Gold Technical and Fundamental Forecast: Bullish

- Investors find safety in gold on renewed banking fears

- Gold prices supported by market expectations of rate cuts and safe-haven qualities

- Gold’s key technical levels after reaching all-time high, $2008 and the 20 SMA come into focus

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

See what our analysts foresee in Q2 for gold

The bullish tag accompanying this weekly forecast was arrived at after considering the market moving potential of the renewed regional bank instability and the potential for softer fundamental data in the US. Accumulative tightening via multiple hikes in the Fed funds rate, quantitative tightening, and tighter credit conditions (a result of banking instability) asserts downward pressure on economic activity and prices. Headline inflation has fallen nicely but core inflation needs to follow suit next week when the April CPI data is released. Market implied rate cuts continue to be priced in for H2, which bodes well for the non-interest bearing metal.

Investors Fled to Gold and Other Safe-Havens on Renewed Banking Fears

Despite a rather drawn-out process, markets could see that First Republic Bank was inevitably going to be resolved last weekend and in the early hours of Monday morning a deal was done, with JP Morgan seen as the best candidate to take on depositors. However, just a day later, the US regional banking index dropped lower as PacWest Bancorp and Western Alliance witnessed a renewed sell-off in their respective share prices.

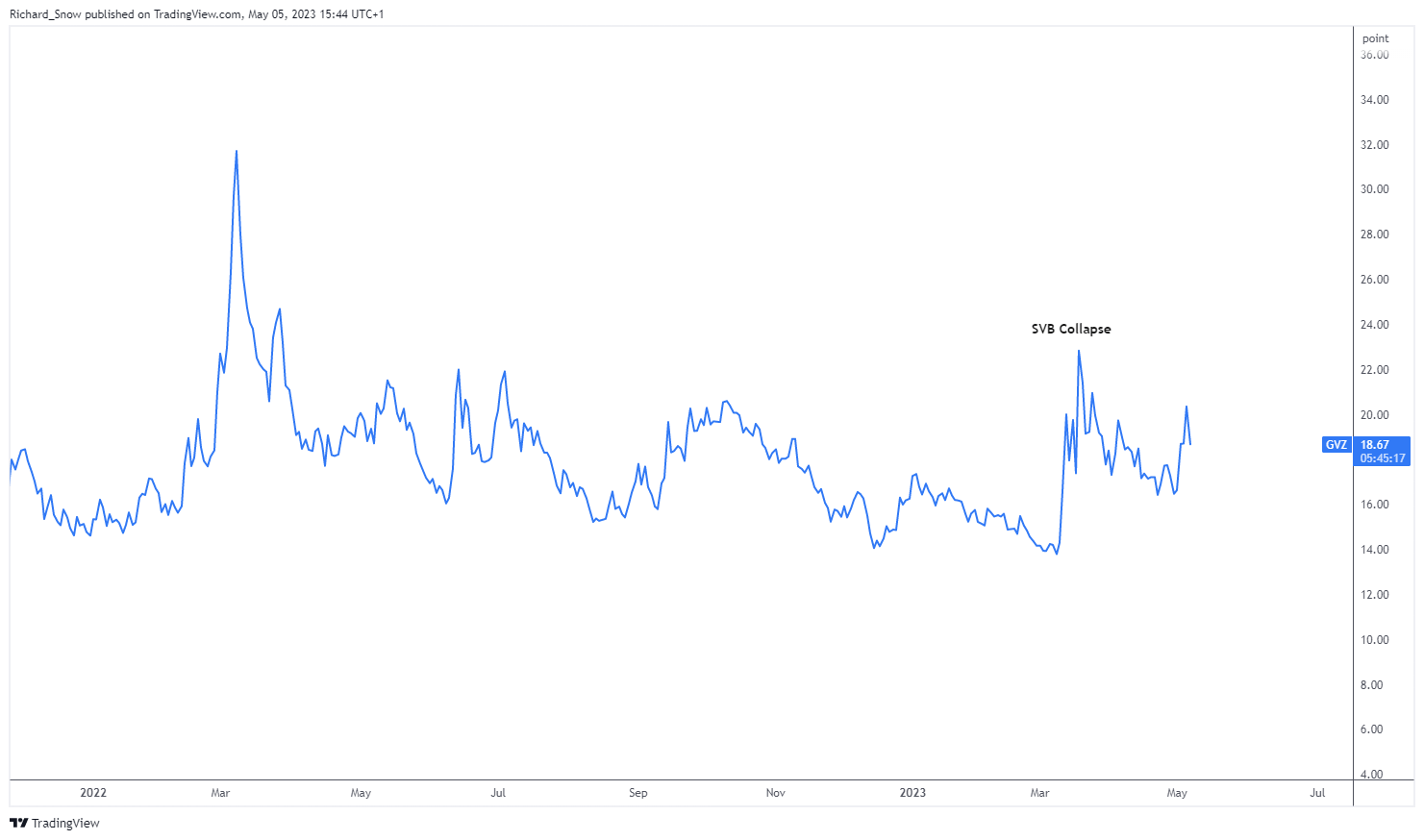

Mass uncertainty swept across markets once again and investors quickly piled into gold. The gold volatility index (GVZ) turned sharply higher and just a day later the precious metal printed a new all-time high around $2081.80 an ounce. Gold emerged as an attractive alternative for being both a safe-haven and beneficiary of a lower interest rate environment currently priced in.

Implied 30-Day Gold Volatility via the CBOE

Source: TradingView, prepared by Richard Snow

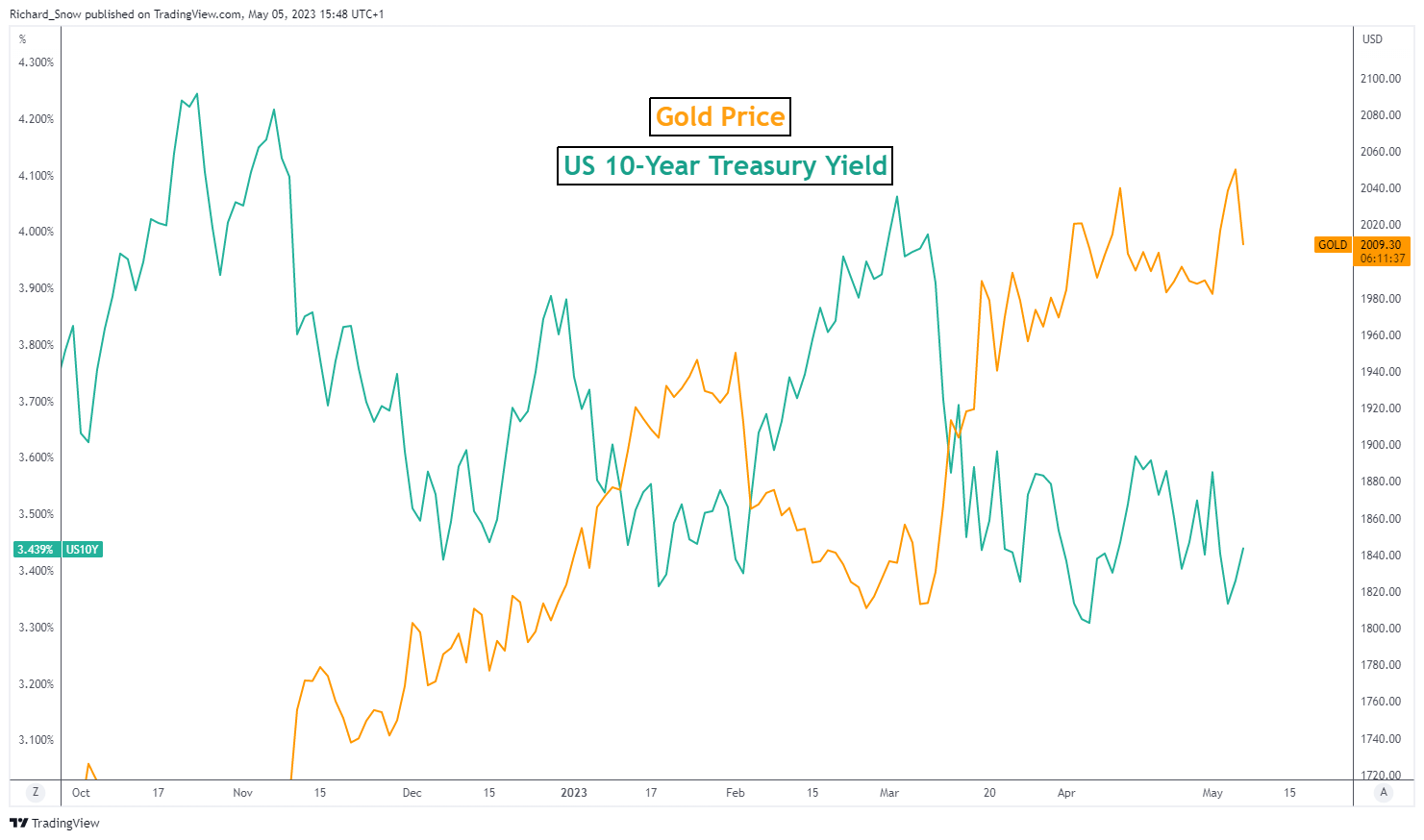

Historically, gold has exhibited a strong negative correlation to US treasury yields, particularly the 10-year, which headed lower at the start of the week. If markets anticipate a lower Fed funds rate, treasuries typically follow the same path meaning declining yields are set to support gold prices going forward. All of this depends on core inflation and whether the Fed can stop the domino effect of bank failures currently taking shape.

Gold Prices Exhibiting a Negative Correlation with US 10-Year Treasury Yields

Source: TradingView, prepared by Richard Snow

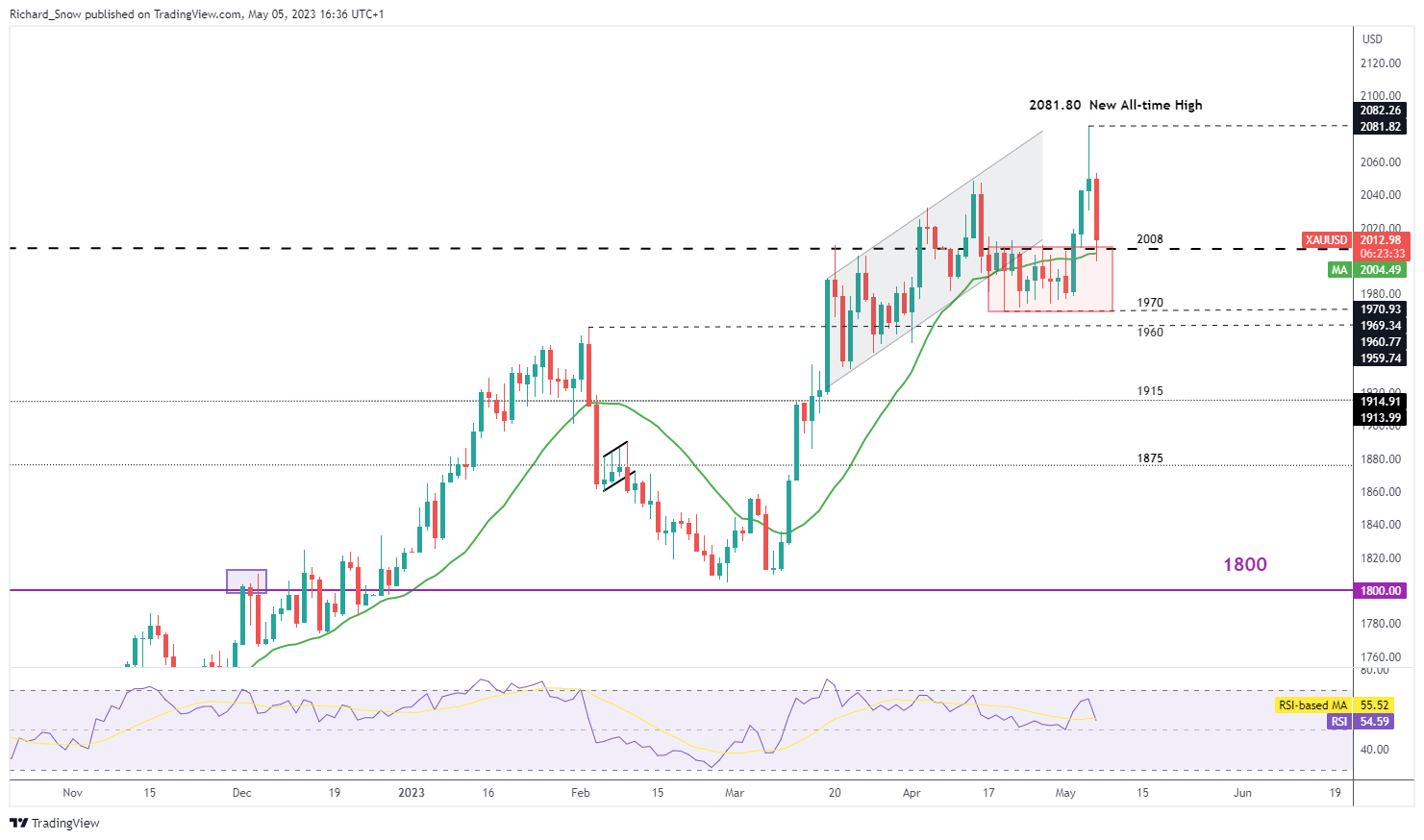

Gold Pulls Back Heavily After Printing New All-Time High

Gold appeared like a runaway market until the significant and immediate pullback after reaching a new all-time high on Thursday. The pullback itself is unsurprising given the magnitude of the bullish advance but as of Friday after the NFP surprise, the move gained pace has already reclaimed around two thirds of the initial advance.

While the longer-term outlook remains bullish, traders will be monitoring how deep this pullback will go. At the moment, prices are hovering above $2008 with the 20-day SMA not far below that. In the event the pullback engulfs the entire bullish advance, the underside of the prior channel of consolidation comes into focus at $1970.

Upside levels have become quite tricky given the speed at which prices have moved but at the moment the psychological level of $2050 before the all-important $2081.80.

Daily Gold Price Chart Showing Massive Pullback from ATH

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Learn the #1 mistake traders make and how to avoid it

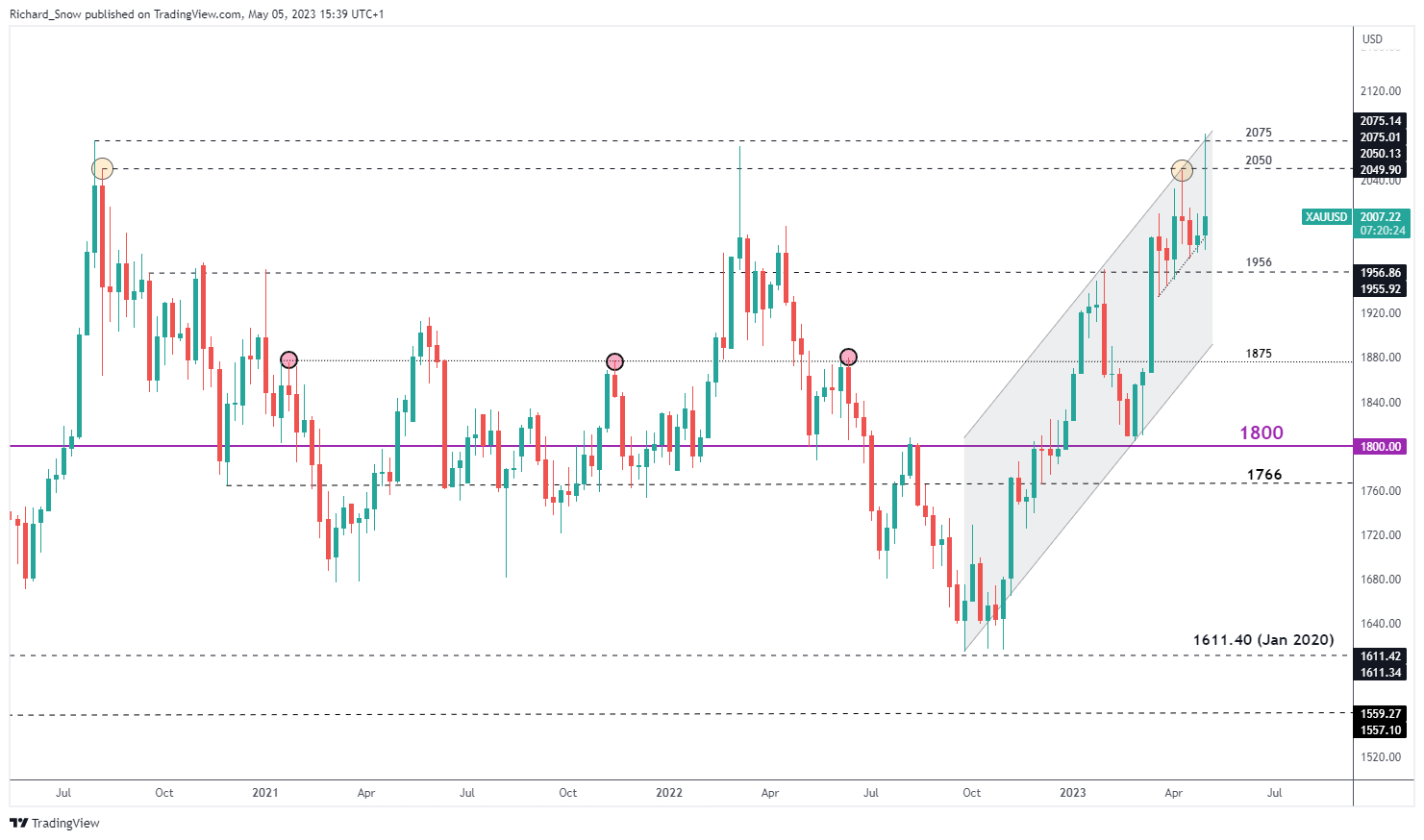

The weekly chart helps to inform the longer-term view on gold where the precious metal remains within an ascending channel after tagging the upper bound and now trades around the medium term trendline support (dotted line).

Weekly Gold Price (XAU/USD) Maintaining Long-Term Bullish Trend

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX