OPTIONS WATCHLIST 9/22/24

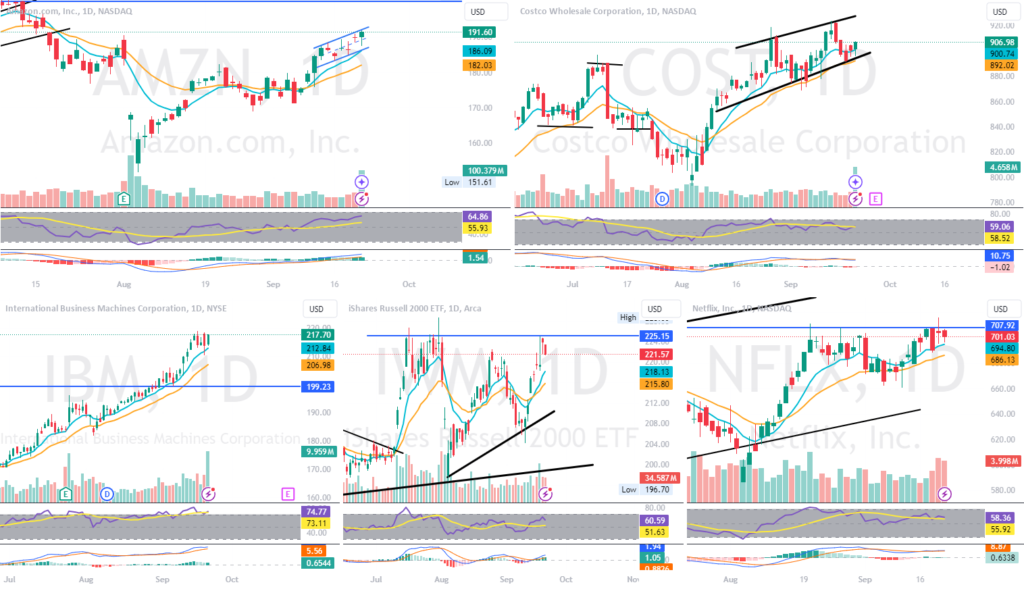

COST – Stock to benefit from rate cut. Stock bouncing off trendline support. Next resistance at $930. Calls above $910 for a move towards $930. Stock has earnings on thursday could be a good pre earnings play.

IBM – Stock is consolidating around all time highs. Needs to break $220 for more highs. Stock is overbought on multiple time frames on RSI. could see pull back if $212 fails. Outs below that level.

IWM – ETF failing another retest of $225 resistance level. Looking for a breakout above that level. Stock is strong on a daily and weekly time frame. On high watch.”

NFLX – stock again failing to hold $705 level. Making that U -shape on a daily time frame. Looking for calls above $705 with some resistance at $708 then $720. If it fails to hold $695 then puts. Stock is decent on indicators