Japanese Yen Weekly Forecast: Bearish

Recommended by Daniel Dubrovsky

Get Your Free JPY Forecast

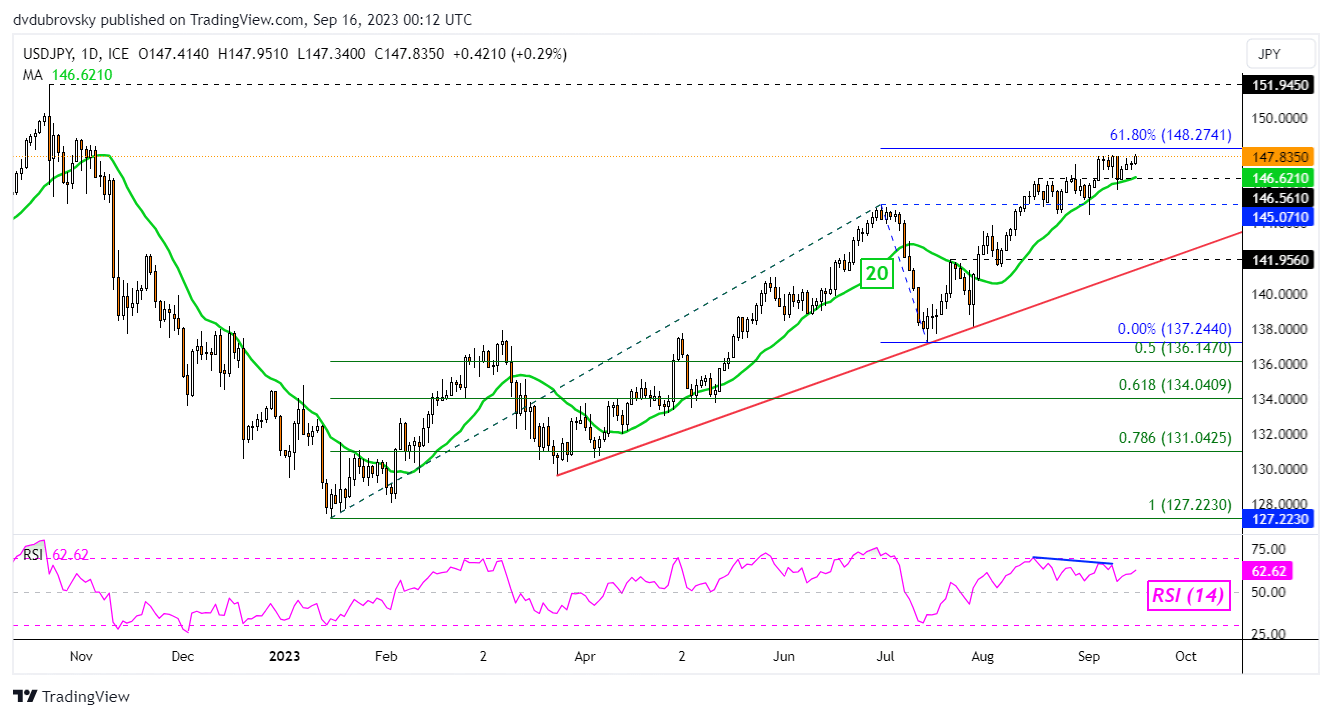

The Japanese Yen remains in a bearish posture against the US Dollar. While USD/JPY finished last week little changed, the important part is that the strength seen earlier in the week was reversed by Friday, underscoring the broader upside technical bias for the exchange rate.

The 20-day Moving Average held as key support, maintaining the bullish trajectory as the 146.56 inflection zone held. Still, it should be noted that negative RSI divergence is present. This is a sign of fading upside momentum, which can at times precede a turn lower.

Still, the longer-term bullish bias is being maintained by rising support from earlier this year. As such, it would take further losses to reverse the upside posture. Immediate resistance is the 61.8% Fibonacci extension level at 148.27. Clearing higher exposes last year’s high of 151.94.

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | 9% | 5% | 6% |

| Weekly | -8% | 9% | 5% |

USD/JPY Daily Chart

Chart Created in TradingView

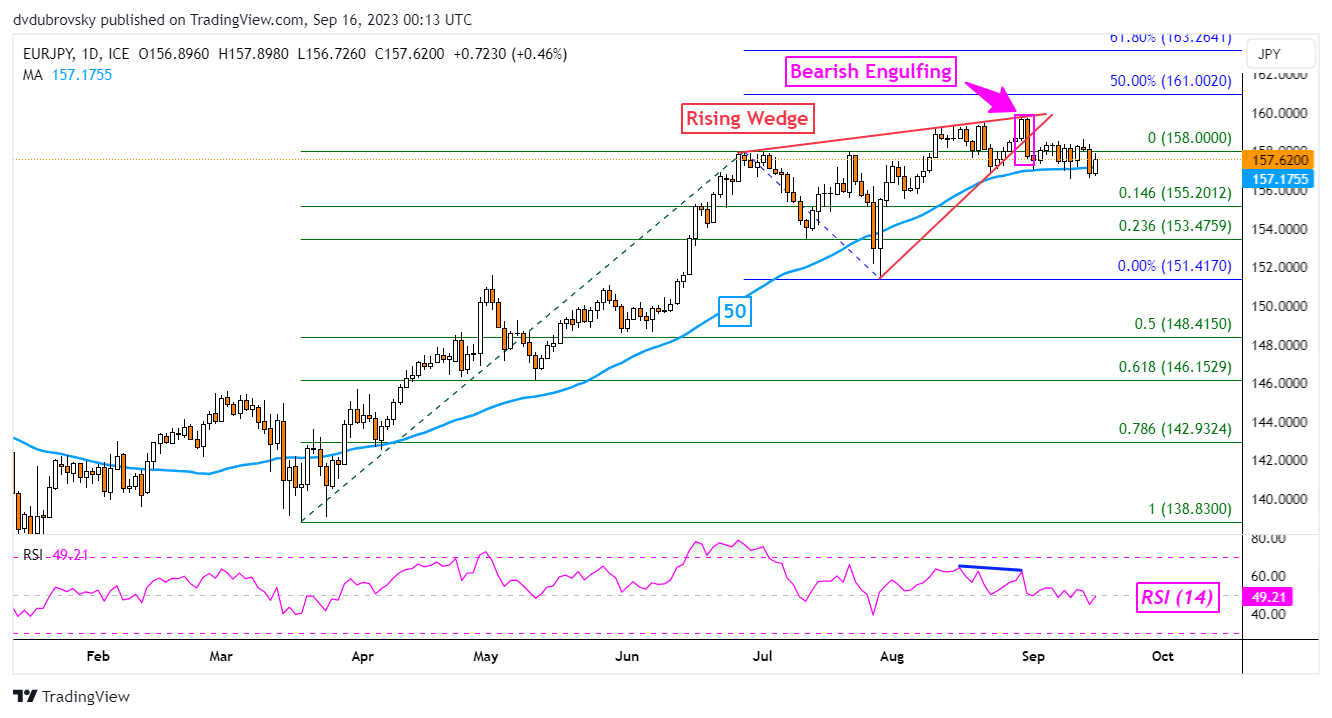

Things are looking different when taking a look at EUR/JPY. The exchange rate has continued lower ever since breaking under a bearish Rising Wedge chart formation, coupled with the emergence of a Bearish Engulfing candlestick pattern.

Still, like with USD/JPY, the broader upside technical bias remains in EUR/JPY. That is being maintained by the 50-day Moving Average. A breakout lower in the week ahead could open the door to a shift towards a bearish technical bias for the exchange rate.

That would expose the minor 14.6% Fibonacci retracement level at 155.20, followed by the 23.6% point at 153.47. Otherwise, immediate resistance is the 158.00 inflection point.

Recommended by Daniel Dubrovsky

The Fundamentals of Breakout Trading

EUR/JPY Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com