Hang Seng Index, HSI, China, CCP, US Dollar, Crude Oil, Gold – Talking Points

- The Hang Seng Index responded to the possibility of more stimulus

- Broader Chinese markets also bounced in anticipation of a business-friendly outlook

- If the Fed is less hawkish tomorrow, will that further lift Hong Kong’s HSI?

Recommended by Daniel McCarthy

Traits of Successful Traders

The Hang Seng Index (HSI) roared more than 4% higher today after dipping almost 2% on Monday.

The rally comes in the aftermath of the Politburo gathering over the weekend. The details of which only came to light late yesterday and lifted Chinese-listed American Depository Receipts (ADR) in the New York session.

The main thrust of the Communist Party of China’s Central Committee held symposium is that there has been an acknowledgement that more needs to be done to boost the economy.

However, there have not been any specific details on exactly what type of stimulus measures will be undertaken at this stage.

Nonetheless, all the mainland China and Hong Kong bourses swelled on the prospect with the Hang Seng China Enterprises Index leading the way, posting gains of over 5% on Tuesday.

Other APAC equity indices were mixed on smaller moves ahead of tomorrow’s Federal Open Market Committee (FOMC) meeting.

Treasury yields have been mostly unchanged although the yield on the 2-year note slipped below 4.85% after trading at 4.92% yesterday.

The US dollar is slightly weaker across the board while the Australian Dollar has been the best-performing currency, encouraged by the news out of China.

EUR/USD has steadied after falling following weak PMI data in Europe compared to the US yesterday.

Crude oil has held onto overnight gains with the WTI futures contract is near US$ 79 bbl while the Brent contract is around US$ 83 bbl. Spot gold is oscillating around US$ 1,960 at the time of going to print

Looking ahead, after Germany’s IFO business survey, the US will see the results of the Conference Board Consumer Confidence household survey.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

The Fundamentals of Range Trading

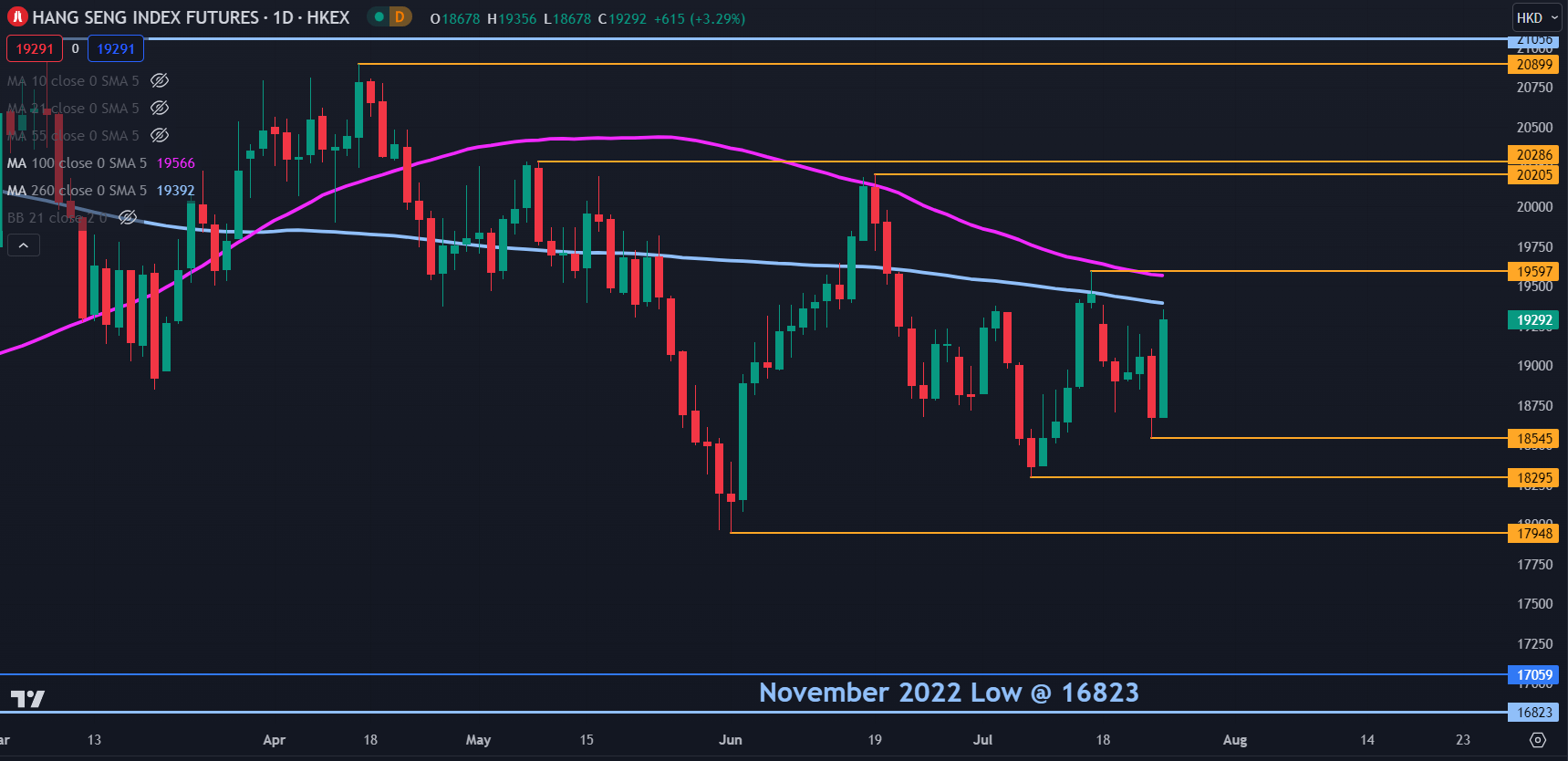

HANG SENG INDEX TECHNICAL ANALYSIS

Hong Kong’s Hang Seng Index (HSI) made large gains today, but the overall picture is that of a narrowing range-trading environment.

Resistance could be at the nearby 100- and 260-day simple moving averages (SMA) currently in the 19390 – 19570 area, just ahead of the recent high near 19600.

On the downside, the prior lows of 18545, 18295 and 17948 may provide support.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter