Fundamental Forecast for the US Dollar: Neutral

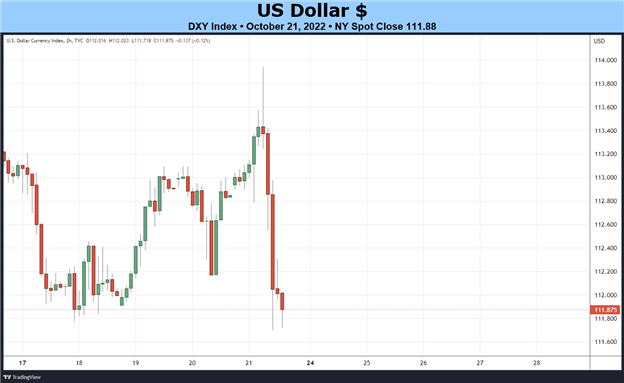

- The DXY Index fell back sharply at the end of the week around two key developments: the resignation of UK Prime Minister Liz Truss, lifting the British Pound; and the intervention efforts to support the Japanese Yen.

- The economic calendar is much busier in the coming days, with several high rated releases; of note, the initial 3Q’22 US GDP report is due.

- According to the IG Client Sentiment Index, the US Dollar has a mixed bias heading into late-October.

US Dollar Week in Review

The US Dollar (via the DXY Index) fared well over the course of most of last week until intervention efforts by one or both of the Bank of Japan and Japanese Ministry of Finance sent USD/JPY rates tumbling on Friday, sinking the US Dollar across the board. Overall, the DXY Index fell by -1.26%, with USD/JPY rates falling by -0.72%. EUR/USD rates added +1.42%, while GBP/USD rates gained +1.06% around the resignation of UK Prime Minster Liz Truss. Gold prices in USD-terms (XAU/USD) nearly set a new yearly low, but were able to settle higher by +0.80%.

Recommended by Christopher Vecchio, CFA

Get Your Free USD Forecast

Much Busier Economic Calendar

After last week, when there were no high rated US data releases, the economic calendar has several meaningful reports due in the coming days. It’s also worth noting that we’re now in the communications blackout period ahead of the November Fed meeting, placing additional emphasis on data releases as a source of volatility in USD-pairs.

- On Monday, October 24, the September US Chicago Fed national activity index is due at 12:30 GMT. The October S&P global manufacturing PMIs will be released at 13:45 GMT.

- On Tuesday, October 25, the August US house price index will be published at 13 GMT. The October US Conference Board consumer confidence index is due at 14 GMT.

- On Wednesday, October 26, weekly US mortgage application figures will be released at 11 GMT, followed by the September US building permits report at 12 GMT. The September US goods trade balance will be published at 12:30 GMT, as will the September US retail inventories report. September US new home sales figures are due at 14 GMT.

- On Thursday, October 27, a bevy of data releases will be published at 12:30 GMT: September US durable goods orders; the initial 3Q’22 US GDP report; the 3Q’22 US GDP price index; the 3Q’22 US PCE and core PCE readings; and weekly US jobless claims figures.

- On Friday, October 28, September US personal income and spending data are due at 12:30 GMT, as are the September US PCE and core PCE readings. At 14 GMT, the September US pending home sales report and the final October US Michigan consumer sentiment reading will be published.

Recommended by Christopher Vecchio, CFA

Trading Forex News: The Strategy

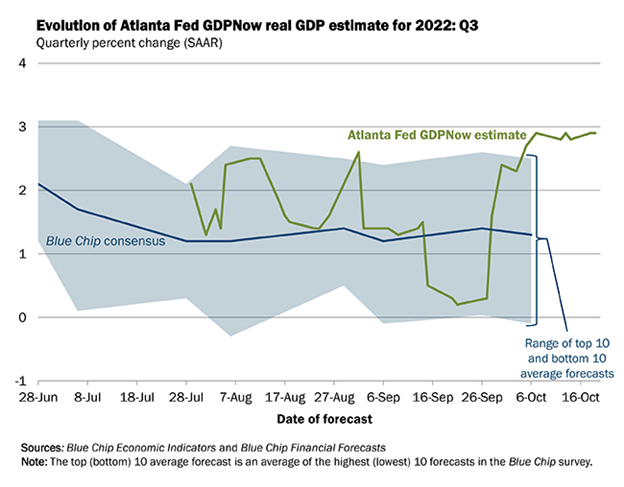

Atlanta Fed GDPNow 3Q’22 Growth Estimate (October 19, 2022) (Chart 1)

Based on the data received thus far about 3Q’22, the Atlanta Fed GDPNow growth forecast is now at +2.9% annualized. The upgrade resulted from “the nowcast of third-quarter real gross private domestic investment growth [increasing] from -3.6% to -3.3%.”

For full US economic data forecasts, view the DailyFX economic calendar.

Rate Hike Expectations Ease Back

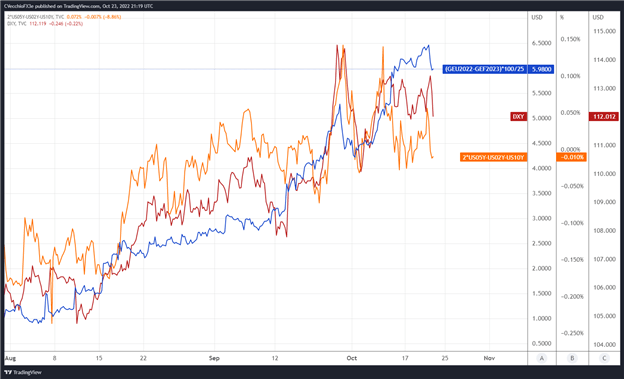

We can measure whether a Fed rate hike is being priced-in using Eurodollar contracts by examining the difference in borrowing costs for commercial banks over a specific time horizon in the future. Chart 1 below showcases the difference in borrowing costs – the spread – for the front month and January 2023 contracts, in order to gauge where interest rates are headed through the end of this year.

Eurodollar Futures Contract Spread (October 2022-January 2023) [BLUE], US 2s5s10s Butterfly [ORANGE], DXY Index [RED]: 4-hour Timeframe (August to October 2022) (Chart 2)

Since the beginning of August, there has been a tight relationship among the DXY Index, the shape of the US Treasury yield curve, and Fed rate hike odds. Despite easing back at the end of last week, Eurodollar spreads are still pricing a full 75-bps rate hike for the next Fed meeting in November. Additionally, a 75-bps rate hike in December is discounted by Eurodollar spreads and Fed funds futures.

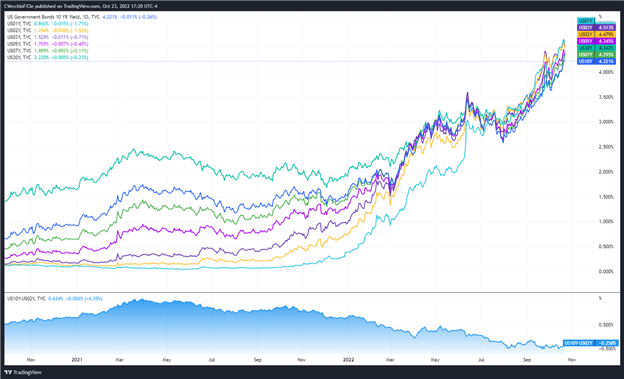

US Treasury Yield Curve (1-year to 30-years) (October 2020 to October 2022) (Chart 3)

The shape of the US Treasury yield curve – inverted near -26-bps, but steeper than in recent weeks – alongside a drop in Fed rate hike odds has impaired the US Dollar in in the near-term. US real rates (nominal less inflation expectations) continue to hold near yearly and multi-decade highs, helping cushion the US Dollar from a steeper fall.

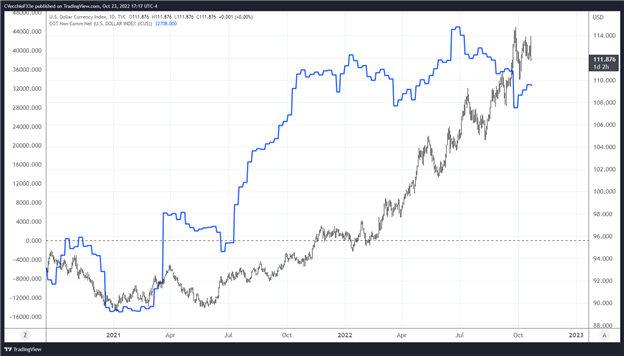

CFTC COT US Dollar Futures Positioning (October 2020 to October 2022) (Chart 4)

Finally, looking at positioning, according to the CFTC’s COT for the week ended October 18, speculators slightly decreased their net-long US Dollar positions to 32,708 contracts from 32,814 contracts. A lack of change in positioning is not necessarily a surprise, given the sideways trading experienced by the US Dollar after the reporting period ended. Overall, US Dollar positioning remains near its most net-long levels in over five years; the long US Dollar trade is still overcrowded.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Christopher Vecchio, CFA, Senior Strategist