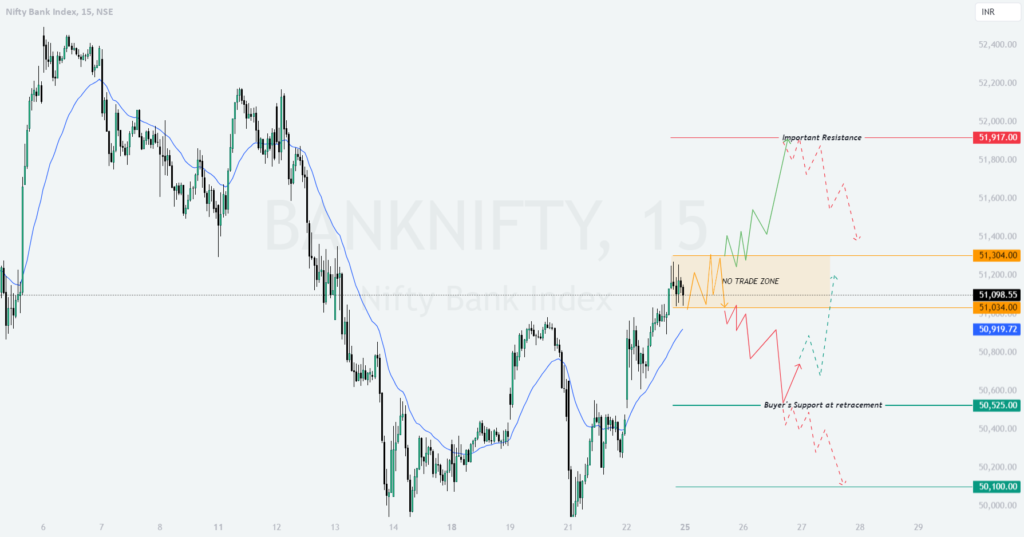

Gap-Down Opening (200+ points):

If Bank Nifty opens below 50,919, the next critical support lies at 50,525:

A breakdown below 50,525 could result in a sharp sell-off, with the next target being 50,100. Monitor volume and candlestick patterns for confirmation.

A bounce from 50,525 could indicate recovery, with potential upside back to 50,919 and 51,034.

Be cautious during a gap-down scenario, as volatility can lead to whipsaw movements.

Risk Management Tips for Options Trading:

Trade near-the-money strikes for higher liquidity and better responsiveness to price changes.

Use strict stop-loss levels based on key support and resistance zones to protect capital.

Avoid trading during the “No Trade Zone” to minimize unnecessary losses.

Scale into positions gradually instead of committing the full capital at once, especially in volatile markets.

Summary and Conclusion:

The market’s movement today will revolve around the critical zones of 51,304 and 51,034. Patience and discipline are essential to capitalize on clear breakout or breakdown opportunities. Stick to the plan, avoid overtrading, and respect stop-loss levels for effective risk management.

Disclaimer: I am not a SEBI-registered analyst. The analysis shared is for educational purposes only. Please consult your financial advisor before making any trading decisions.