S&P 500 Analysis: Navigating Volatility with Key Price Levels and Scenarios Amid NFP Impact

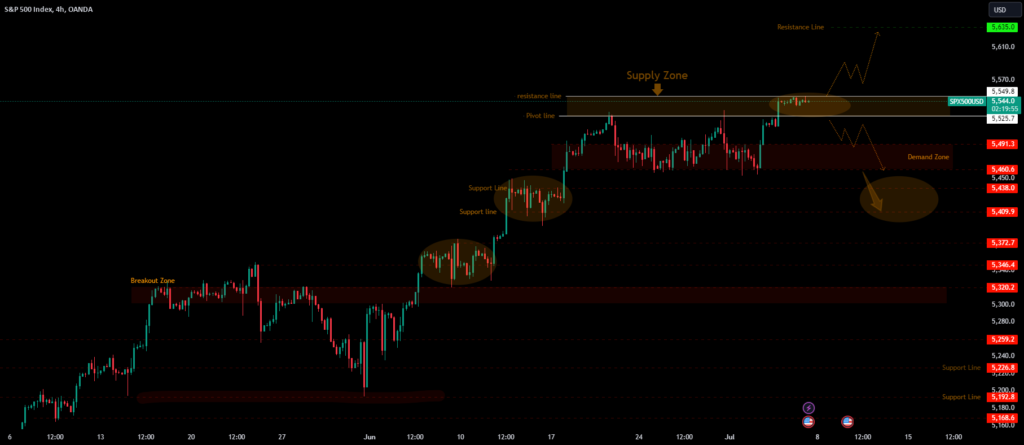

The S&P 500 currently faces a significant supply zone between 5525 and 5550, having recently hit a new all-time high at 5550. Despite this, the broader outlook remains bullish, especially after stabilizing above the previous resistance level of 5525. However, the upcoming Non-Farm Payroll (NFP) report is poised to significantly impact the market.

Bullish Scenario:

To maintain the bullish momentum, the price needs to break through the supply zone and continue upward towards 5635. A 4-hour candle closing above 5550 would indicate a continued uptrend for the following week.

Bearish Scenario:

Conversely, if the price drops and stabilizes below 5525, it would signal a bearish trend, potentially leading to declines towards 5491 and 5460.

Key Levels:

- Pivot Line: 5550 – 5525

- Resistance Levels: 5590, 5620, 5645

- Support Levels: 5491, 5460, 5440

Today’s Expected Trading Range:

Today’s trading range is anticipated to be between the resistance at 5635 and the support at 5460.NFP Scenarios:

– Previous Result: 272K

– Expectation: 191K - If the NFP release is less than 191K, the indices are likely to follow a bullish scenario. Conversely, a result exceeding 191K, particularly around 250K, would likely lead to a bearish scenario.

- In summary, the market’s direction hinges on the NFP results and critical price levels. Monitoring these key levels and the NFP report will be crucial for navigating the S&P 500’s volatility.