Japanese Yen Price, Chart, and Analysis

- Japanese authorities will act ‘appropriately’ says MoF’s Kanda.

- BoJ’s Ueda reiterates that monetary policy will remain accommodative.

- US debt ceiling proposal to be put to the vote

Recommended by Nick Cawley

How to Trade USD/JPY

It looks like the Bank of Japan (BoJ) will continue with its ultra-loose monetary policy for the conceivable future, according to comments today from BoJ Governor Ueda. The central bank head said that policy would remain accommodative until 2% inflation became sustainable and that he predicted that price pressures would fall sharply towards the middle of next year.

This is not the first time that Governor Ueda has underpinned the central bank’s loose policy position. Last week the central bank said that they would continue with large-scale monetary easing, including yield curve control, until inflation meets their target.

Japanese Yen (JPY) Latest: USD/JPY Toying with 140.00 on Supportive US Yields

In a sign that Japanese authorities are watching the recent weakening of the Japanese Yen, a senior official at the Ministry of Finance, Masato Kanda, said that they are closely watching the currency market and that ‘currency rates should move stably reflecting fundamentals’, and that ‘excessive volatility is undesirable’.

Bank of Japan (BoJ) – Foreign Exchange Market Intervention

President Joe Biden and House Speaker Kevin McCarthy have reached a preliminary debt ceiling deal that now needs Congressional approval for it to be put into law. The deal is expected to be voted on tomorrow, Wednesday June 1st and while it is expected to pass, there is likely to be some initial pushback before it gets voted through.

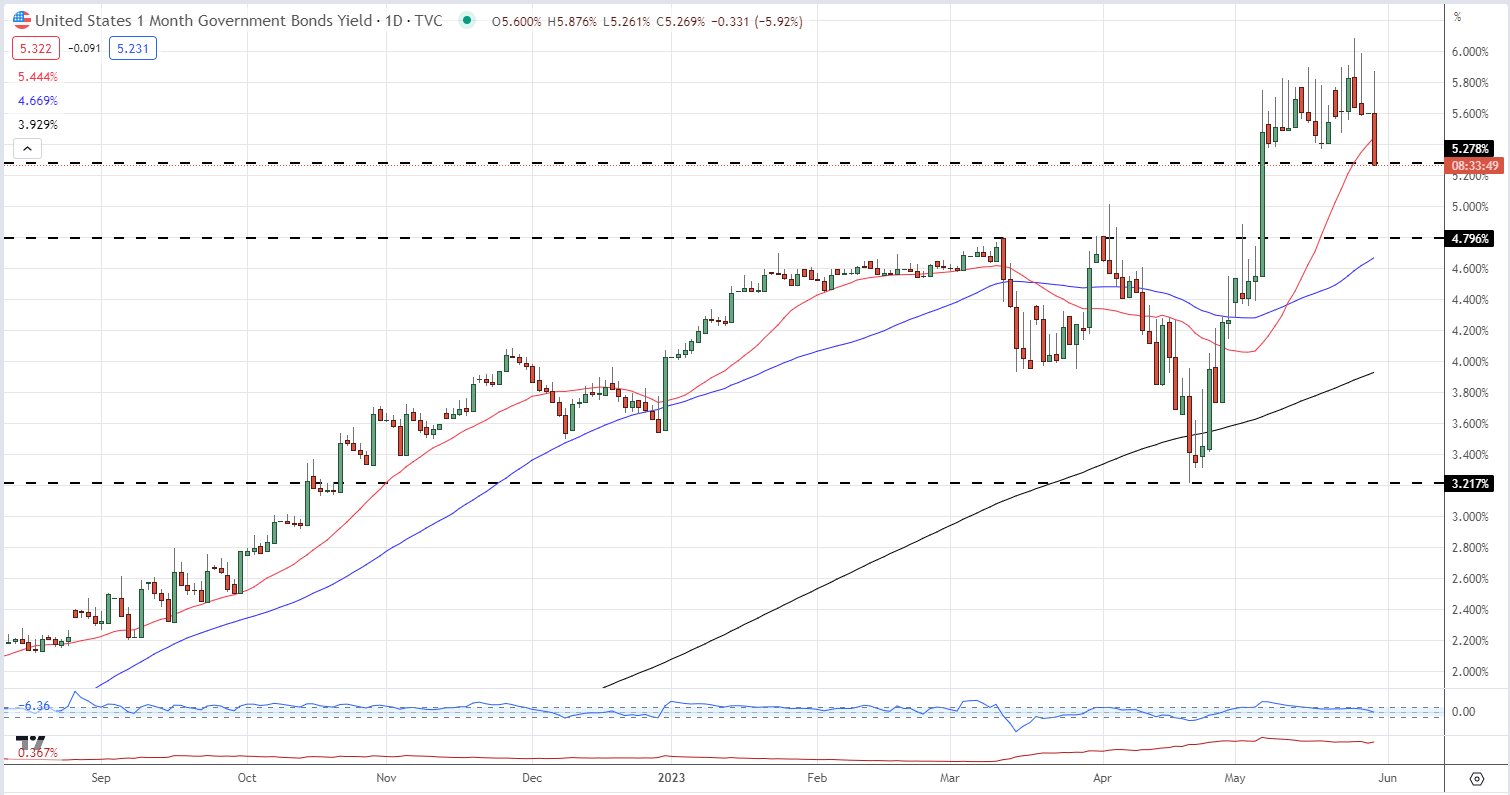

US Treasury bond and bill yields are falling post-announcement, especially in the ultra-short end. At one stage last week, one-month US bills offered a yield in excess of 6% as investors demanded more for the potential risks involved around the debt default. In early trade today the yield on the one-month fell by over 30 basis points to 5.27%. Lower short-end yields undermine the US dollar.

US One-Month T Bill Yield – May 30, 2023

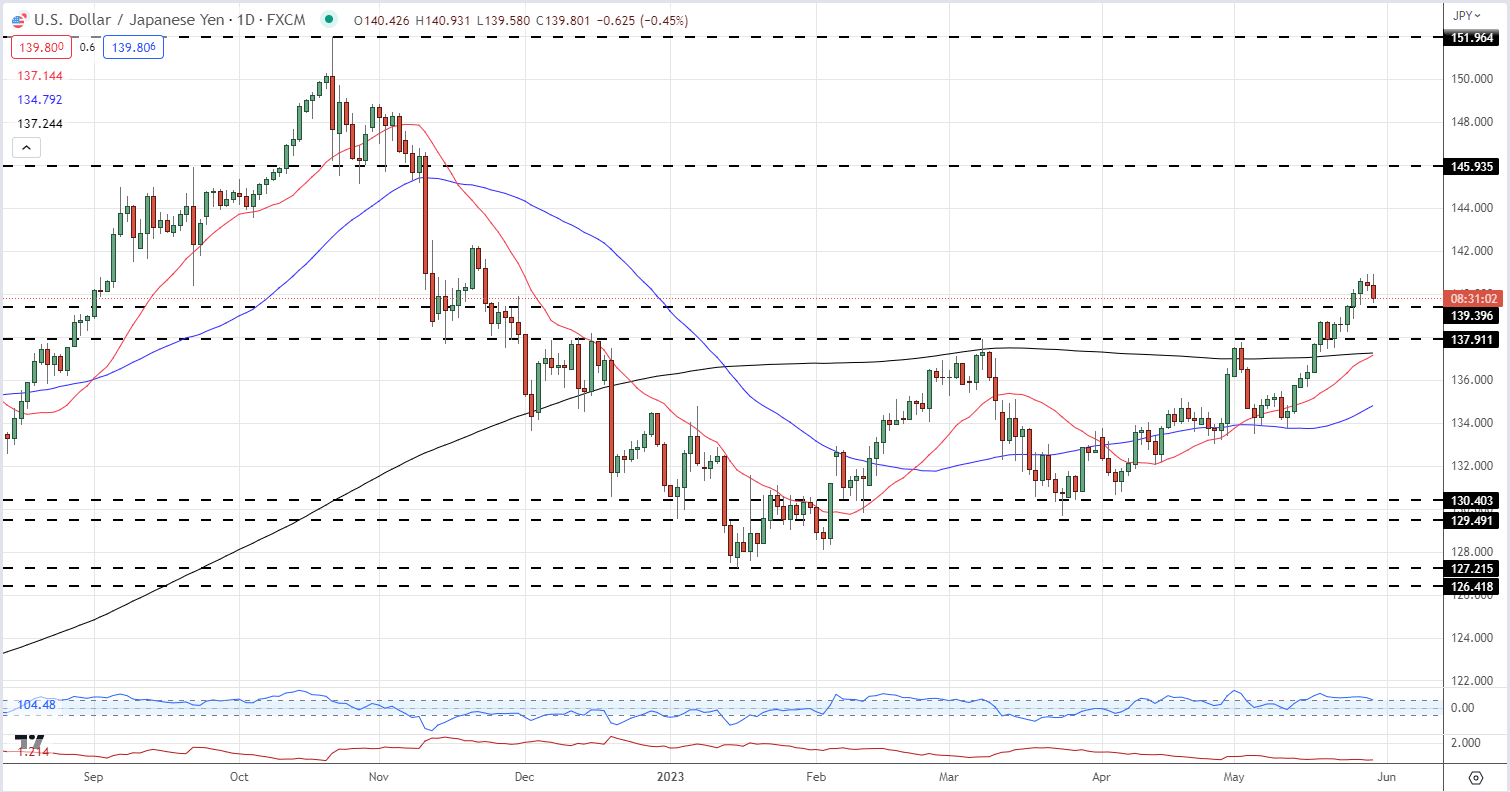

USD/JPY is back below 140.00, driven mainly by US dollar weakness. Initial levels to watch for include 139.36 ahead of 137.92, while the recent double-top just under 142.00 may be difficult to re-visit under the current macro backdrop.

USD/JPY Daily Price Chart – May 30, 2023

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | -10% | -1% | -4% |

| Weekly | 3% | -7% | -4% |

Retail Sentiment is Mixed

Retail trader data shows 29.13% of traders are net-long with the ratio of traders short to long at 2.43 to 1.The number of traders net-long is 8.70% higher than yesterday and 10.71% lower from last week, while the number of traders net-short is 2.26% lower than yesterday and 1.48% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed USD/JPY trading bias.

Chart via TradingView

What is your view on the Japanese Yen – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.