JAPANESE YEN KEY POINTS:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

JAPANESE YEN Q1 RECAP

The Japanese Yen has had an interesting Q1 to say the least with the Yen starting the quarter looking vulnerable against the Greenback. The US Federal Reserve looked set to continue on an aggressive hiking cycle while the Bank of Japan looked set to continue down its easy monetary policy path.

February turned out to be a difficult month for the Yen as it posted steep losses against the US Dollar. The losses were compounded by the rising odds for a higher peak rate from the US Federal Reserve as US data came in better than expected for the majority of February. Late February was the start of the Yen’s recovery with March seeing the Banking sector woes accelerate the decline in USDJPY as the pair declined some 700-odd pips since February 28.

As we head into Q2 the Yen is basically flat against the Greenback with the early gains made in Q1 effectively wiped out. The question we have to ask is are we going to see a continuation of the Yen’s recent comeback over the coming months? While this article focuses on the JPY Fundamental Outlook, the Technical Outlook for Q2 paints an interesting picture – Download the full Q2 forecast below:

Recommended by Zain Vawda

DOWNLOAD THE NEWLY RELEASED Q2 FORECAST FOR THE JAPANESE YEN

BANK OF JAPAN (BoJ) WELCOMES A NEW GOVERNOR AND BOJ POLICY

Q2 starts off with the Bank of Japan welcoming a new Governor in Kazuo Ueda, who will take over on April 9. The incoming Governor faces the challenging task of unwinding the complex monetary policy of the past decade. Any optimism around the appointment of Ueda, has largely faded given his comments during his nomination process before Parliament.

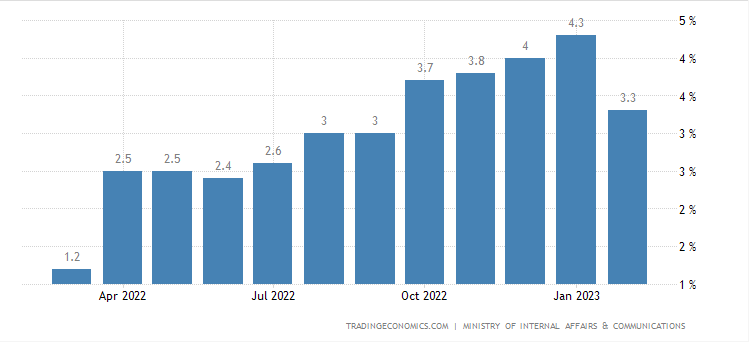

Ueda stated that at present he would like to continue ‘Abenomics’ as the Japanese economy faces rising inflation and slow wage growth. Inflation has been on a steady rise for the entirety of 2022 and continued into early 2023 before finally easing in February from four-decade highs. The February print came in at 3.3% YoY while the core consumer prices went up 3.1% YoY, the least in 5 months, matching forecasts but above the Bank of Japan’s 2% target for the 11th straight month. On a monthly basis, consumer prices declined by 0.6% in February, the first fall since October 2021. Despite this however, service prices have risen as the so-called core-core CPI (excluding fresh food and energy) accelerated further to 3.5% in February (vs 3.2 % in January). This is a sign that underlying pressures remain while the BoJ may breathe a sigh of relief as this the demand driven inflation they had been hoping for if wage growth can keep up with it.

Japan Inflation YoY

Source: Trading Economics, Ministry of Internal Affairs and Communication

A further sign of the challenges evident in the Japanese economy came in the form of the Reuters ‘Tankan’ survey which found the mood at the countries large manufacturers remained gloomy for a third straight month. The recent worry about global demand is clearly weighing on sentiment and affecting the usually formidable Japanese export sector.

JAPANESE YEN Q2 OUTLOOK – FURTHER GAINS IN STORE FOR THE YEN?

The Yen has benefitted from its safe haven appeal of late as fears of a contagion from the failure of US Banks and the struggles of Credit Suisse weighed on sentiment. We have seen calmer markets of late, however a return of fear and uncertainty could work in the Yen’s favor in Q2.

The BoJ is expected to allocate $15 billion in inflation aid ahead of the local elections in April. The measures will likely include handouts for low-income households and support for households that use liquefied petroleum gas, according to documents from the Cabinet Office. The opening of the Chinese economy coupled with a relaxation of Covid entry requirements for Japan may lead to an influx of Chinese visitors and give the economy a much-needed boost.

The incoming BoJ Governor may have reiterated his support for the easy monetary policy path however, given the rising inflation picture, aid package and potential influx of Chinese visitors, the possibility for further Yield Curve Control cannot be ruled out. According to reports PM Kishida’s administration views rigid monetary easing as problematic with the BoJ apparently monitoring the impact of Decembers widening of the control range until current Governor Kuroda’s term ends. The rise in the so-called core-core CPI (excluding fresh food and energy) in February hinted at underlying price pressures and could reignite speculation that the Bank of Japan might implement policy normalization sooner than expected. At this stage however, given the recent market turmoil surrounding the banking sector further widening of the control range remains the more likely option. This would offer further support to the Yen and lead to an appreciation for the Japanese currency.

Recommended by Zain Vawda

How to Trade USD/JPY

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda