Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

The US dollar rose slightly while global equity markets ended largely flat in the past week as a positive start to the earnings season has been overshadowed by concerns that central banks may not be done with tightening just yet. The MSCI All Country World Index was largely flat, and the US dollar index (DXY index) rose 0.1%.

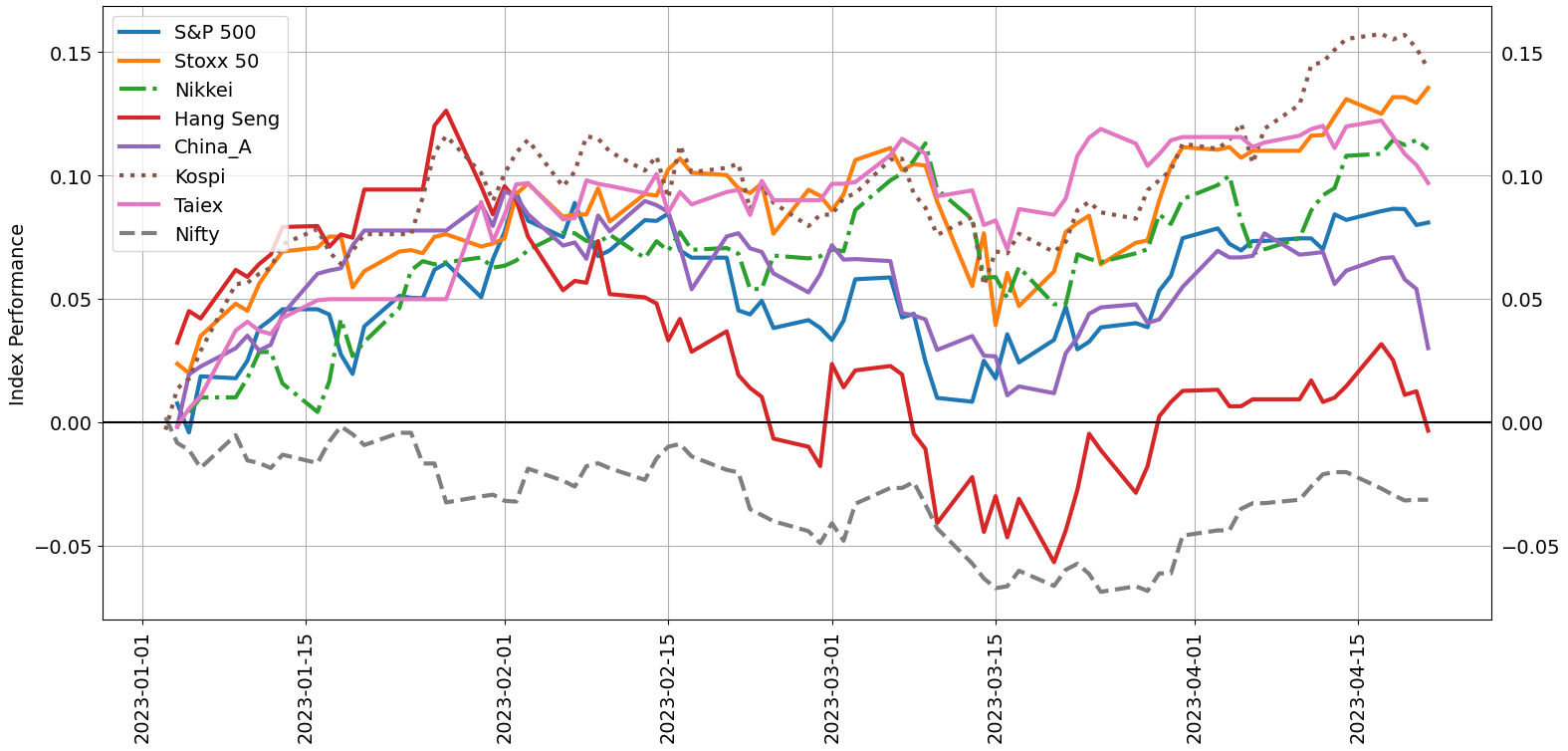

Within equities, the S&P 500 ended the week down 0.1%, while the Nasdaq 100 index lost 0.6%. The German DAX 40 advanced 0.5% and the UK FTSE 100 gained 0.5% respectively, while Japan’s Nikkei 225 rose 0.3% and the Hang Seng index dropped 1.8%. Meanwhile, one-year US credit default swaps – the price of insuring against a US government default in the next 12 months – rose to the highest level since at least 2008.

Last week’s price action was largely characterized by the earnings season, US Federal Reserve officials’ comments, better-than-expected China data, and global inflation numbers. As of April 21, 18% of the companies in the S&P 500 index have reported actual results for Q1-2023 to date, of which 76% have reported actual EPS above estimates, while 63% of the companies have reported actual revenues above estimates. For the upcoming week, 180 S&P 500 companies (including 14 Dow 30 components) are scheduled to report results for the first quarter, according to FactSet.

Year to Date Equity Market Performance

Source Data: TradingView

A number of Fed speakers recently have argued for another 25-bps hike. Market participants have priced in an 83% chance, with many expecting the Fed to start cutting rates by the end of 2023. US macro data has been largely mixed: business activity accelerated to an 11-month high in April, but weekly jobless claims rose, indicating that the labour market may be starting to show signs of slowing.

China’s GDP data beat expectations, prompting analysts to upgrade the world’s second-largest economy’s outlook for this year, which bodes well for the rest of Asia and Emerging Markets. UK core inflation failed to fall as expected last month, holding steady at 6.2% on-year, and surpassing estimates of 6.0%, with investors now fully pricing in a 25-basis point rate hike to 4.25% on May 11.

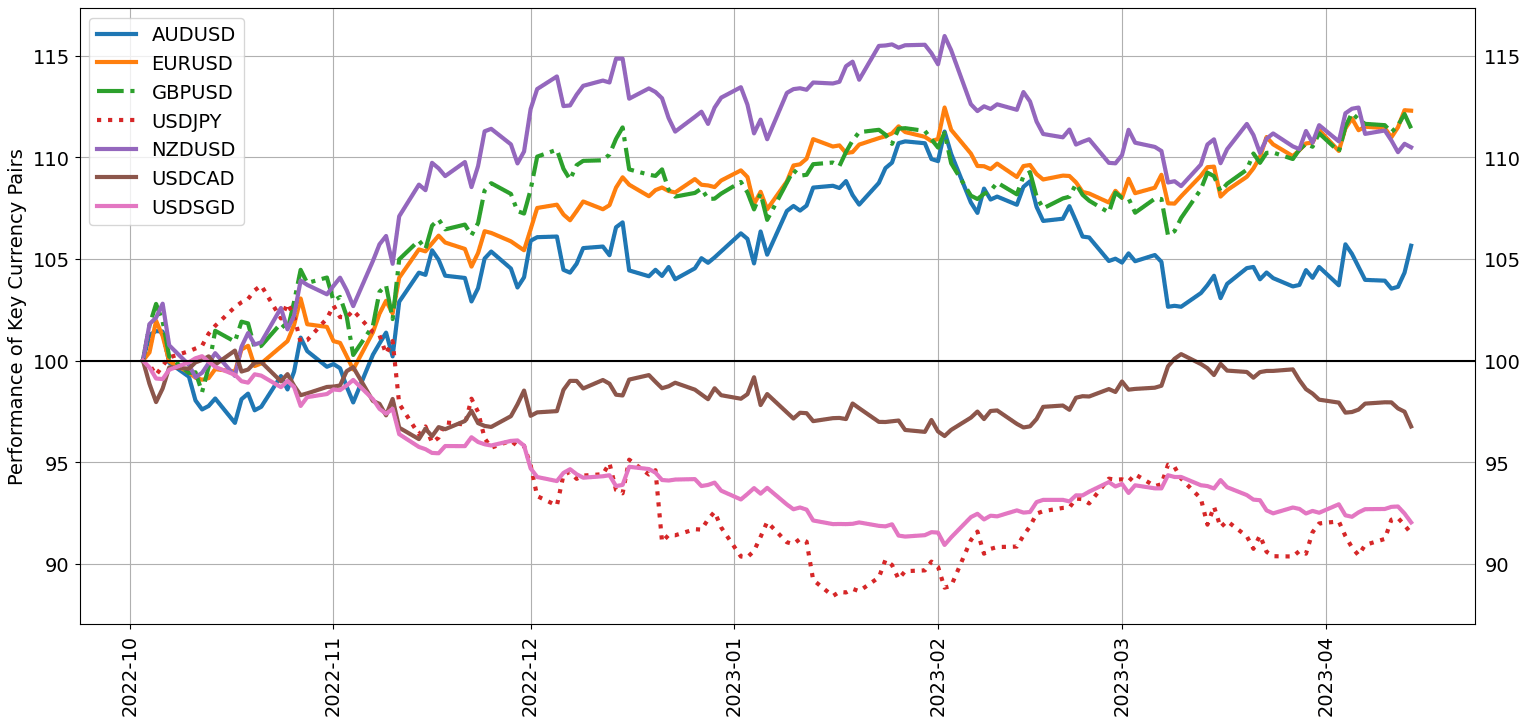

Meanwhile, New Zealand Q1-2023 inflation data surprised toward the downside, raising the odds that inflation may have finally peaked, but not enough to prevent the RBNZ from proceeding with another 25-basis point hike in May. Japan’s CPI rose 3.2% on-year in March, in line with expectations, but is still away from BOJ’s 2% target.

Year to Date Performance of Key Currency Pairs

Source Data: TradingView

Key data/policy focus in the coming week: German IFO business climate for April on Monday; US Consumer confidence and housing market data on Tuesday; Australia Q1 inflation, Germany GfK consumer confidence, and US durable goods data due Wednesday; US Q1 GDP on Thursday; BOJ interest rate decision, Euro area Q1 GDP, and US core PCE price index due Friday.

Perhaps of less significance in the coming week, and more for June-August is the US debt ceiling. The jump in US 3-month T-Bills yield and US credit default swaps signals growing uncertainty. If lawmakers don’t raise the nation’s borrowing limit by June, the federal government runs the risk of defaulting on its debt obligations, Treasury Secretary Janet Yellen said in January. Democrats and Republicans appear to be at odds about a potential resolution, but the hope is that some sort of compromise would be eventually found. However, the path toward the resolution could be bumpy, keeping markets on the edge.

Forecasts:

Euro Week Ahead: Will Heavyweight Data Breathe Life Back Into a Lethargic EUR/USD?

EUR/USD volatility is at a two-month low with the pair stuck in a 90 pip range this week. Next week’s data releases look set to challenge this range.

British Pound Weekly Outlook: Is GBP/USD Ready to Break Higher?

The British pound’s rally against the US dollar has stalled recently, and chances are that the consolidation could continue a while longer before it embarks on a new leg higher.

AUD/USD Weekly Forecast: Ominous Signs for Aussie Dollar

AUD/USD looks to a US dominated week while technical analysis favors more pain for the Aussie dollar.

US Dollar Weekly Outlook: is the US Heading for Uninspiring Economic Growth?

The US Dollar finally got a break this week after persistent losses. But, this may be short-lived if GDP signals that uninspiring growth is ahead. What are the key DXY levels to watch next week?

Gold Price Forecast: XAU/USD Attempts Hints at Breakdown Ahead of US GDP

The precious metal turned sharply lower at the end of the week as impressive US PMI data lifted the downtrodden dollar. US GDP data next week likely to provide direction.

S&P 500 Week Ahead Forecast: Bullish Momentum Fades as Bears Flirt with Comeback

The S&P 500 and Nasdaq 100 rose slightly during the week, but upward momentum waned as interest rate expectations have begun to drift higher from their level of a few weeks ago.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Article Body Written by Manish Jaradi, Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members

— Contact and follow Jaradi on Twitter: @JaradiManish