US DOLLAR FORECAST:

USD FORECAST: NEUTRAL

For Tips and Tricks on Navigating Your Way Through News Events, Download the Guide Below

Recommended by Zain Vawda

Introduction to Forex News Trading

READ MORE: USD/ZAR Forecast: Rand (ZAR) Slides Despite BRICS Expansion Plans, A Temporary Blip?

RATE HIKE PROBABILITIES INCREASE ON HAWKISH POWELL MESSAGE

The US Dollar has extended its gains to a 6th consecutive week on the back of hawkish message from Fed Chair Powell at Jackson Hole following another week of largely positive US data. The DXY for its part struggled on Friday despite Powell’s hawkish message as it seemed a lot of what the Fed Chair had to say had been baked into the price prior to him taking the podium. This was echoed by risk assets which enjoyed a bullish Friday to end a mixed week.

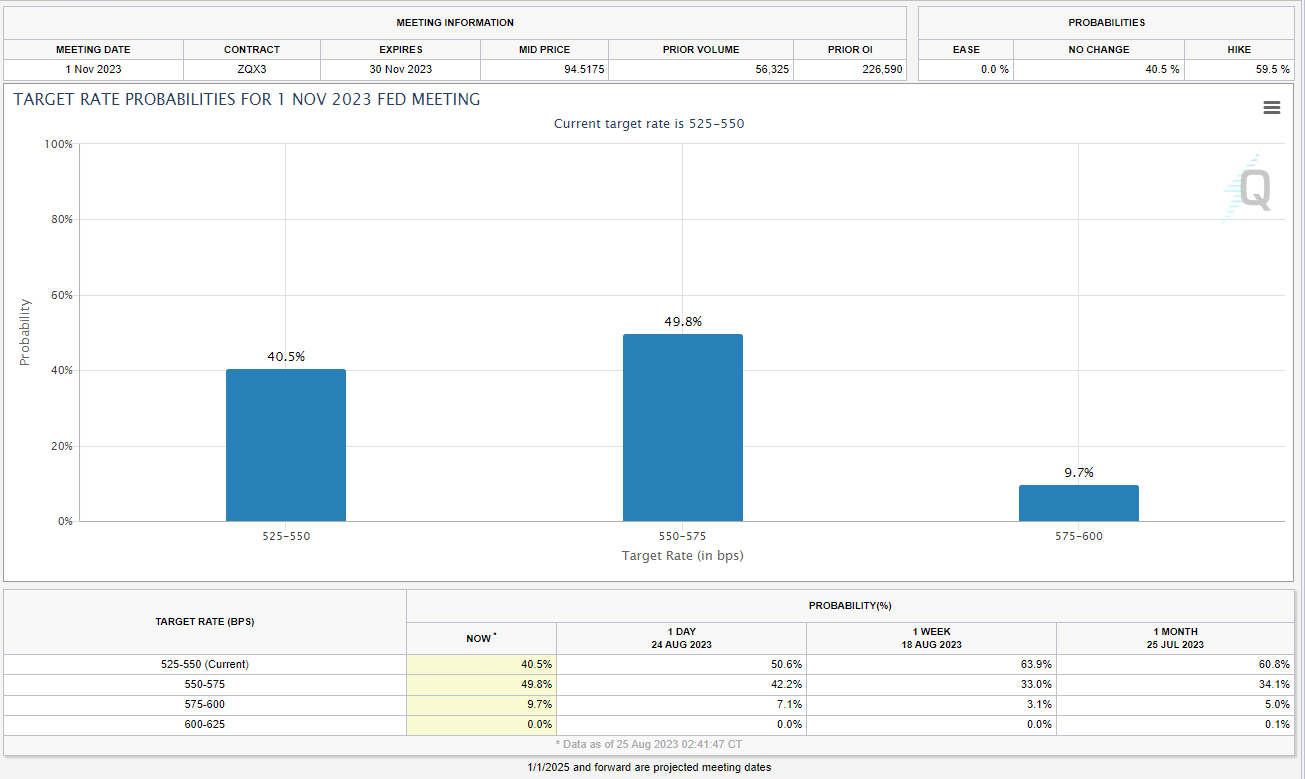

We did see a bit of back and forth in terms of rate hike probabilities in the aftermath of Fed Chair Powell’s speech. As the dust settled however, we saw no change in the odds for a September rate hike but odds for a 25bps hike in November have risen from around 42% to 49.8% prompting the brief run for the Dollar on Friday. Most of these gains by the Dollar Index were wiped out as the day progressed, however.

Source: CME FedWatch Tool

Central Banks are facing an even tougher task the closer they get to their inflation targets as they balance the possibility of resurgent inflation with the risk of overtightening. This week’s PMI data showed that while rate hikes are taking effect, we are seeing a slight uptick in input costs which could lead to stubborn inflationary pressure ahead. Fed Chair Powell intimated as much in his speech saying that the Fed are in a position to proceed carefully while not ruling out further rate hikes. Employment is seen as a sticking point for the US Fed as the labor numbers remain robust and the longer this goes on the greater chance of inflationary pressure down the road as demand remains elevated.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

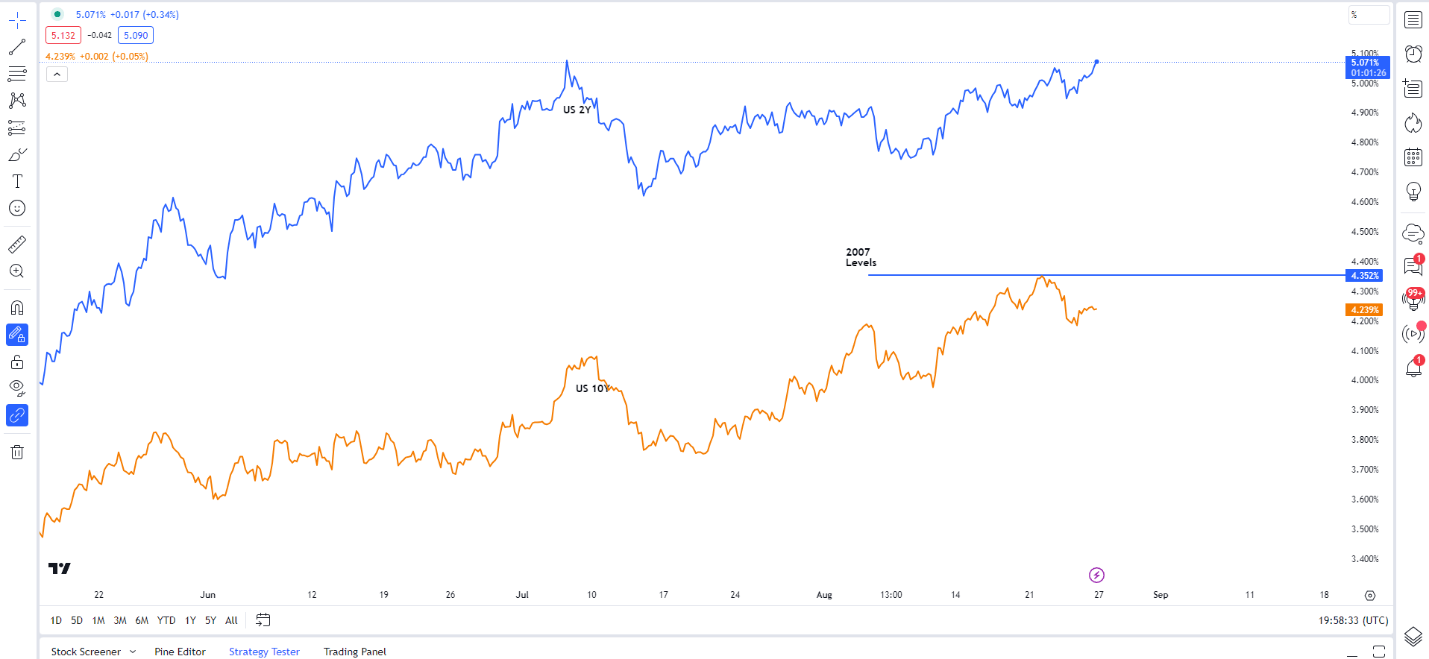

US TREASURY YIELDS

US Treasury yields had a mixed an interesting week with the US 10Y flying in the early part of the week to levels last seen in 2007. Long dated yields were the beneficiary early in the week before a surge on Friday saw the US 2Y reach its YTD high just shy of the 5.1% percent mark following the speech by Chair Powell widening the Yield Curve Inversion once more. This in part down to the expectation that higher rates will remain in place for the short-term.

US 2Y and US 10Y Yields

Source: TradingView, Created by Zain Vawda

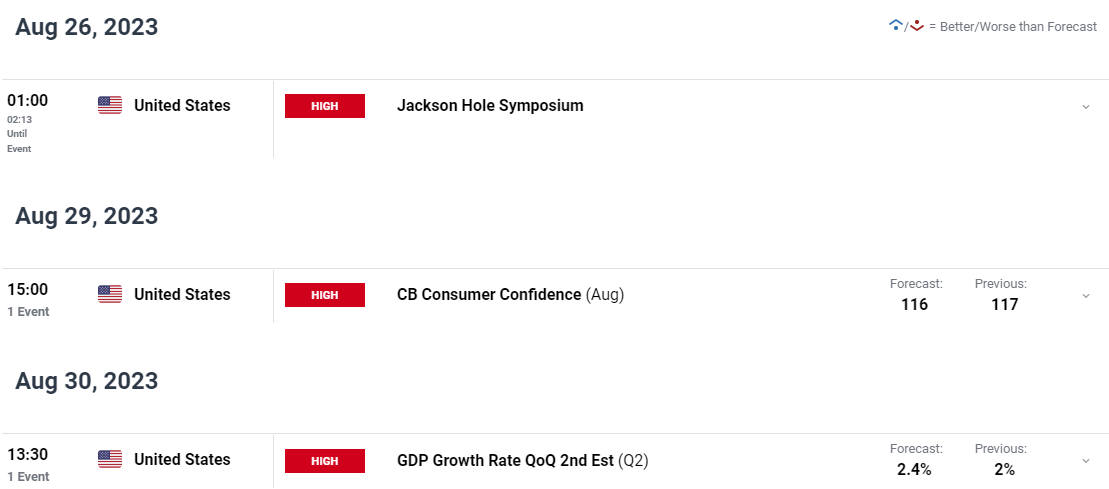

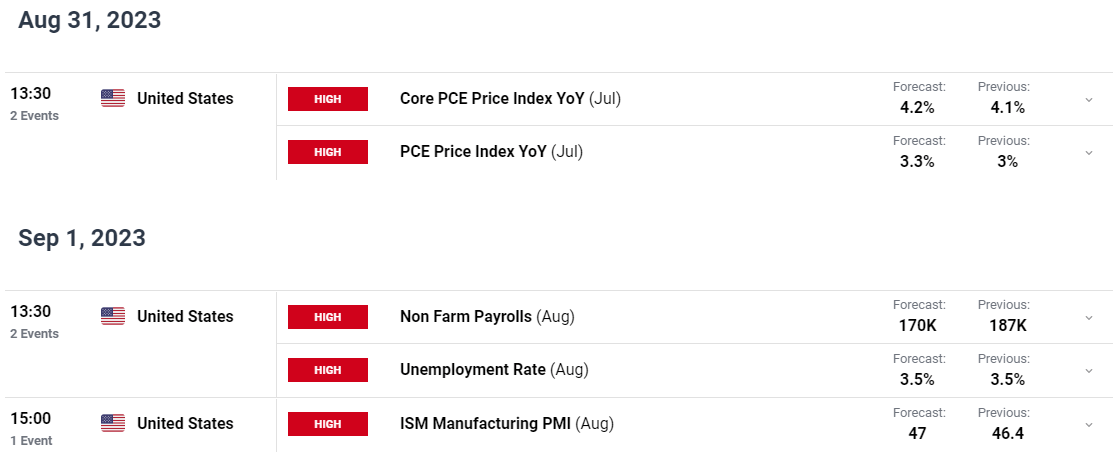

THE WEEK AHEAD: NFP AND PCE DATA MAY SET UP SEPTEMBER FED MEETING

Heading into next week and we have a lot of high impact data events which are expected to hold significant sway on how the Fed proceed heading into the September meeting. Labor data has remained robust with jobless claims holding up well while the lack of a slowdown continues to baffle and concern the Federal Reserve. White House Economic Advisor Bernstein stated on Friday that the labor market continues to fuel inflation as demand remains elevated. This adds extra weight to the NFP data this week and could see implications on the Fed Funds rate probabilities as well.

The Core PCE data remains the Fed’s preferred gauge of inflation and based on some comments this week from both the Fed and the White House Economic Advisor labor remains a sticking point. The US economy is seeing sustained levels of demand, and this has been attributed to the tight labor market and consumer spending. We will also get the 2nd estimate of GDP data from the US. A really interesting week for markets and the US Dollar in particular that could play a huge part in the Fed decision at the September meeting.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

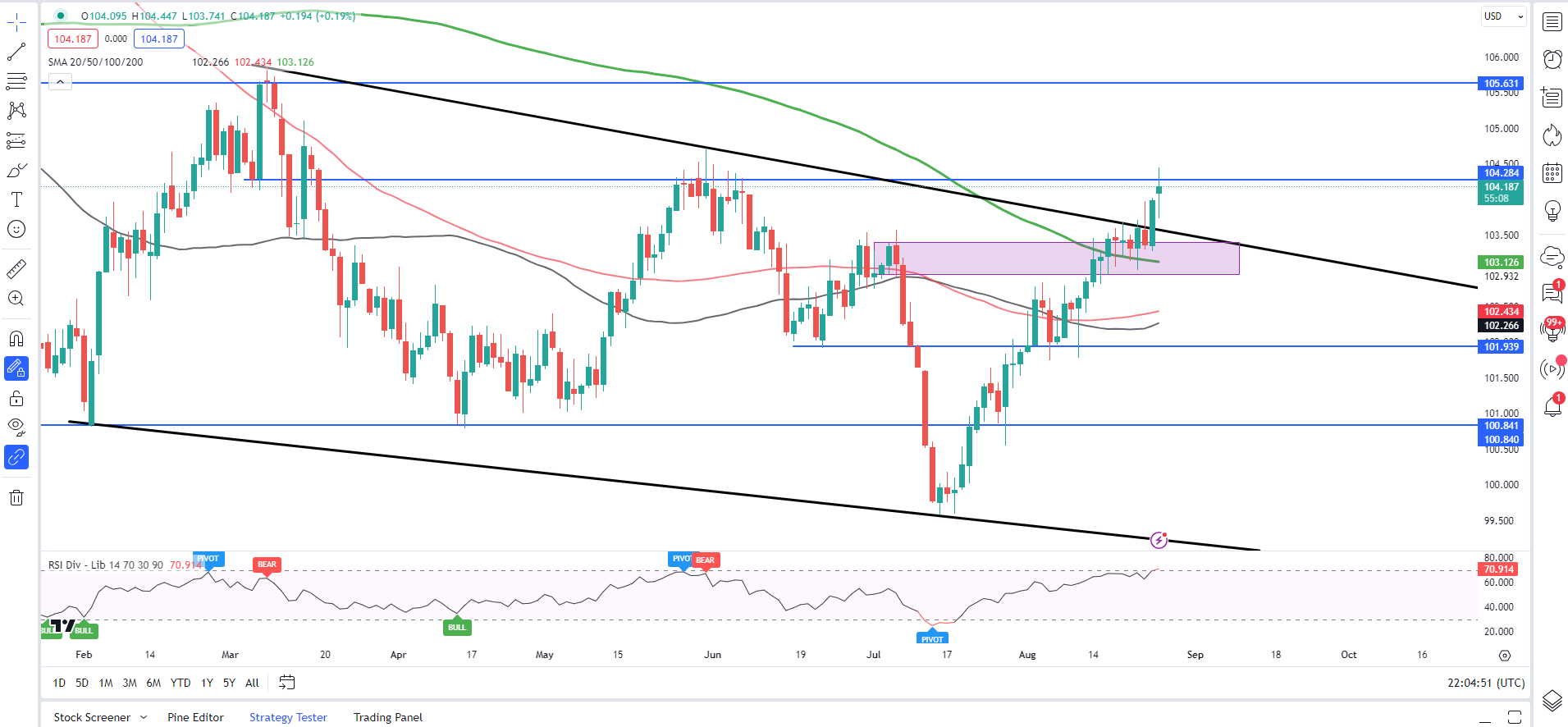

Looking at the technical perspective and the Dollar Index has now seen a change in structure on a weekly chart having taken out the previous swing high around the 103.00 handle. This is massive in my opinion as even if we do see the DXY face selling pressure it could be nothing more than a retracement before the next leg to the upside.

The Daily chart has also crossed a critical hurdle as we have broken back above the 200-day MA, the first time since November 2022 and followed that up with a break of the descending channel.

The only thing to consider is that given the extended rally to the upside the RSI (14) has entered overbought territory while running into resistance around the 104.30 mark. We could be in for a period of retracement before continuing the next leg to the upside.

A lot of the early week moves could be rangebound in nature ahead of the PCE and NFP data as we have seen the sensitivity of markets to data releases of late. Fundamental factors have been driving both volatility and market moves for the majority of 2023 and with Central Banks paying even closer attention to the data expect this to only increase as the year progresses.

US Dollar Index (DXY) Daily Chart – August 25, 2023

Source: TradingView

Key Levels to Keep an Eye On:

Support Levels

- 103.50

- 103.12 (200-day MA)

- 102.43 (100-day MA)

Resistance Levels

- 104.30

- 105.00 (psychological level)

- 105.63 (March swing high)

Recommended by Zain Vawda

The Fundamentals of Breakout Trading

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda