Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

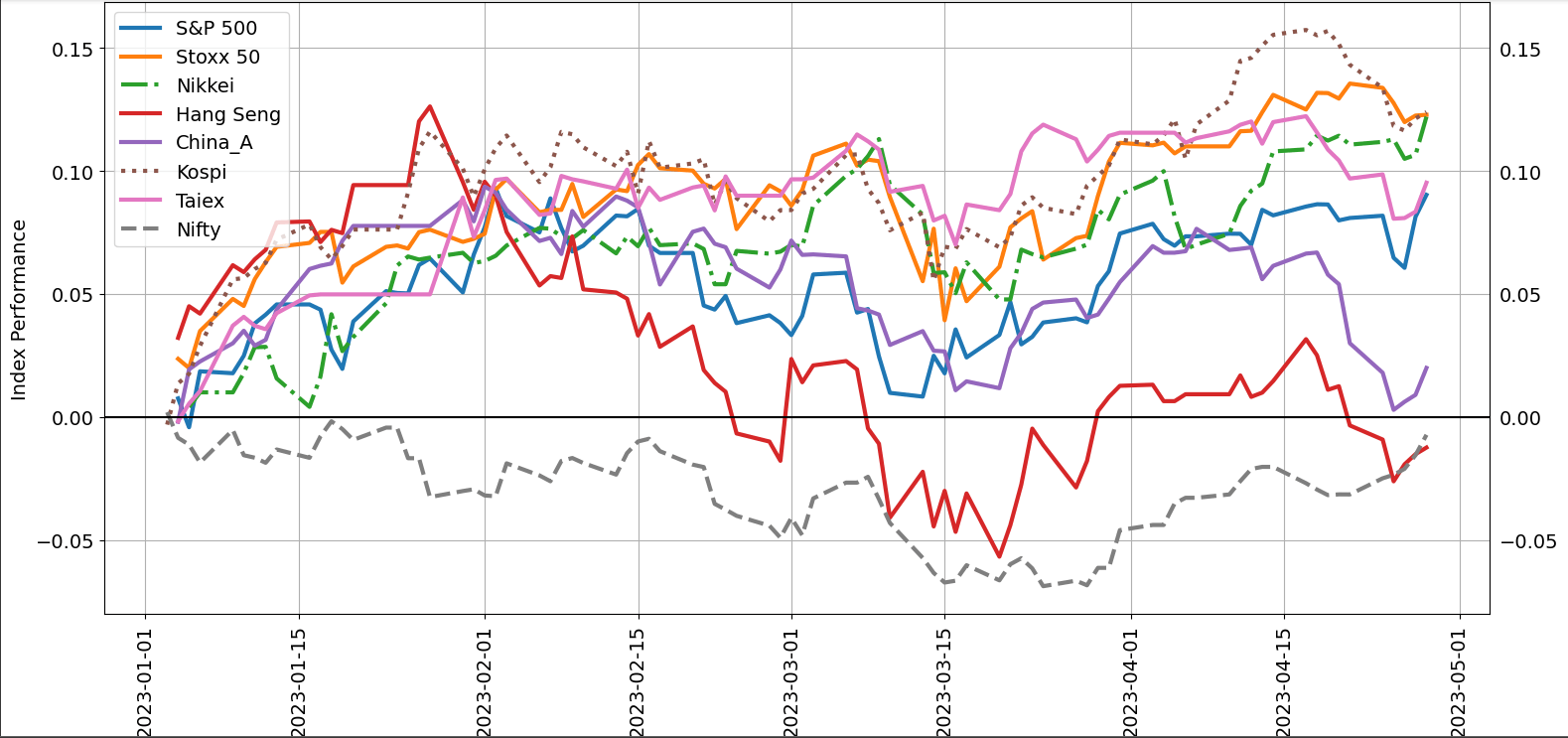

Global equity markets ended mostly higher in the past week, led by the US, following better-than-expected earnings from big technology companies. The MSCI All Country World Index was largely flat, and the US dollar index (DXY index) closed mostly flat. Within equities, the S&P 500 ended the week higher by 0.87%, while the Nasdaq 100 index jumped nearly 2%. The German DAX 40 gained 0.3% and the UK FTSE 100 lost 0.6% respectively, while Japan’s Nikkei 225 rose 1.0% and the Hang Seng index declined 0.9%.

Of the roughly 50% of the S&P 500 companies that have reported, 66% have reported sales surprise and 80% have reported earnings surprise, according to Bloomberg data. In the coming week, 162 S&P 500 companies are scheduled to report results for the first quarter, according to FactSet.

Data released during the week showed the US economy slowed more than expected in Q1, while the Euro area economy barely grew during the same period. Meanwhile, progress on the inflation front remains slow (the US core PCE price index didn’t cool as much as expected, while in Germany inflation fell only slightly in April). Still, the US Fed and the ECB are widely expected to raise rates by 25 bps at their May 3 and May 4 meetings respectively. How the growth-inflation dynamics unfold in the coming months would be key in determining the central banks’ reaction function. .

Year to Date Equity Market Performance

Source Data: Bloomberg

Global manufacturing and services data, due in the coming week, will likely shed some light on the global activity, especially in the US given a little consensus on a soft landing, hard landing, or no landing. In addition, the pace and the extent of the cooling-down in inflation globally will be critical. The market’s expectation with regard to the central banks’ pivot will vary depending on how some of these scenarios unfold.

Given that Australian inflation eased in the first quarter, the RBA is expected to keep rates on hold at 3.6% when it meets on Tuesday. The Australian central bank kept rates on hold in April but left the door open for additional tightening.

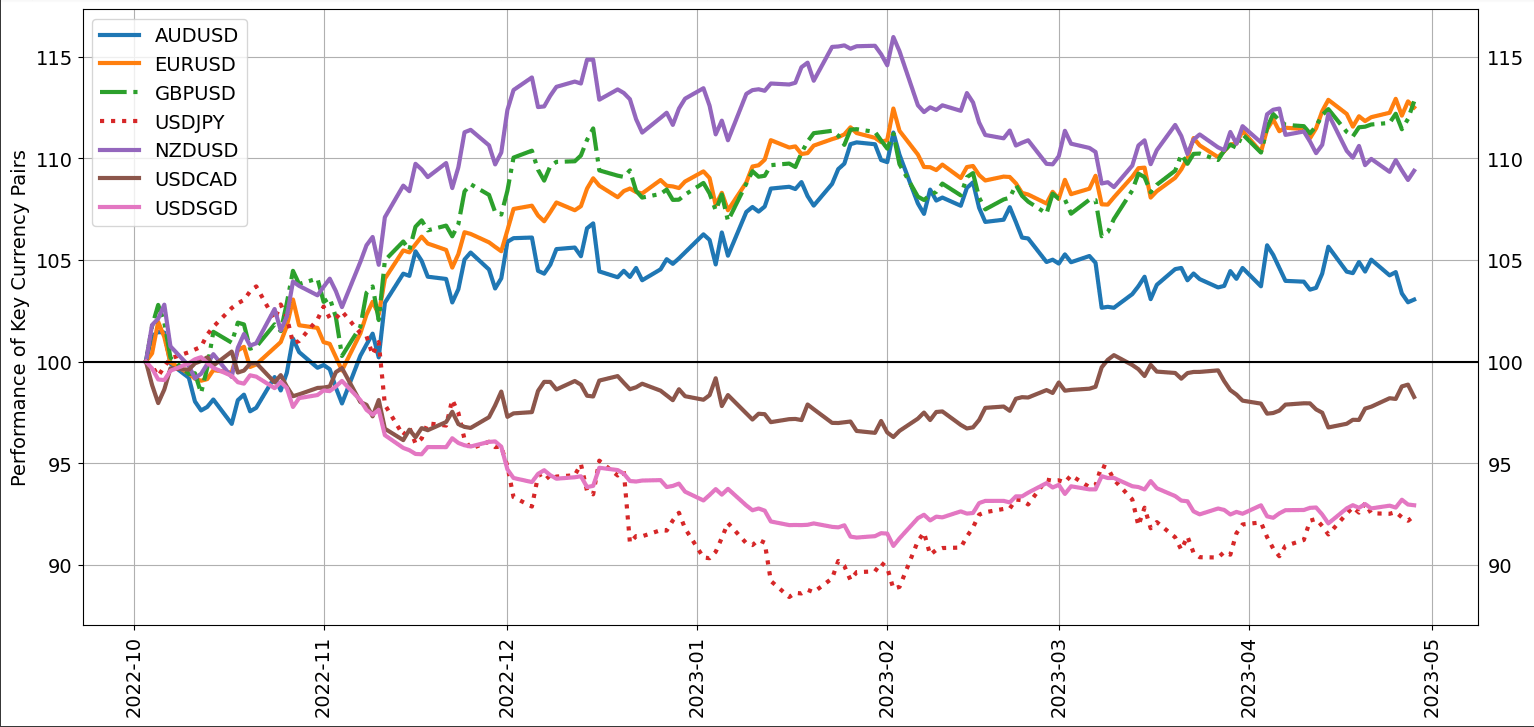

Year to Date Performance of Key Currency Pairs

Source Data: Bloomberg

Global manufacturing and services activity data is due in the coming week, starting with China NBS manufacturing PMI and non-manufacturing PMI for April released earlier today; US ISM manufacturing PMI for April due Monday; RBA interest rate decision and Euro area inflation data for April due Tuesday; RBNZ Financial Stability Report and New Zealand jobs data for Q1, US ISM services PMI data for April, ad US Fed interest rate decision due on Wednesday; ECB interest rate decision on Thursday; US jobs data for April, and Euro area retail sales data for March on Friday.

Aside from data and central bank policy decisions, the debt ceiling issue remains a source of volatility – the US 1-year CDS hit the highest level at least since 2014. US Treasury Secretary Janet Yellen on Tuesday warned that failure by Congress to raise the government’s debt ceiling would trigger an “economic catastrophe”.

Forecasts:

EUR/USD Preps for Data Heavy Week with ECB & Fed in Focus

EUR/USD looks to economic data including both ECB & Fed rate decisions. Unsure euro traders now look to fundamentals for directional bias- reversal or continuation?

British Pound Week Ahead: GBP/USD and EUR/GBP Will Dance to Different Music

The British pound’s rally against the US dollar has stalled recently, and chances are that the consolidation could continue a while longer before it embarks on a new leg higher.

Australian Dollar Outlook: The RBA and the Fed Move into View

The Australian Dollar stumbled last week but remains within a two-month range and with monetary policy decisions ahead, a breakout might see momentum unfold in AUD/USD.

Gold Price Forecast: XAU/USD Range Holds Ahead of Huge Event Risk

Gold prices have been stuck in a broad range these last two weeks. Potentially high impact event risk (FOMC, PMI or NFP) may provide the necessary impetus for a breakout.

S&P 500, Nasdaq Weekly Forecast: Climbing the Wall of Worry

Earnings from the big technology companies may have boosted US equity indices but the bar for further gains is rising ahead of the US FOMC meeting next week. That said, the trend remains up and so far, there are no signs of a reversal of the uptrend on technical charts.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Article Body Written by Manish Jaradi, Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members

— Contact and follow Jaradi on Twitter: @JaradiManish