Recommended by Daniel Dubrovsky

Where are stocks going in Q2?

Global market risk appetite improved generously in the first quarter despite the financial threat of Silicon Valley Bank’s collapse. By the end of Q1, there was no sign from the VIX market ‘fear gauge’ of stress in stock markets. Things were looking slightly different from the MOVE index, which is basically the Treasury market equivalent of the VIX.

At one point MOVE was up almost 65% in the first quarter following the fallout of SVB. But, thanks to efforts from the Federal Reserve and the government to protect depositors, bond market volatility notably cooled in the final few weeks of the first quarter. This allowed traders to focus on what the Federal Reserve could do in the future.

Fed rate hike expectations were slashed compared to where market pricing was at the end of last year. Long story short, traders potentially see the central bank cutting rates down to about 4.25% from the 5% prevailing upper bound at the end of March. As bank volatility cooled, traders indulged in assets that would benefit the most from this.

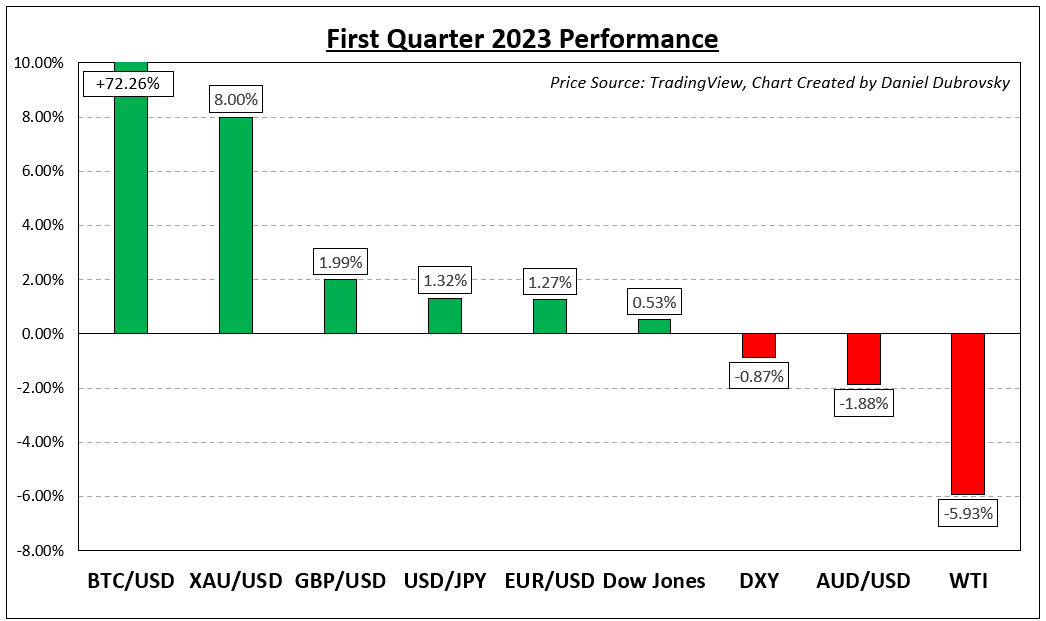

As a result, the tech-heavy Nasdaq 100 outperformed, soaring over 20% and entering a bull market. That was the best 3-month gain since the immediate recovery after the 2020 pandemic crushed stock markets. Traders also piled into cryptocurrency, with Bitcoin ripping over 70% higher. Treasury yields declined as traders priced in a dovish Fed, denting the US Dollar.

What lies ahead for global markets? All eyes will be on the United States to continue judging the aftermath of SVB’s collapse. The saying goes when the US sneezes, the world catches a cold. However, the threat of a recession could unwind a lot of upside progress seen across asset classes in Q1. Meanwhile, if the economy holds up, markets will have to price out rate cuts.

With that in mind, the path ahead remains uncertain. What is becoming clearer is that major central banks across the world are either preparing to wind down tightening cycles or are already there as economists continue monitoring inflation expectations. Labor markets remain tight, opening the door to sticky inflation. With that in mind, what are the key event risks traders should watch ahead?

Recommended by Daniel Dubrovsky

Where is USD heading in Q2?

How Markets Performed – First Quarter

Fundamental Forecasts:

Gold Fundamental Forecast: Gold Glowing into Q2 as Fed Peaks

Gold prices ripped higher in Q1 as rate expectations eased and banks fell into financial distress. Will bulls continue to drive the safe-haven commodity in Q2?

British Pound Q2 2023 Fundamental Forecast: Waiting for Inflation to Fall

The British Pound is barely above its Q1 opening level with GBP/USD constrained in a six-point, sideways trading range since the start of the year.

Euro Q2 Fundamental Forecast: Recovery May Continue but Upside Will Be Limited

EUR/USD has the potential to keep strengthening during the second quarter of 2023, but its upside will be limited considering the current macro and financial backdrop.

Equities Q2 Fundamental Outlook: Who is Right About SVB, the Fed or Markets?

The Nasdaq 100 outperformed the Dow Jones in the first quarter as SVB’s collapse triggered aggressive Fed rate cut bets. The only thing is that is not what the central bank envisions.

Technical Forecasts:

Australian Dollar Outlook: Inflation to Drive Rates Path

The Australian Dollar finished the first quarter not far from where it started after trading in a wide range of 0.6565 – 0.7158 through the first three months of 2023.

Bitcoin Technical Outlook: Candlestick Patterns Suggest Bullish Continuation is Possible in Q2

Bitcoin bulls have come back with vengeance after a disappointing 2022, resuming the uptrend from the first quarter of this year. After gaining approximately 70%, candlestick patterns suggest that bullish continuation is possible in Q2.

Japanese Yen Q2 Technical Forecast: Yen Looks Set for Gains in Q2

The Yen has displayed resilience in the final month of Q1 as recent price action hints at Yen strength in the months ahead.

WTI Technical Forecast: Long-Term Downtrend Remains but Signs of Fatigue Appear

Q1 unfolded with price action oscillating between key levels. Q2 shows potential for a continuation of the long-term downtrend but signs of fatigue are showing.

US Dollar Q2 Technical Forecast: Sellers Take Hold of Steering Wheel

The U.S. dollar heads into the second quarter with a negative bias, challenging a key technical support and at risk of a significant breakdown that could put the February lows in play.

— Article Body Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members

To contact Daniel, follow him on Twitter:@ddubrovskyFX