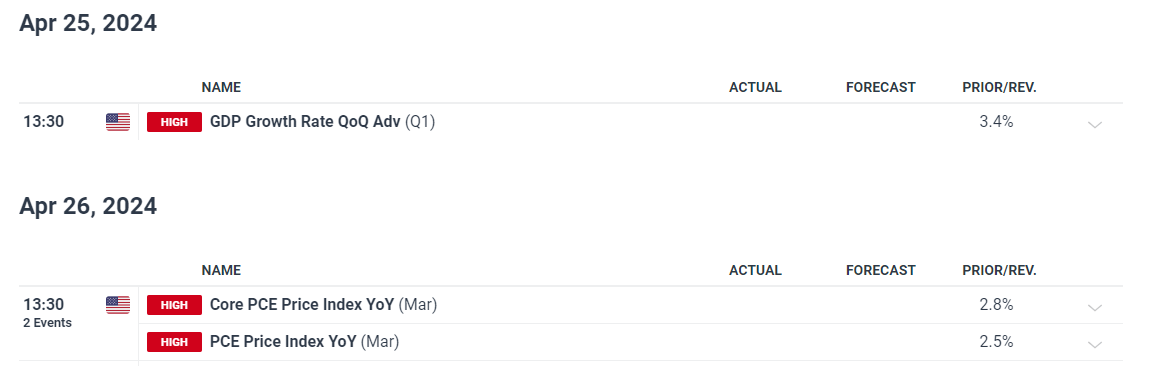

- US data returns as Q1 GDP and PCE inflation headline next week’s calendar

- Empower yourself to make informed trading decisions this quarter – download our Gold Q2 forecast

Recommended by Richard Snow

Get Your Free Gold Forecast

Gold Price Shaped by Middle East Conflict to end the Week

Gold is a well-known safe haven and has acted like one during the latest phase of the conflict in the Middle East involving Israel and Iran. In the early hours of Friday morning, the precious metal spiked higher as reports of explosions in Iran spread. Israel has communicated that it would respond after hundreds of Iranian drones targeted the nation but proved mostly ineffective in the end.

The international community watched on, hoping for a de-escalation which may be on the cards as Iran appears not to have any immediate plan to retaliate, according to a senior Iranian official – Sky News.

In fact, reports out of Iran have brushed off that this was an attack and prefer to call it an infiltration rather than an attack as no major damage was reported.

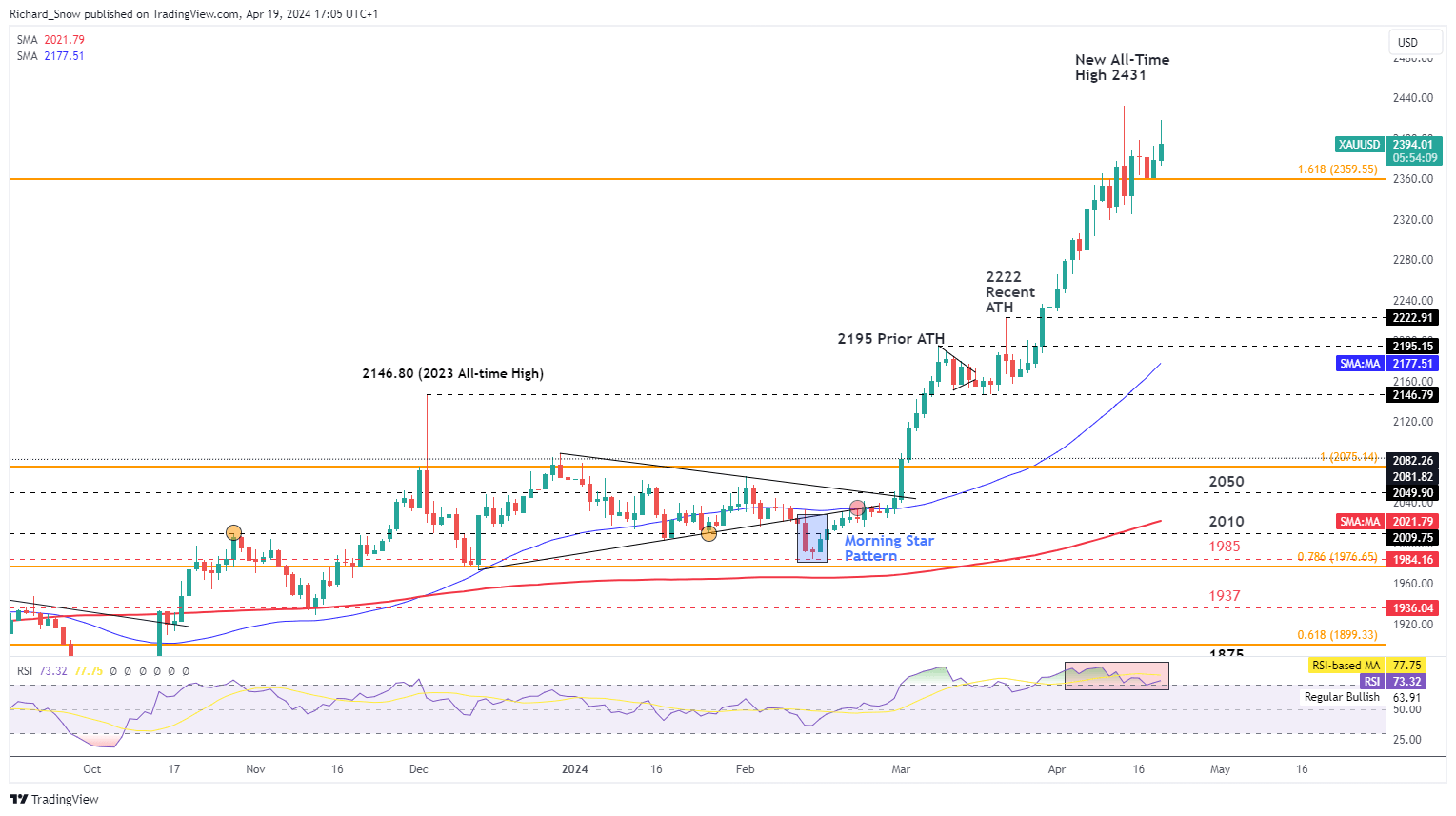

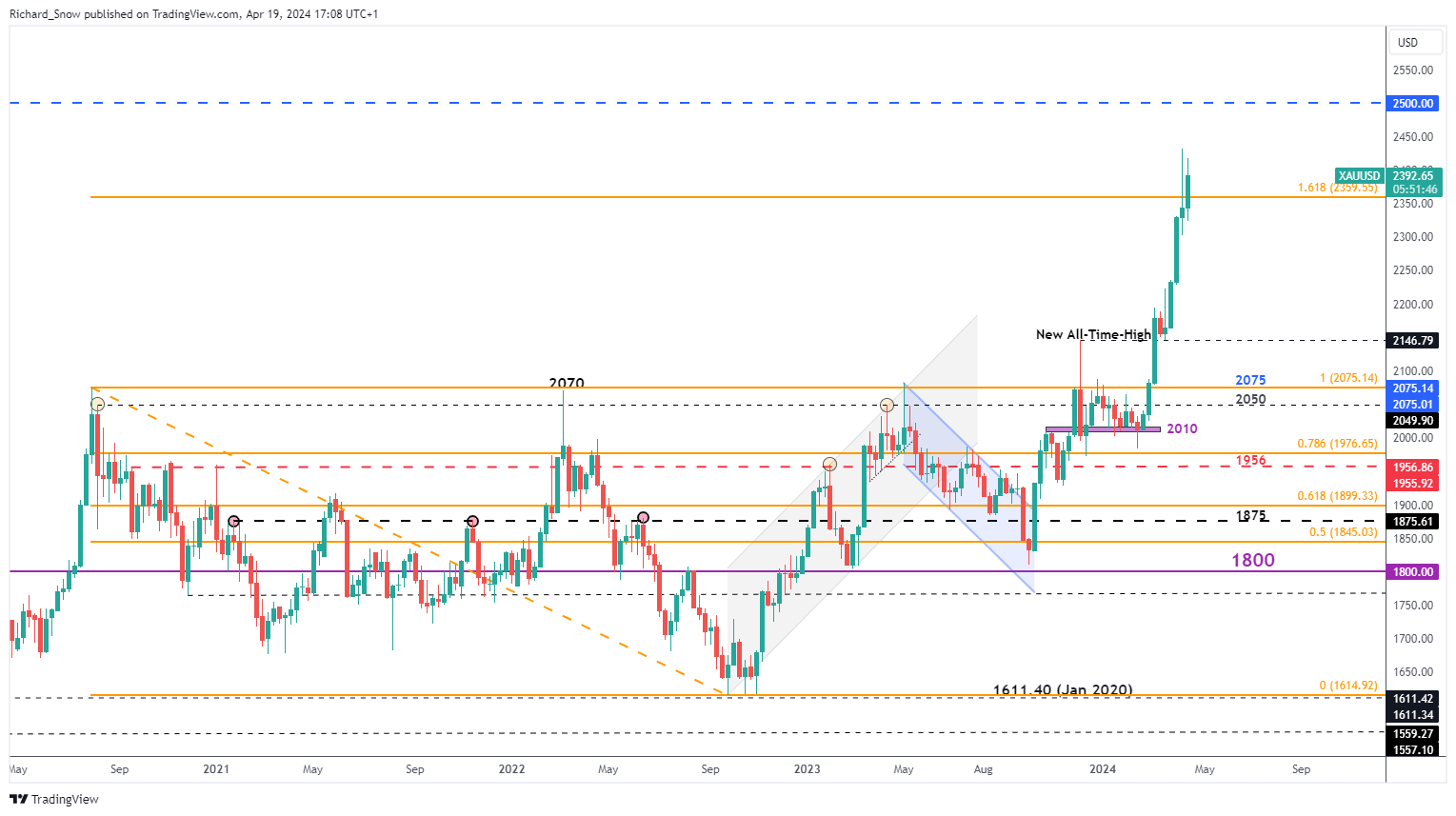

Nevertheless, gold prices spiked higher and as more detail emerged, eased throughout the morning. Later on in the day, gold appeared to revert back into its upward trajectory, looking to close the week higher for a fifth consecutive time. Gold trades above the 1.618% Fibonacci extension of the major 2020-2022 move ($2360) and a weekly close above this level reinforces the solid uptrend and a retest of the all-time high and potentially another push higher, towards $2500.

Gold (XAU/USD) Daily Chart

Source: TradingView, prepared by Richard Snow

However, US tech stocks and even AI-focused stocks are due to announce earnings for the first quarter of the year which may help risk assets halt the sell-off if the overall mood is positive. With the Fed likely to delay rate cuts, potentially to next year, US equities have endured the sharpest pullback since the impressive bull run began in October last year.

Therefore, with the prospect of de-escalation and the possibility of encouraging earnings reports, gold may finally recover from overbought conditions and consolidate. It must be noted that the bull trend is very much still in play over the more medium-term but next week could see the metal’s impetus dampened to a degree all else equal.

Gold (XAU/USD) Weekly Chart

Source: TradingView, prepared by Richard Snow

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the second quarter!

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

Major Event Risk on the Horizon: US Data Returns to Prominence

There are a number of important data points next week including Australian CPI, EU flash PMI data and the Bank of Japan meeting but the most relevant data for gold, lies with the US GDP and PCE figures.

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX