US Dollar, EUR/USD, ECB, Fed, BoE, BoJ, Kanda, AUD/USD, Crude Oil, Gold – Talking Points

- The US Dollar might see some volatility with an all star cast lined up for today

- The ECB conclave will see the head honchos from the BoE, BoJ, ECB and the Fed speak on a shared panel

- Not all central bankers are swimming in the same direction. Will comments move EUR/USD?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The US Dollar appears poised going into Wednesday ahead of the European Central Bank’s (ECB) Forum on Central Banking.

The policy panel discussion at the Sintra, Portugal event will include all the heavy hitters – Andrew Bailey, Governor, Bank of England, Christine Lagarde, President, European Central Bank, Jerome Powell, Chair, Board of Governors of the Federal Reserve System and Kazuo Ueda, Governor, Bank of Japan.

Comments emanating from the gathering will be closely scrutinised for hints on their respective monetary policy agendas.

In the lead-up to the meeting, Mr Bailey, Ms Lagarde and Mr Powell had reiterated their hawkish perspective. Mr Ueda and the Bank of Japan have different points of view as they maintain ultra-loose settings.

Earlier today, Masato Kanda, Japan’s Vice Finance Minister for International Affairs, said that authorities will respond if there are excessive FX moves. USD/JPY eased below 144 on the comments but has since steadied.

Australia’s monthly CPI was a notable miss and the Aussie Dollar collapsed in the aftermath. The year-on-year headline CPI gauge for May was 5.6% rather than the 6.1% anticipated and against 6.8% previously.

The ASX 200 equity index climbed over 1% on hopes that the RBA will pause on its tightening regime at their meeting next Tuesday. Japan’s main indices were also higher following on from a positive Wall Street lead after sold US economic data overnight.

China’s CSI 300 and Hong Kong’s Hang Seng Index (HSI) were a bit softer as concerns remain for their economic recovery after industrial profits data remained subdued in May.

Treasury yields are mostly unchanged so far on Wednesday after a handful of basis points were added across most of the curve in the North American session.

Gold is struggling to hold ground as it lingers near its 3-month low around US$ 1,920.

Crude oil has steadied after taking a tumble overnight. The WTI futures contract is back above US$ 68 bbl while the Brent contract is looking to reclaim US$ 73 bbl. Live prices for these markets can be found here.

Aside from the ECB panel discussion, the economic calendar is mostly second-tier data. The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade EUR/USD

EUR/USD TECHNICAL ANALYSIS

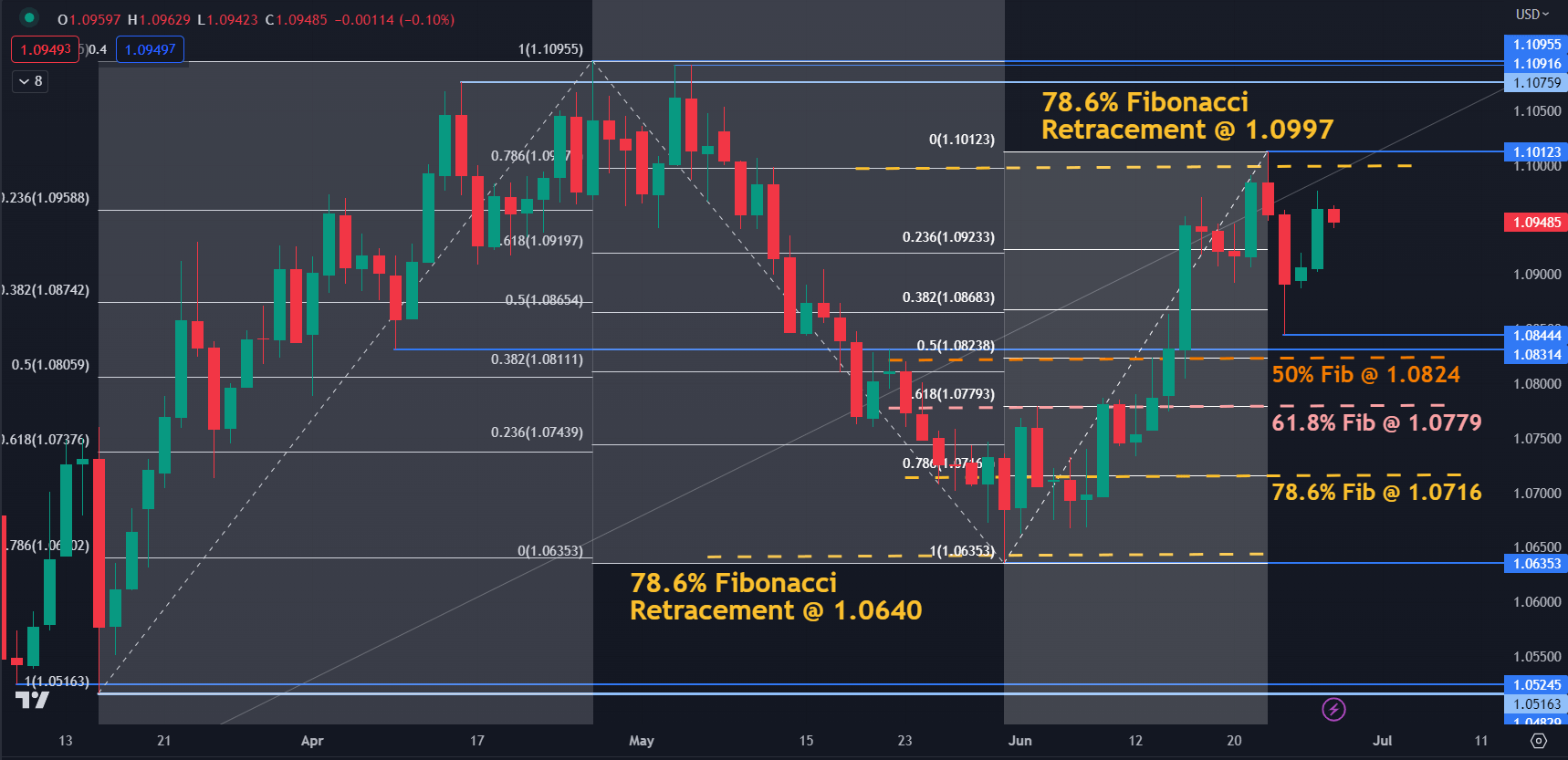

EUR/USD remains in the six-week range of 1.0516 – 1.1096 after failing to meaningfully challenge the topside last week.

The run higher barely eclipsed the 78.6% Fibonacci Retracement of the move from 1.1096 down to 1.0635 at 1.0997 when it peaked at 1.1012. Those levels may continue to offer resistance ahead of a series of potential resistance levels in the 1.1076 – 1.1096 area.

Nearby support could be at the recent low of 1.0844, which is just above the breakpoint of 1.0831.

Further to the downside, there are a series of Fibonacci Retracement levels of the move from 1.0635 up to 1.1012 that might provide support. The 50% Retracement level is at 1.0824, the 61.8% at 1.0779 and 78.6% is at 1.0716.

The late May low of 1.0635 was only a fraction below the 78.6% Fibonacci Retracement of the move from 1.0516 to 1.1096 at 1.0640. This could make the 1.0635-40 area a possible support zone ahead of the prior lows at 1.0525, 1.0516, 1.0483 and 1.0443.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter