US Dollar, Stocks, Gold, and Silver Analysis and Charts

For all high impact data and event releases, see the real-time DailyFX Economic Calendar

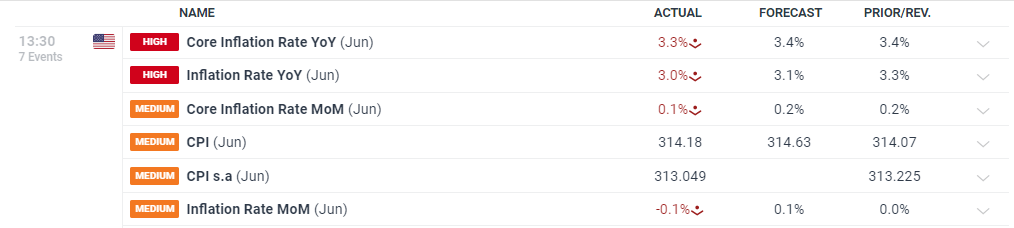

The US dollar index fell by nearly half a point after the latest US CPI showed inflation eased by more than forecast. Headline inflation y/y fell to 3.0% from 3.3% in May, while core inflation y/y fell to 3.3% from 3.4%. Core inflation m/m fell to 0.1% from a prior month’s reading of 0.2%.

Recommended by Nick Cawley

Get Your Free USD Forecast

Markets are now showing an 87% chance of a 25 basis point interest rate cut at the September 18th FOMC meeting.

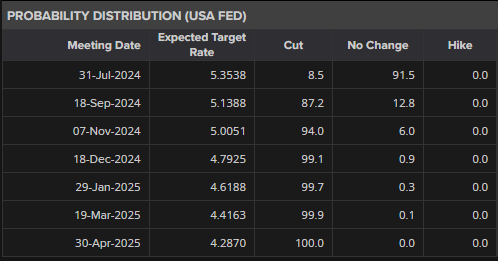

The US dollar index fell around 40 pips on the news and continues to sell off. The DXY is now closing in on the recent low prints around 104.00 made in early June

US Dollar Index Daily Chart

US indices have now turned positive pre-open with the Nasdaq 100 and the S&P 500 currently showing gains of 0.3% on the session.

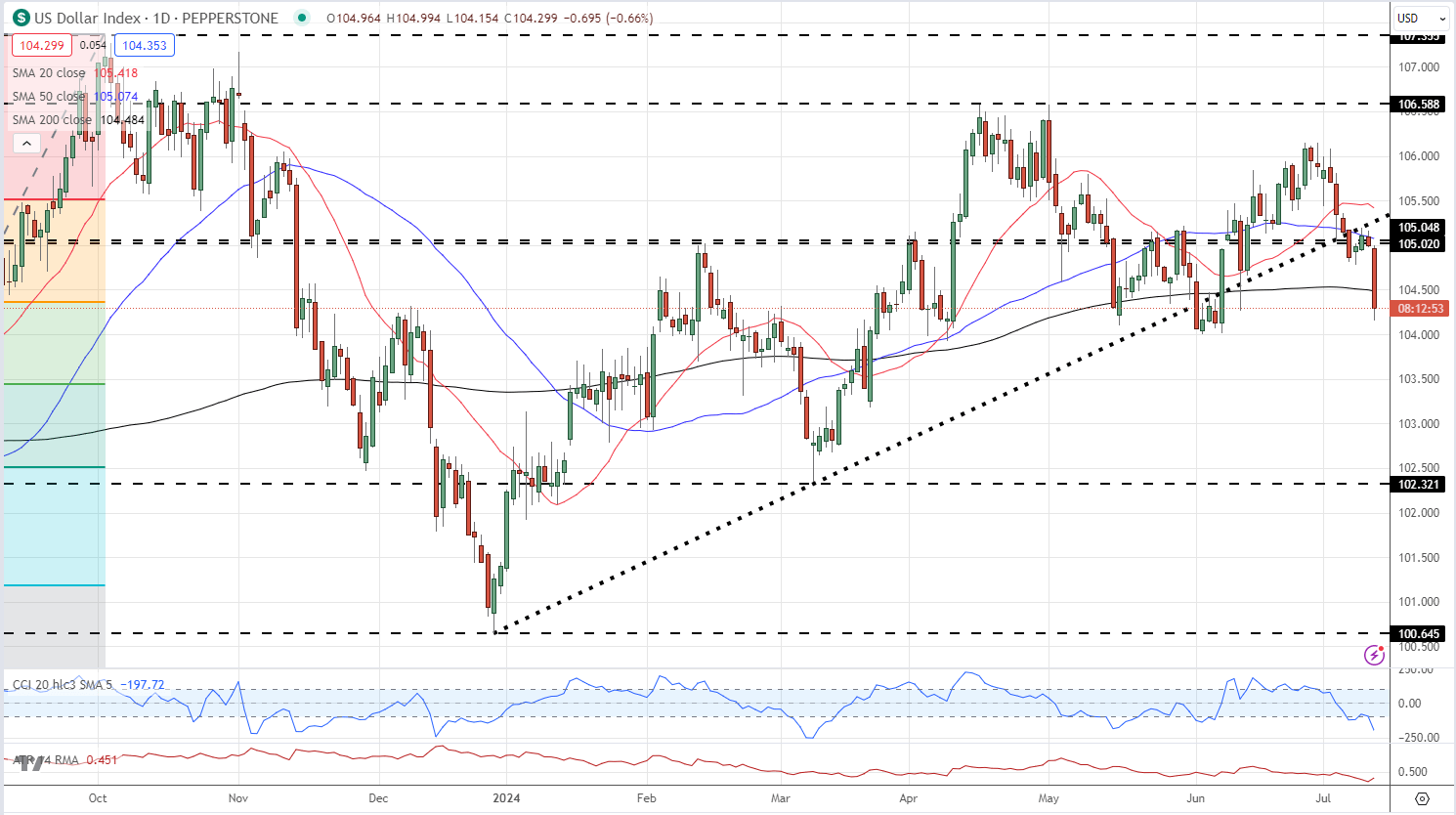

Gold is back above $2,400/oz. for the first time since late May, and there is little resistance left on the daily charts until the recent high at $2,450/oz. comes into play.

Gold Daily Price Chart

Recommended by Nick Cawley

Get Your Free Gold Forecast

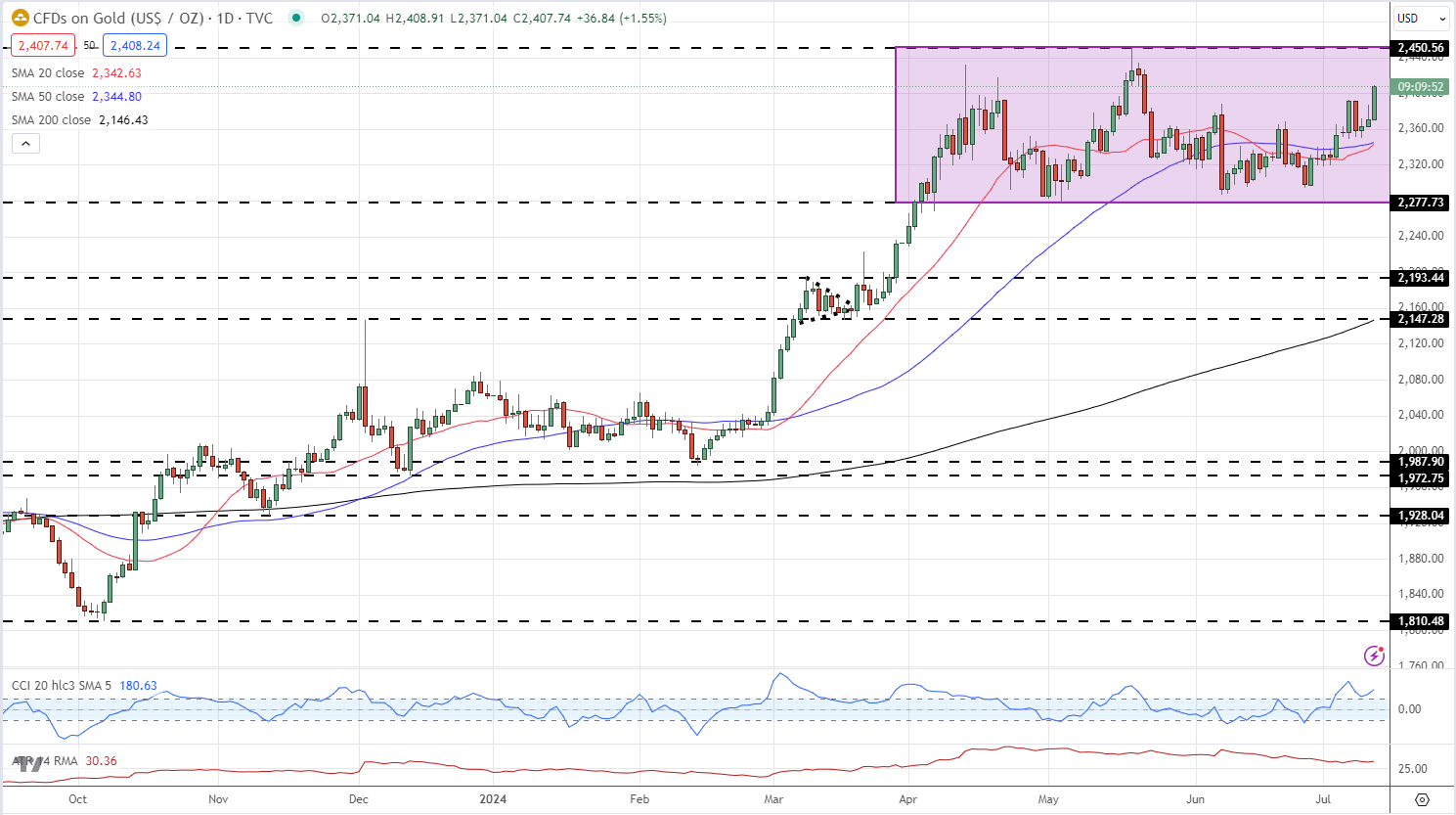

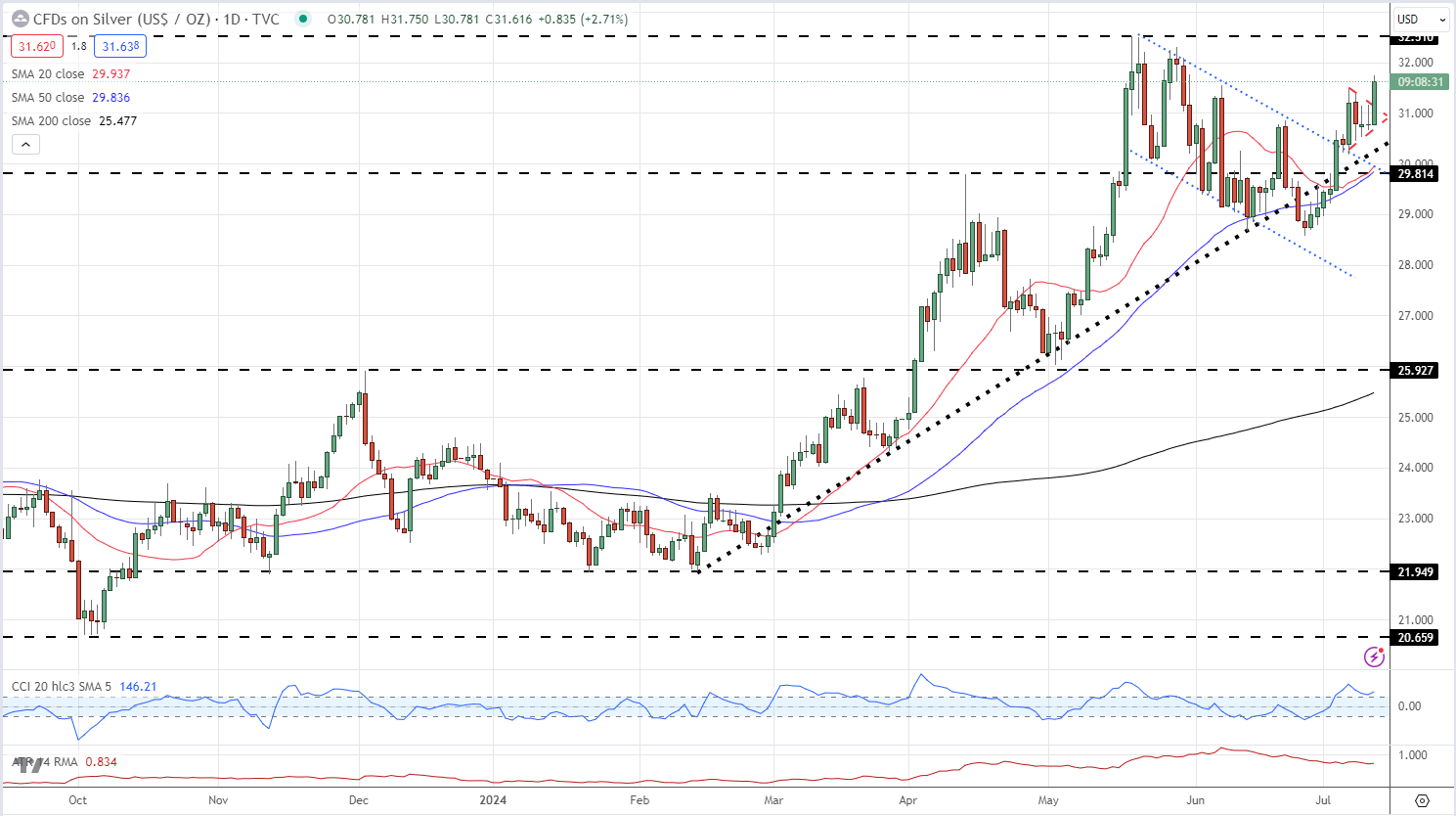

Silver outperforms gold and is over 2.5% higher after the data release. Silver has also broken out of the recent daily pennant pattern, confirming a bullish outlook and a test of $32.50/oz.

Silver – Bullish Technical Patterns on the Daily Chart

Silver Daily Price Chart

What are your views on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.