USD/JPY, JGB News and Analysis

- The Yen makes up more ground against the dollar. USD/JPY accelerates lower

- USD/JPY continues the bearish trend after the pair took out major support levels

- BoJ to decide if weak consumption is likely to delay inflation goal

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

How to Trade USD/JPY

The Yen Makes up More Ground Against the Dollar

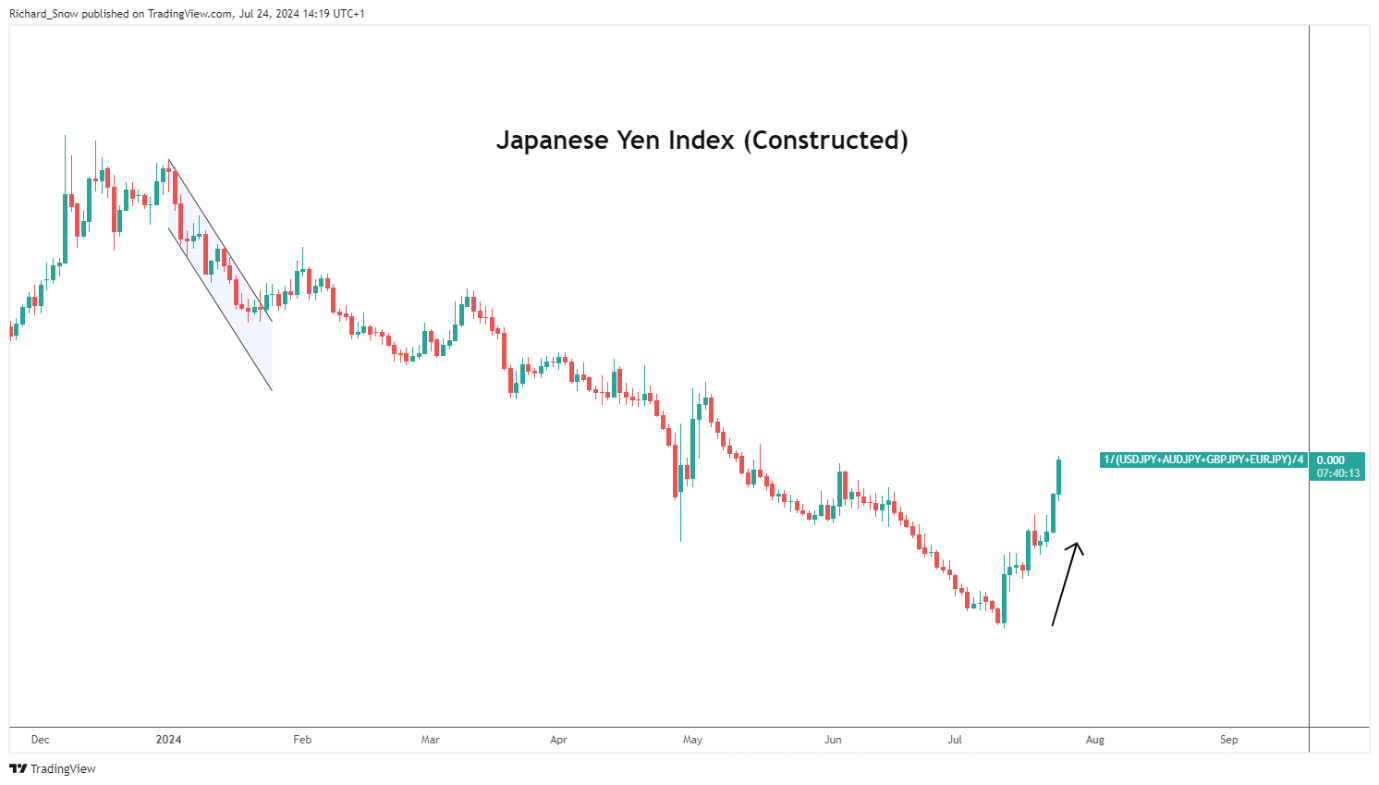

The Japanese yen appreciated against a basket of major currencies on Wednesday, one week ahead of the much-anticipated Bank of Japan (BoJ) meeting. The BoJ mentioned in their June meeting that details around reducing their balance sheet will be made available at the end of this month after disappointing market hopefuls last month.

Japan is in the slow process of policy normalisation whereby it is expected to hike rates to a neutral that is neither stimulatory nor restrictive – said to be anywhere between 0.5% and 1.5% – but is weighing up encouraging inflation data against less than stellar consumption data.

It is hoped that reduced taxes and higher wages would stimulate a rise in local consumption and household sentiment to such a degree that the inflation target of 2% is likely to be breached consistently.

Japanese Index (Equal-Weighting in USD/JPY, GBP/JPY, AUD/JPY, EUR/JPY)

Source: TradingView, prepared by Richard Snow

USD/JPY Technical Analysis

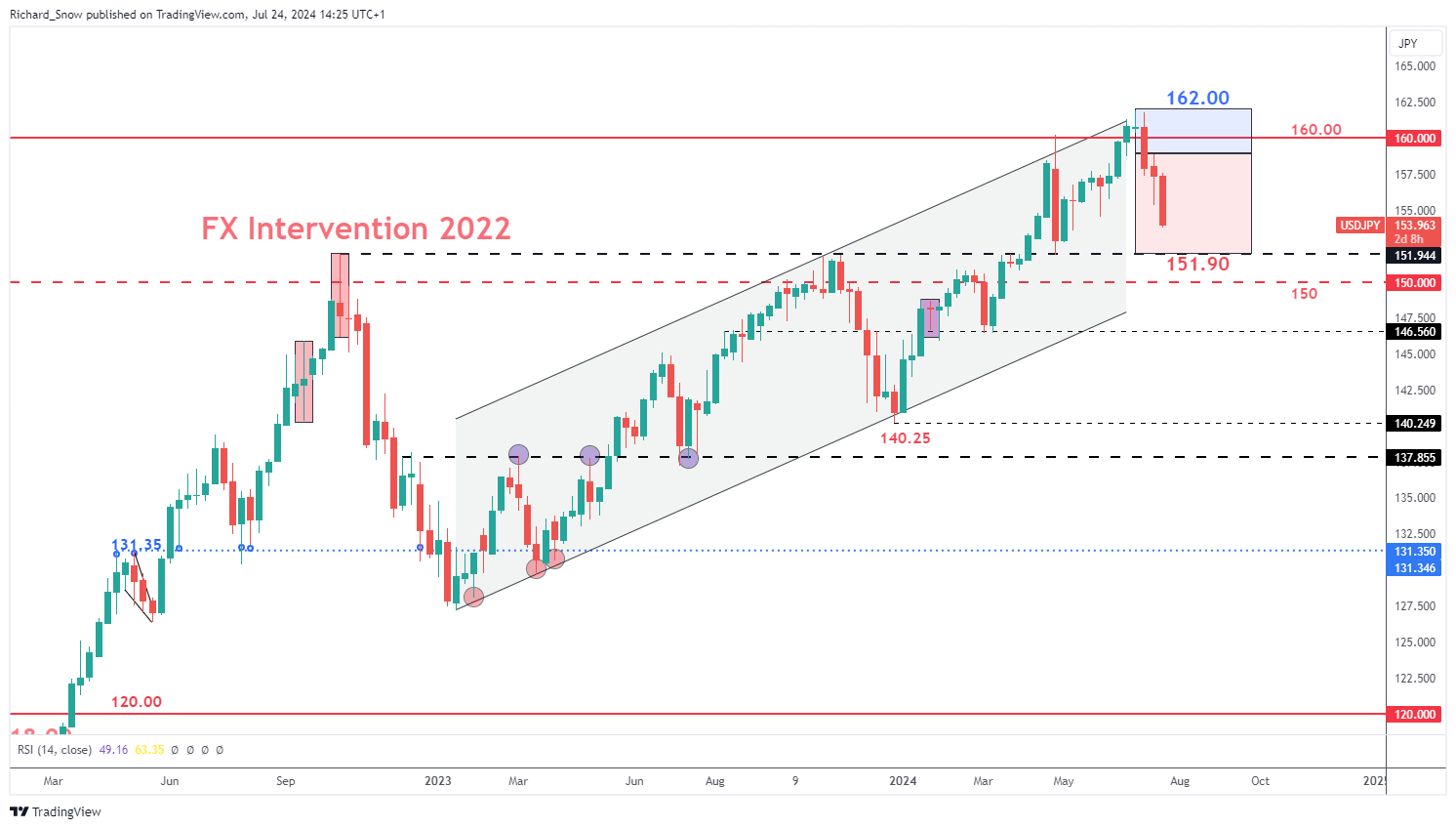

The weekly USD/JPY chart reveals the anticipated Q3 trading range, highlighting both the upward drift at the start of the quarter, followed by the much-anticipated move lower as the yen claws back significant losses. The next level of significance is the 151.90 level of support which market the moment Tokyo decided to intervene in the FX market back in 2022. Get the full insight of surrounding the many factors influencing the yen in our comprehensive Q3 forecast:

Recommended by Richard Snow

Get Your Free JPY Forecast

USD/JPY Weekly Chart

Source: TradingView, prepared by Richard Snow

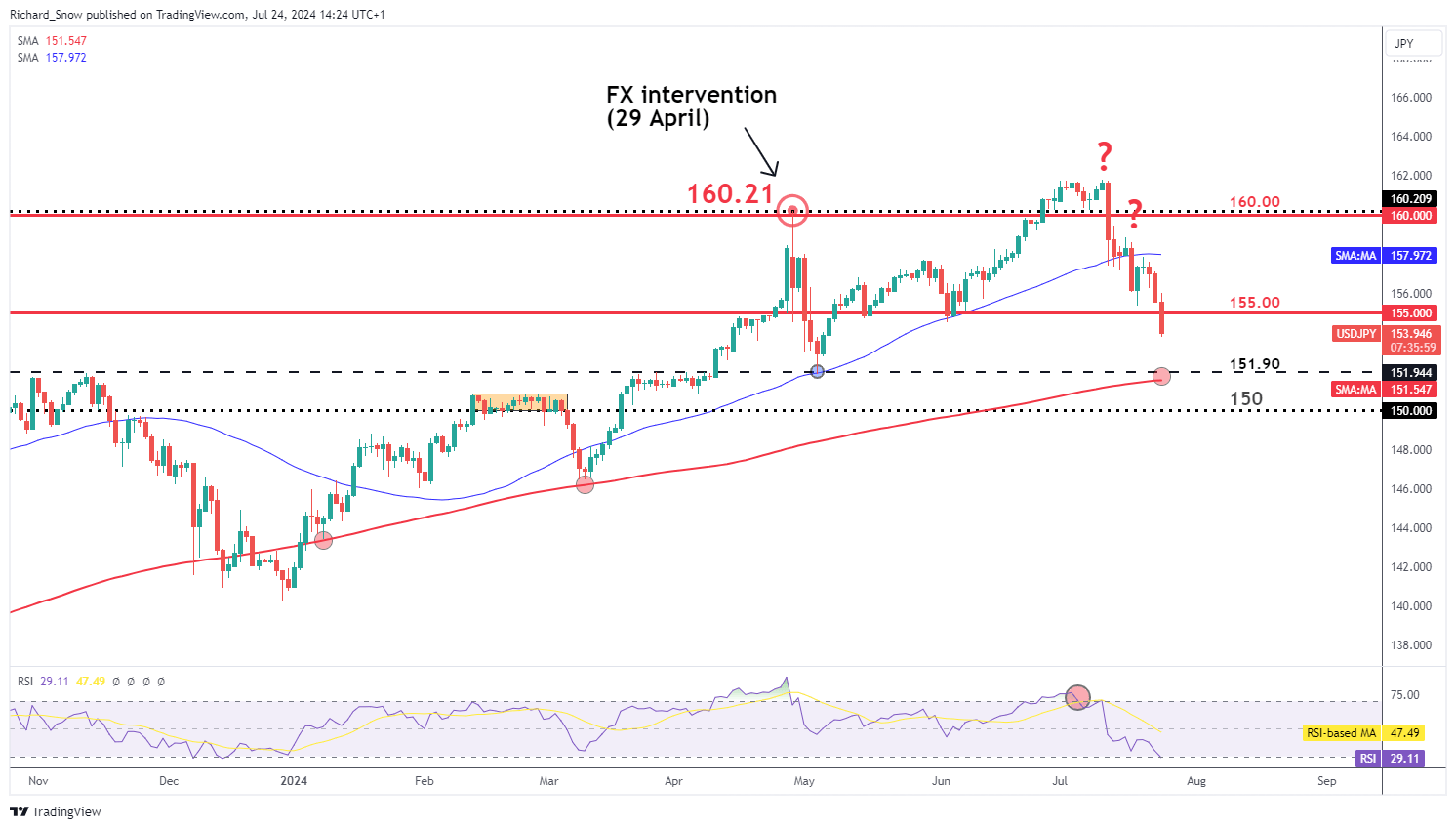

The daily USD/JPY chart shows the recent progress made by the yen, aided by a weaker US dollar and suspected FX intervention from FX officials. Markets have been wrong-footed by Japanese officials as it appears mass yen purchases are being carried out after good news such as lower than expected US inflation. This is in contrast to previous mass yen purchases which were deployed in a reactionary fashion after bad news for the yen like hotter than expected US inflation or economic growth.

The daily chart shows the oversold conditions that hinted at shorter-term bearish reversal which ultimately materialised. Since then, the pair has been riding the bearish wave lower, tagging the 160.00 and 155.00 markers on the way down.

This week’s US PCE data could extend the move if inflation surprises to the downside although, a print in line with expectations may continue the general move just at a slower pace. 151.90 and 150 flat present the next levels of support with the 200-day SMA in between the two levels – providing the next big test for yen bulls.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

BoJ to Decide if Weak Consumption is Likely to Delay Inflation Goal

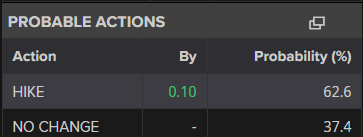

Next week Wednesday the BoJ will have to decide if recent uninspiring consumption figures are likely to stand in the way of the committee’s inflation goal. Markets expect a 62% chance of a rate hike of 0.1% to move the needle ever so slightly towards the neutral rate. The Bank will also provide greater detail around its plans to reduce its balance sheet by reducing the quantity of Japanese Government Bonds it purchases each month. Previously the BoJ sought to contain government borrowing costs to help stimulate the economy through fiscal spending initiatives. Now that the inflation and wages trend upwards, the Bank can afford to allow yields to rise. Higher yields often result in currency appreciation, especially against currencies linked to central banks that are now engaged in a rate cutting cycle.

Market-implied probability of a 0.1% hike at next week’s BoJ meeting

Source: LSEG Refinitiv, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX