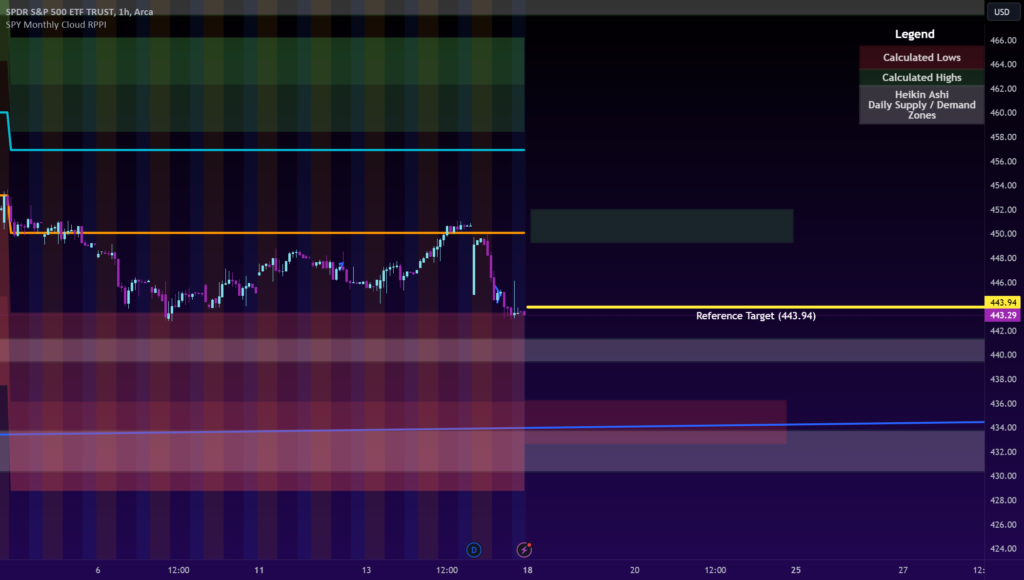

So the annoying thing about all of this is my original analysis was correct, we did indeed go back up to re-test the bear threshold on the month and rejected (shown in chart above).

So now this is 2 clear rejections of the threshold. There usually isn’t a third re-test (unless sentiment dramatically changes mid month, which I find unlikely here and in those cases it tends to break through). So we really shouldn’t see this try to come back up to 450 again. This kind of invalidates the forecasted high targets on the week next week, which align pretty much with that threshold level.

That said, we should see it push up a bit to that reference target.

So my main target now was my previous target of 436, the monthly low. 436 is also the first part of our forecasted low range.

Our FO SHO target is 439.79. (Well as fo sho as we can get absent the 99 targets, but its a very high prob target in the 90s). By the way, what an amazing week this week with 99s, we had that bearish one and that bullish one and both lead to really great trade opportunities! We likely won’t get that lucky next week but we can hope.

Fed meeting next week. Probability on Monday is a mess. Its going to be a nightmare to trade and I will keep my day trades limited and at small size. This is a week where I just try to keep the big picture at the forefront and focus on that. The market is incredibly choppy right now and volatile, very horrendous PA in general.

That said, I don’t want to give any opinions right now until we see how we open on Monday. The ideal setup is for our threshold to align with that reference target, or somewhere around there and just see rejection here. Do I think it will play out that way? No. I suspect its going to be a mess next week looking at these weekly probs, but like I said, keep the bigger picture in the forefront. We don’t need to overcomplicate it, this is a very clear second rejection of the bear threshold on month, really hammering in a TP of 436.

Futures also broke down from my little channel:

It will get really complex if we tank right down to 436 leading into the fed meeting. Let’s see how we open and where the 99s fall on Monday and how we close on Monday. From there we can have, hopefully, some better clarity of the short term.

Either way, immediate target remains 436. So that is what I am targeting.

I am sort on it with SPXS once I realized that my theory was actually correct about the re-test and reject. For day trades on Monday, leaving SPY alone, it will be difficult. My reliable prob models are all 50/50. My purely technical models (which are less reliable and thus I never trust them fully) are showing bearish continuation into Monday. So I am neutral for Monday.

That’s it for now.

Someone asked for US30, and I realized its DJI. I do have stuff on DJI so I will post an idea over there probably tomorrow.

Safe trades everyone and have a great weekend!