Retail Trader Sentiment Analysis – USD/JPY, EUR/JPY, and AUD/JPY

Gauge market dynamics by examining sentiment indicators, position ratios, price fluctuations, and technical signals to determine prevailing bullish or bearish trends.

Recent market data indicates notable performance variations among key currencies, with the Japanese yen showing relative strength while the Australian dollar underperforms. The following analysis examines current retail trader positioning and its potential implications for future price movements, utilizing a contrarian approach.

Recommended by Richard Snow

Improve your trading with IG Client Sentiment Data

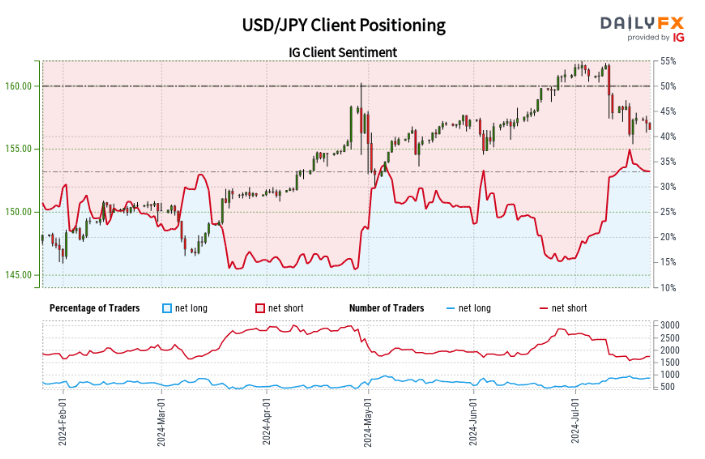

USD/JPY Retail Trader Data: Bullish Bias

Current retail trader data reveals a short-to-long ratio of 2.07 to 1, with 32.57% of traders holding net-long positions. Net-long traders have increased by 0.70% since yesterday but decreased by 3.68% over the past week. Conversely, net-short traders have risen by 6.94% since yesterday and 3.96% over the week. This positioning suggests a USD/JPY bullish contrarian bias.

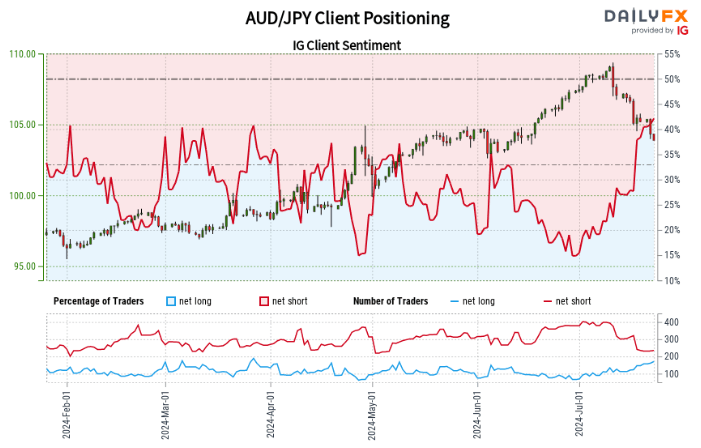

AUD/JPY Retail Trader Bias: Bearish Continuation

Retail trader data shows a short-to-long ratio of 1.39 to 1, with 41.91% of traders in net-long positions. Net-long traders have increased by 8.23% since yesterday and 47.41% over the week, while net-short traders have marginally increased by 0.42% since yesterday but decreased by 24.76% over the week. While the net-short position typically indicates potential price increases, recent shifts in sentiment suggest the AUD/JPY trend may continue lower despite the fact traders remain net-short.

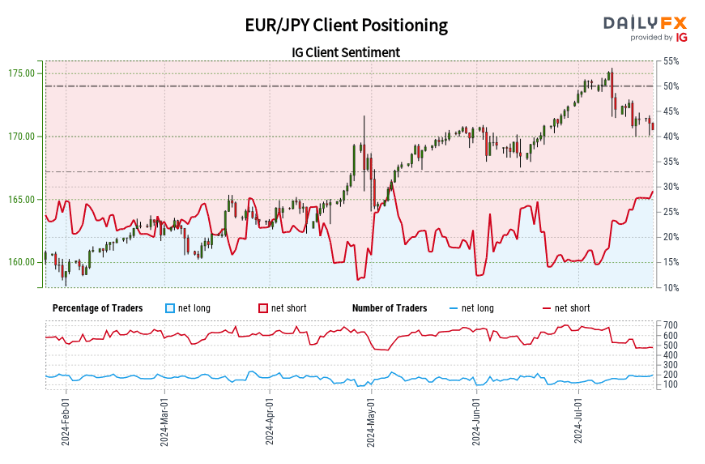

EUR/JPY Retail Trader Data: Bearish Bias

Current data indicates a short-to-long ratio of 2.44 to 1, with 29.09% of traders holding net-long positions. Net-long traders have increased by 9.24% since yesterday and 13.56% over the week, while net-short traders have risen by 2.30% since yesterday but decreased by 8.41% over the week. Despite the overall net-short position suggesting potential price increases, recent sentiment changes may indicate a bearish continuation.

This analysis provides valuable insights for market participants to consider when formulating trading strategies. However, it is crucial to combine this information with other analytical tools and market factors for comprehensive decision-making.

Recommended by Richard Snow

Get Your Free JPY Forecast

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX