Pound Sterling (GBP/USD, GBP/AUD) Analysis

- UK jobs and growth data to take a back seat as US CPI, FOMC steal the spotlight

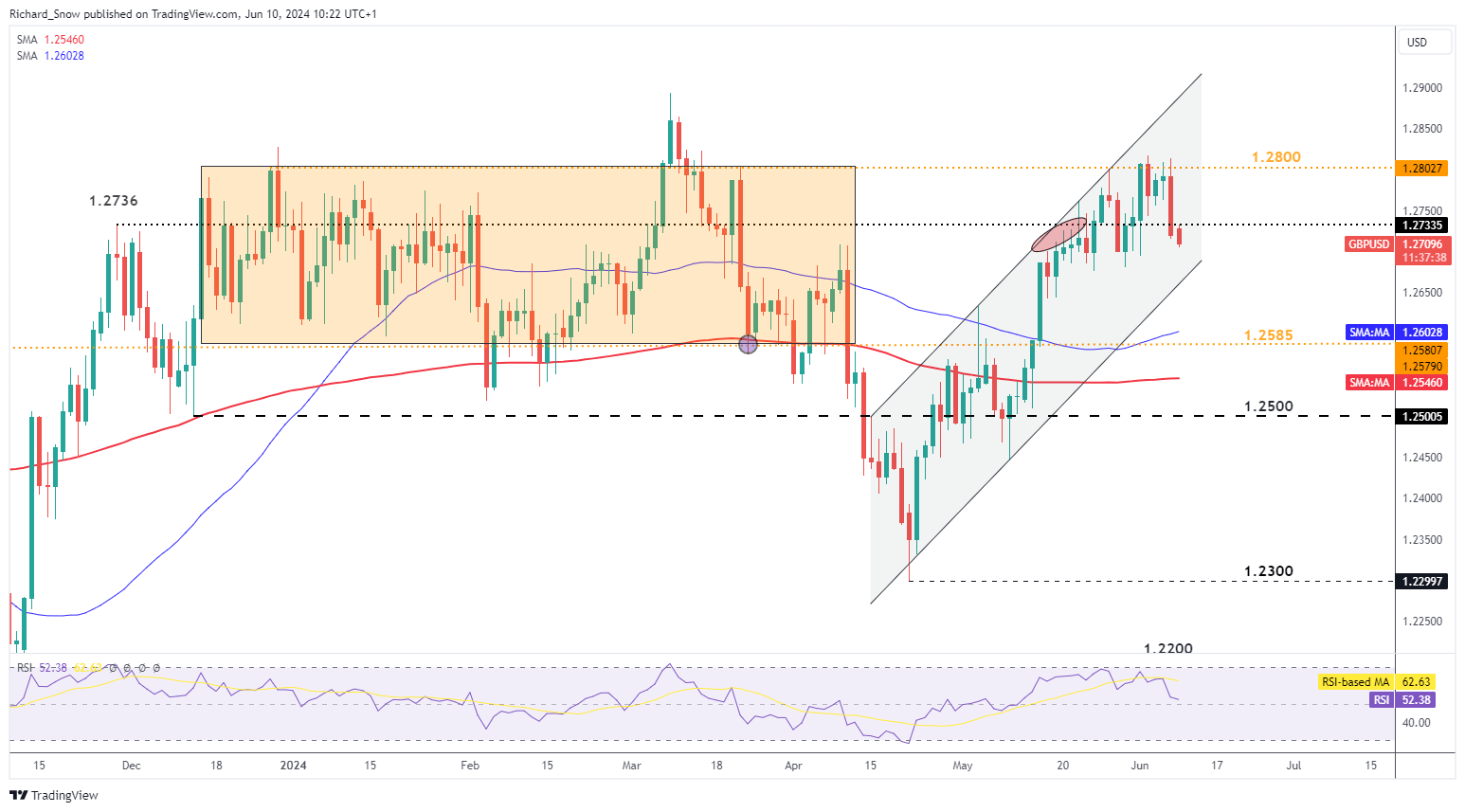

- GBP/USD shows signs of stress but will ultimately be decided upon top tier US data

- GBP/AUD eases at the start of the week but the recent bullish move remains constructive for now

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

UK Jobs and Growth Data to Take a Back Seat as US CPI, FOMC Steal the Spotlight

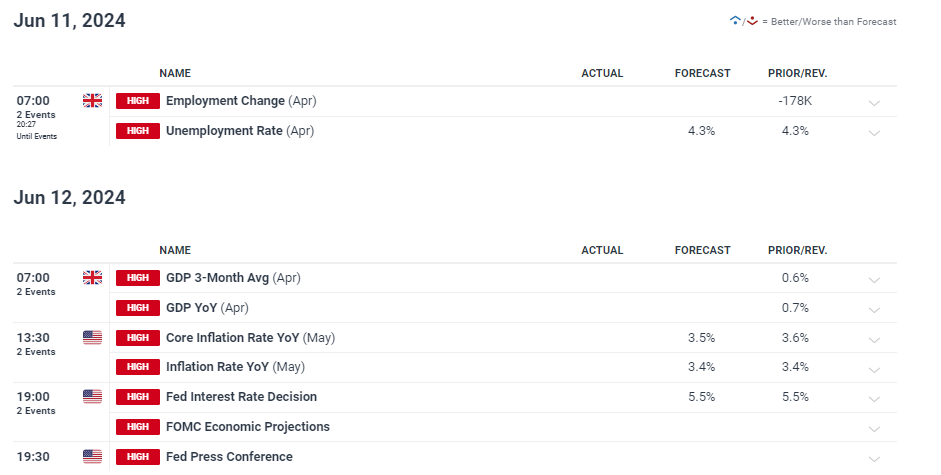

This week is shaping up to be another busy one as UK jobs and growth data is due but so is US inflation and the FOMC meeting. The UK labour market has shown clear signs of easing with the unemployment rate rising steadily to 4.3% where it is expected to remain for the month of April. The shock rise in US NFP on Friday proved that the Fed does not have the luxury of deciding when to cut rates as a resilient labour market threatens to reignite inflation concerns – providing a bullish lift for the greenback which sent GBP/USD sharply lower.

On Wednesday, US inflation data and the FOMC statement are due. The Fed will update its economic projections with plenty of eyes on the dot plot. Back in March the Fed signaled it would likely cut rates three times this year but stickier monthly inflation data coupled with the recent NFP print may force the Fed to trim its rate outlook by one 25 basis point cut.

UK price increases dropped in April but by less than anticipated, keeping sterling buoyed but growth is the one metric where the UK is really struggling. The three-month GDP average started rising off the 0 mark in February but has remained aneamic on the whole. The year-on-year comparisons stagnated from December to February, lifting by 0.7% in March.

However, cable (GBP/USD) has managed to make inroads against the US dollar during this time, mainly due to softer US data that emerged and GDP continued to moderate.

Customize and filter live economic data via our DailyFX economic calendar

Learn how to prepare for high impact economic data or events with this easy to implement approach:

Recommended by Richard Snow

Trading Forex News: The Strategy

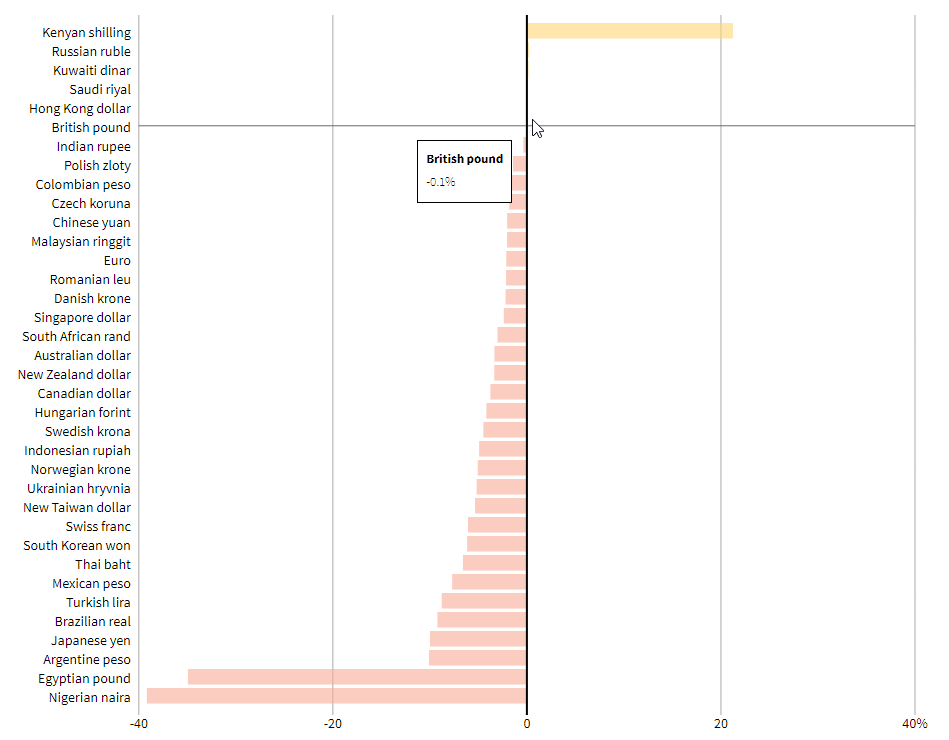

Sterling has performed well in 2024, almost unchanged since the start of the year. It remains the top performing of the G7 currencies against the dollar.

Global Currencies vs the Dollar (2024 Performance)

Source: Reuters, prepared by Richard Snow

Cable trades lower at the start of the week, continuing the momentum from last week’s shock NFP data. The pair trades below the 1.2736 swing high and approaches channel support.

This week’s UK data could see a continuation of the sell-off if the labour market eases further or growth remains subdued. The Bank of England is expected to pave the way for a likely cut in August at next week’s meeting but until then markets will be sensitive to incoming data; particularly that in the US

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

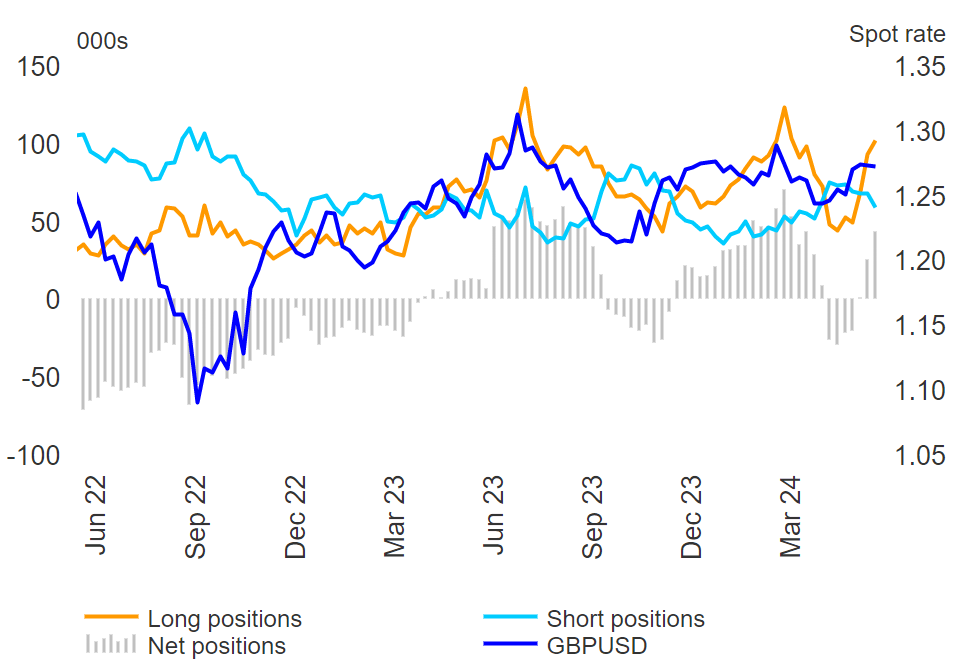

Sterling longs have also been rising sharply in the last few weeks with shorts dropping off.

GBP Commitment of Traders Report

Source: TradingView, prepared by Richard Snow

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | -5% | 9% | 1% |

| Weekly | 4% | -17% | -7% |

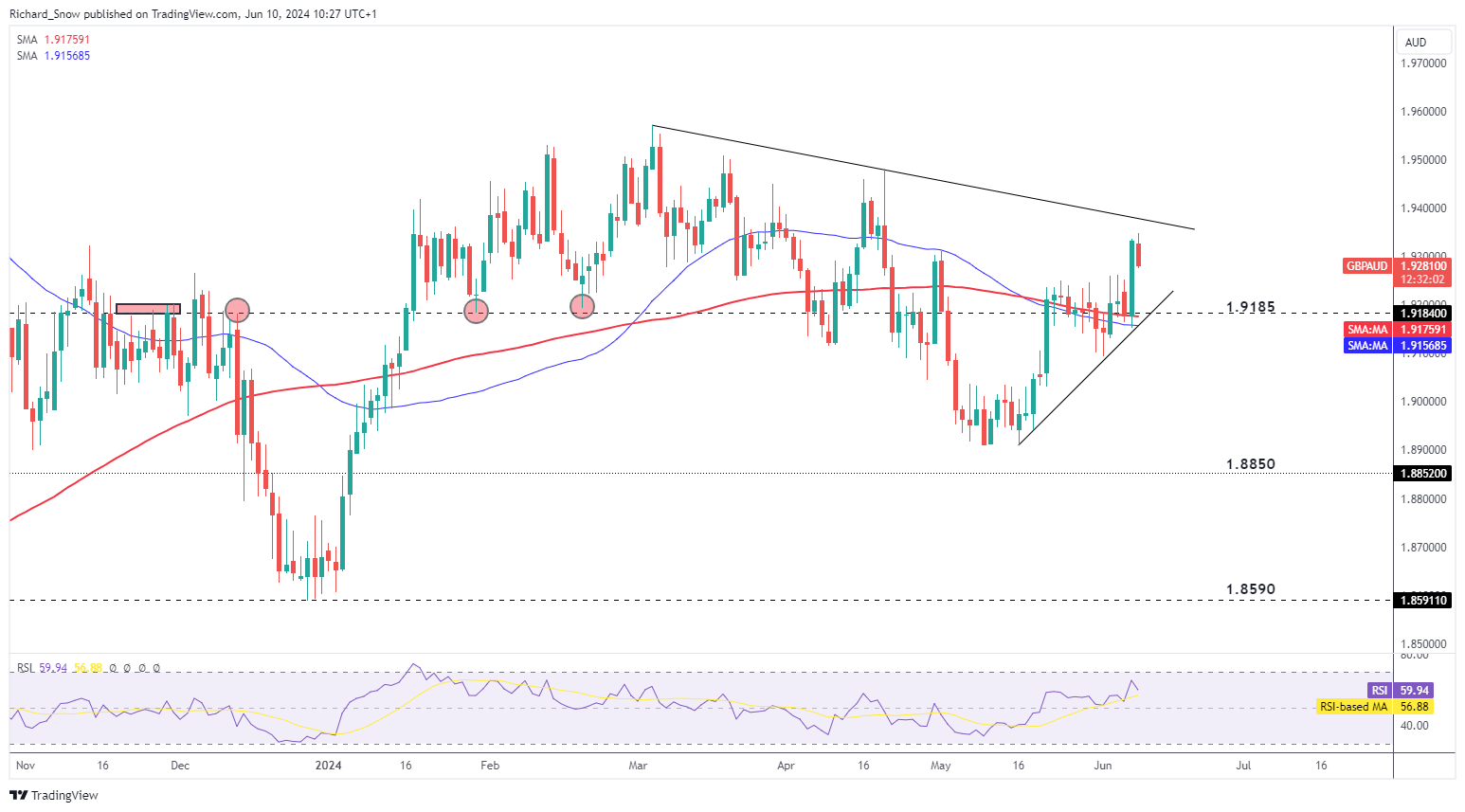

GBP/AUD appears to have pulled back ahead of the descending trendline resistance but the shorter-term bullish move remains in place. The broader triangle pattern provides an well-defined level of support around the 200-day simple moving average (SMA) which coincides with trendline support around 1.9185.

GBP/AUD Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX