Swiss National Bank, Swiss Franc Analysis

- SNB keeps the momentum, lowering the interest rate further, to 1.25%

- Inflation in Switzerland has fallen below the target and is expected to remain there

- In the lead up, a notable proportion of the market envisioned a hold, CHF repricing taking effect

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

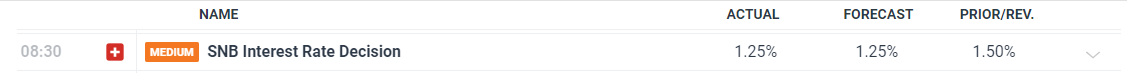

Swiss National Bank (SNB) Voted to Lower the Interest Rate by 25 Basis-Points

The SNB voted to lower interest rates by 25 basis points to set the policy rate at 1.25%. The rate cut was expected by the majority of the market but there was a notable outside chance that the Bank may decide to hold given the phenomenal drop in inflation and firm wage growth that revealed few, if any, signs of abating.

Customize and filter live economic data via our DailyFX economic calendar

Chairman Jordan referred to the recent appreciation of the franc being due to political uncertainty. A stronger local currency makes Swiss exports more expensive to its trading partners and can weigh on growth. Jordan also communicated the Banks commitment to intervene in the FX market in any direction, if deemed necessary. The announcement resulted in a drop in the value of the franc.

Learn how to prepare for high impact economic data or events with this easy to implement approach:

Recommended by Richard Snow

Trading Forex News: The Strategy

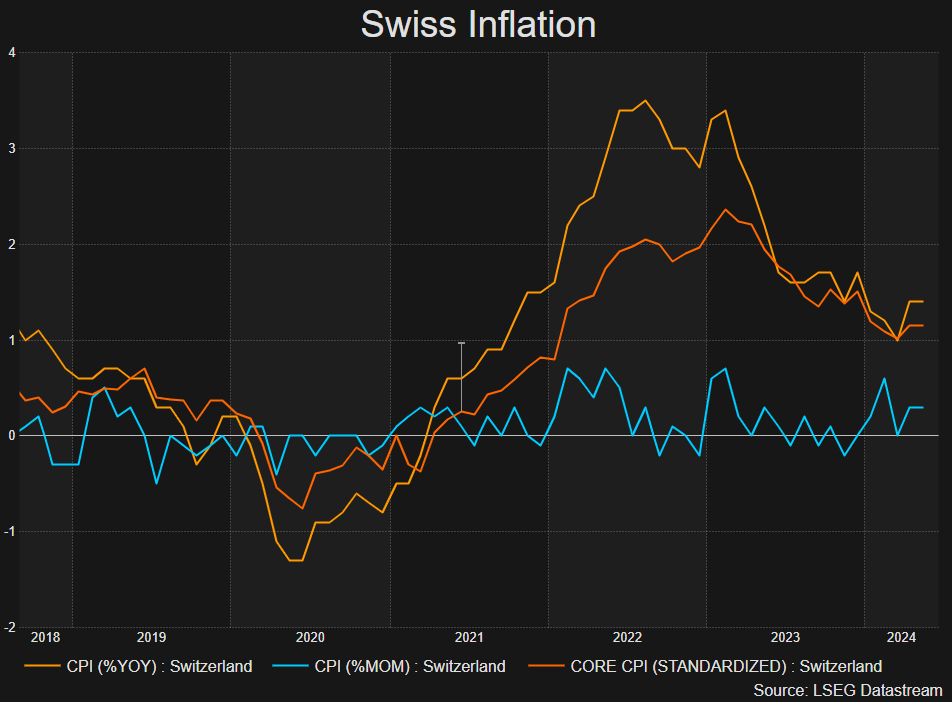

Swiss Inflation – The Envy of Developed Markets

Swiss inflation remains comfortably beneath the 2% target, remaining at 1.4% for a second month in a row as other countries like the US and the EU are yet to achieve the feat. Just yesterday, the UK managed to hit the Bank of England’s 2% target but unlike Switzerland, UK inflation is expected to remain above 2% for some time thereafter.

Swiss Inflation (Headline and Core Measures of CPI)

Source: Refinitiv, prepared by Richard Snow

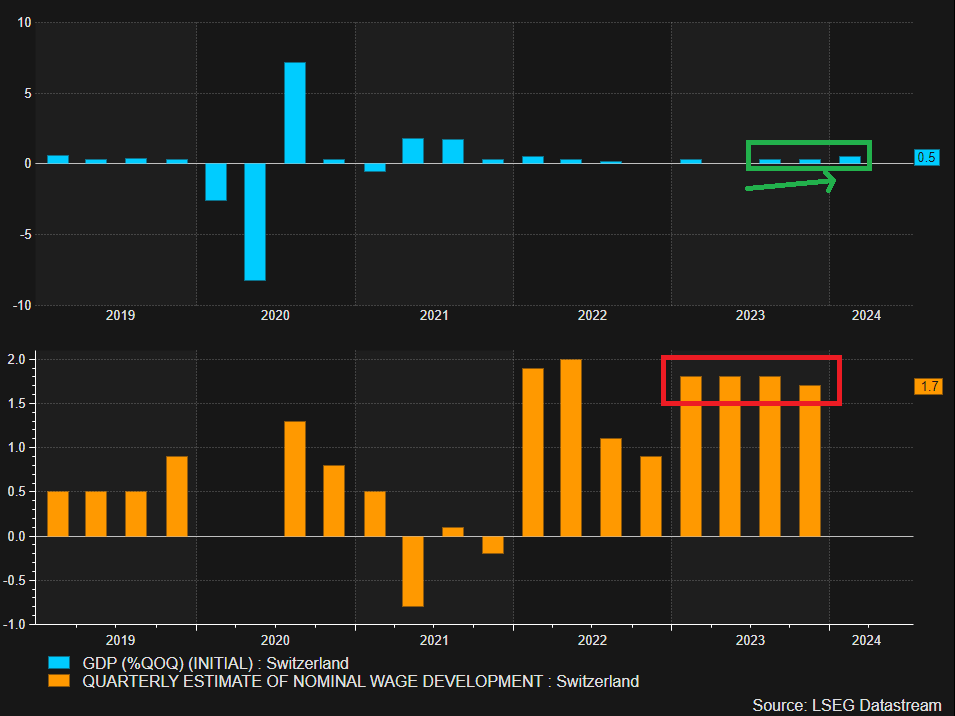

Swiss GDP and Wage Growth Gave SNB Hawks a Reason to Hold

Early signs of an economic recovery in Switzerland have been building, suggesting that rates are not too restrictive to hamper growth. In addition, wages in Switzerland had shown resilience, holding at 1.8% for three quarters in a row, only dropping marginally in Q4 2023 to 1.7%. These developments provided some uncertainty around the decision with many of the view the Bank might have held rates steady.

GDP Showing Green Shoots and Wage Pressures Hold Firm

Source: Refinitiv, prepared by Richard Snow

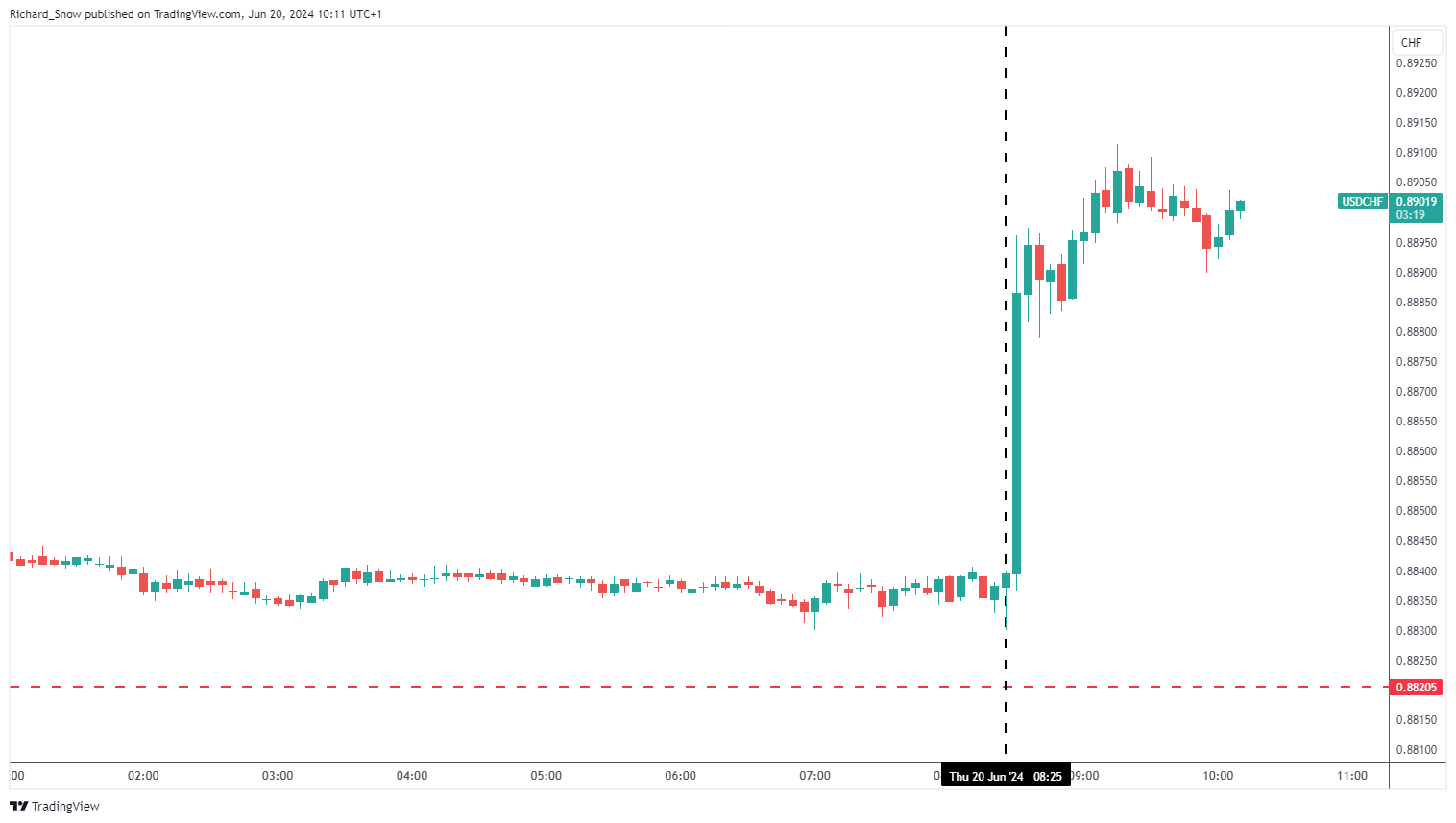

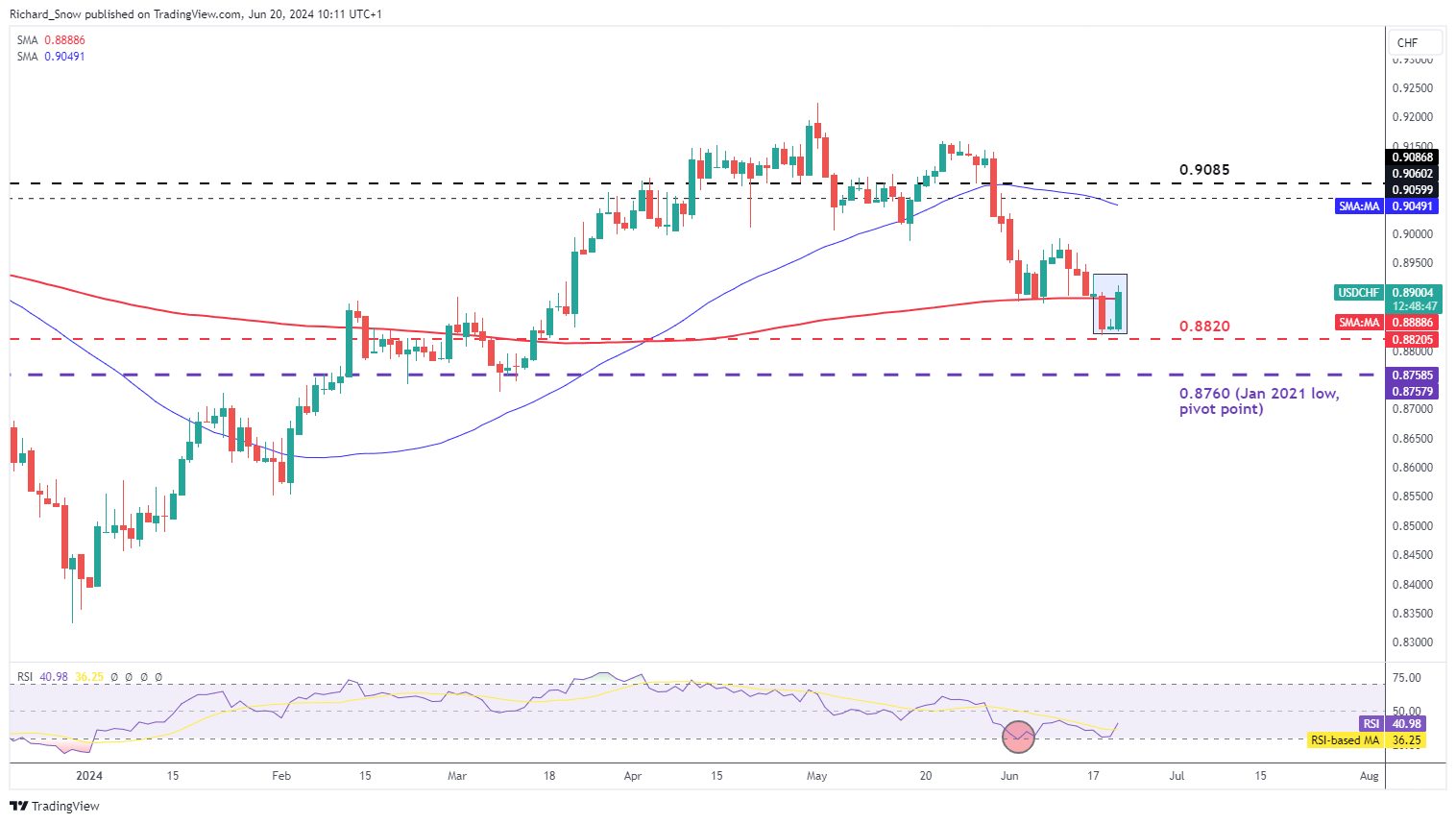

USD/CHF Immediate Market Reaction and Outlook

With many market participants holding out for an unchanged interest rate announcement today, its unsurprising to see a sharp repricing in the franc (weakness) as USD/CHF climbed 67 pips in the aftermath.

USD/CHF 5-Minute Chart

Source: TradingView, prepared by Richard Snow

The weaker franc presents a potential reversal formation unfolding at the moment. Should price action close for the day around current levels, the three-day candle formation could be likened to that of a morning star – a typically bullish reversal pattern. The one concern here is the longevity of bullish drivers around the dollar. Hawkish revision to the Fed’s inflation forecast sent the greenback sharply higher but with inflation appearing on track for 2%, markets may soon price in a rate cut as early as Q3. US PCE data next week will help provide direction for the dollar and either confirm or invalidate CPI improvements.

USD/CHF Daily Chart

Source: TradingView, prepared by Richard Snow

If you’re puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls

Recommended by Richard Snow

Traits of Successful Traders

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX