Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

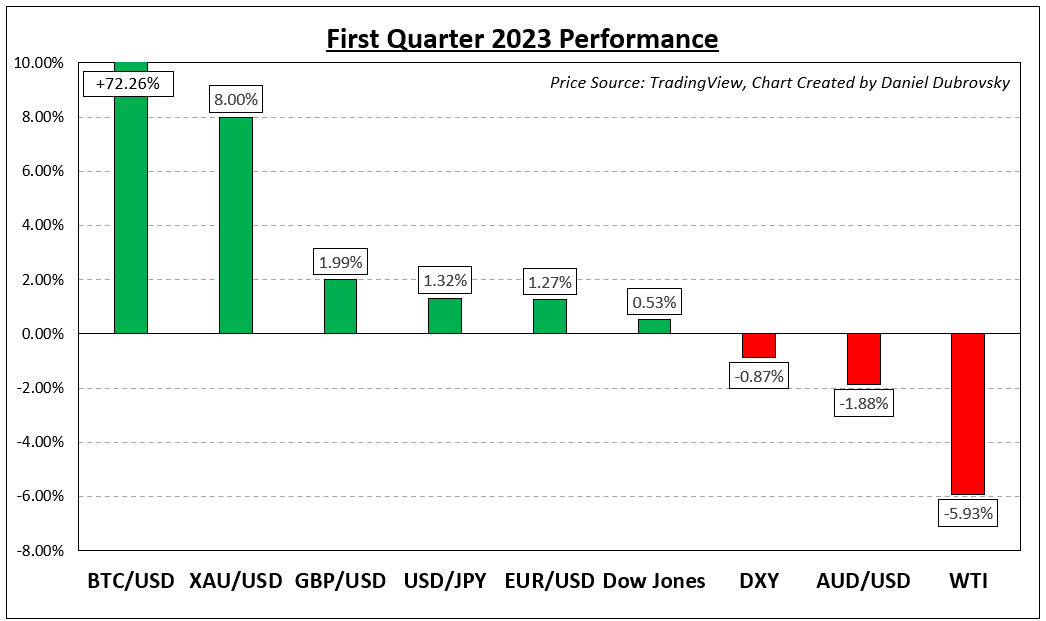

Below is a chart showing how various corners of financial markets performed in the first quarter. Bitcoin greatly outperformed and gold also did solidly. In the currency space, the British Pound outperformed the Japanese Yen, Euro, US Dollar and Australian Dollar. Meanwhile, crude oil sank. Do any of these surprise you?

Perhaps the most interesting is a solid 3 months for the tech-heavy Nasdaq 100 despite the fallout of Silicon Valley Bank’s collapse. In fairness, the Federal Reserve and the government stepped in to protect depositors. Financial market volatility cooled amid early stages of fading stress in the system when you look at the central bank’s balance sheet.

For now, it seems markets are brushing aside US recession woes. Instead, they are focused on pricing in a pivot from the Federal Reserve towards the end of this year. But think about what that could mean. Inflation is still high and policymakers have downplayed expectations of rate cuts this year. As such, if there is a realignment, then volatility could come back into play for Q2.

There are some early signs of cracks beginning to form in the US economy as momentum fades. This is mostly coming in the form of economic data that is missing expectations and weakening from previous prints. What could this mean for financial markets in the second quarter? Below are links to various forecasts where you can learn more about the path ahead.

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

How Markets Performed – First Quarter

Fundamental Forecasts:

Australian Dollar Fundamental Outlook: RBA Pauses with CPI Ahead

The Australian Dollar finished the first quarter not far from where it started after trading in a wide range of 0.6565 – 0.7158 through the first three months of 2023.

Japanese Yen Q2 2023 Fundamental Forecast: Safe Haven Appeal to Keep Yen Supported

The Yen looks set to benefit from its safe-haven appeal, while the incoming BoJ Governor Ueda is likely to keep policy unchanged in the short-term.

Oil Fundamental Forecast: WTI to Head Lower in Q2 as Fundamentals Weaken

OPEC forecasts a drop in global oil demand in Q2 as the Biden administration backtracks on SPR refills, effectively removing a zone of support.

Will Systemic Risks Make or Break Bitcoin in Q2?

As fears of financial instability continue to drive risk sentiment, Bitcoin prices have surged and could continue to be driven by the same systemic risks in the second quarter.

Technical Forecasts:

Gold Q2 2023 Technical Forecast: Uncertainty Lies Ahead for XAU/USD

Spot gold looks to the upside at the start of Q2 2023 from a technical perspective as XAU/USD eyes the $2000 resistance handle, but how long will this last?

British Pound Q2 2023 Technical Forecast: GBP/USD and EUR/GBP

Are there any attractive Q2 set-ups against Sterling? Two currencies spring to mind.

Euro Q2 Technical Forecast: EUR/USD Presents Attractive Price Action for Now

Despite retaining a positive bias in early 2023, EUR/USD has lacked strong bullish conviction. The outlook, however, could change if prices break out of recent ranges.

Dow Jones, S&P 500, Nasdaq 100 Technical Outlook: Will Q2 Offer Meaningful Breakouts?

The Dow Jones, S&P 500 and Nasdaq 100 reinforced key price levels in the first quarter for traders to watch. Will meaningful breakouts occur in Q2?

US Dollar Q2 Fundamental Forecast: USD Weakness to Make Headway as Fed Abandons Hawkish Pledge

The U.S. dollar is likely to have a challenging second quarter as the Fed’s tightening campaign comes to an end and markets begin to price in rate cuts for the second half of the year.

— Article Body Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members

To contact Daniel, follow him on Twitter:@ddubrovskyFX