Japanese Yen, USD/JPY, US Dollar, PBOC, Yellen, Biden US Debt Ceiling – Talking Points

- The Japanese Yen dipped after rising domestic PPI today ahead of CPI

- China’s PBOC added liquidity, but equity markets did little in response

- The US debt ceiling is creating anxiety in markets. Will it drive USD north?

Recommended by Daniel McCarthy

How to Trade USD/JPY

The Japanese Yen slid again today while the Aussie and Kiwi Dollars are firmer after large gains were seen by the US Dollar last Friday.

Japanese PPI came in above expectations at 5.8% year-on-year to the end of April rather than the 5.6% anticipated. National CPI is due for release this Thursday and a Bloomberg survey of economists is forecasting the annual headline number to be 3.5%, up from 3.2% previously.

Rising price pressure may call into question the Bank of Japan’s continuing its loose monetary policy stance.

Elsewhere today, the People’s Bank of China (PBOC) left the medium-term lending facility (MLF) rate unchanged at 2.75% but injected 25 billion Yuan of liquidity.

Despite the measure, APAC equity markets were little moved on Monday, and futures are pointing toward a flat start to the Wall Street session. Having said that, Japan’s TOPIX index is trading near its 30-year peak.

The US debt ceiling issue appears likely to be a key focus for markets this week. Over the weekend US Treasury Secretary Janet Yellen made it clear that if Congress is unable to lift it, there will be damage to the economy and financial markets.

President Joe Biden is optimistic a deal will be done, and he is expected to be meeting the Speaker of the House Kevin McCarthy on Tuesday.

The US Senate and the House of Representatives are both in session until Thursday. According to the President’s schedule, he will be in Washington until Wednesday before leaving.

If a deal isn’t done by Thursday, the logistics to achieve a satisfactory outcome could become more difficult.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Crude oil is languishing again today after sliding last week. The WTI futures contract has dipped under US$ 69.50 bbl while the Brent contract is near US$ 73.50 bbl at the time of going to print.

Gold is holding ground above US$ 2,010 an ounce and the rest of the metals complex has started the week on a positive note.

Looking ahead, there will be several speakers from the BoE, ECB and Fed crossing the wires while the Empire State Manufacturing survey will be a notable data point for markets.

The full economic calendar can be viewed here.

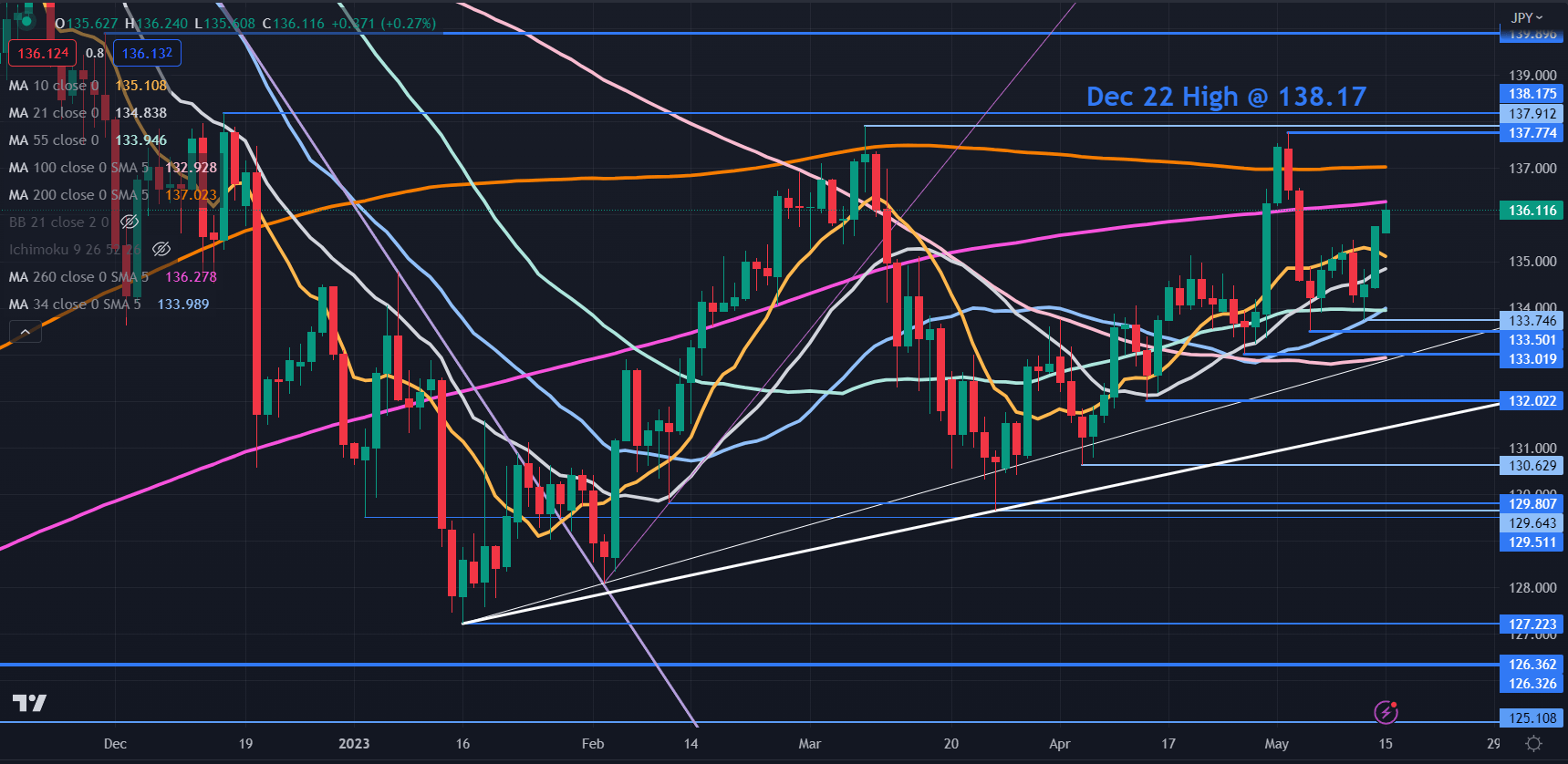

USD/JPY TECHNICAL ANALYSIS

USD/JPY has added to last week’s gain today as it remains above a couple of ascending trend lines.

While it broke above several short and medium-term daily simple moving averages (SMA), the 200- and 260-day SMAs lie above the price. This may suggest that short and medium-term bullish momentum could be evolving while longer-term momentum signals are yet to confirm this.

Resistance might be at the previous peaks at 137.77, 137.91 and 138.18. On the downside, support lay lie near the recent lows of 133.75, 133.50 and 133.00

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter