**DIYWallST Weekly Recap & Market Forecast**

—

Hello Investors! This week was marked by significant economic and political developments, driving volatility in global stock markets. Let’s dive into the key events that shaped the financial landscape.

**Market Overview:**

The week began with a surprise rate cut by China’s PBOC, but this was quickly overshadowed by President Biden’s announcement that he was dropping out of the race. The Democratic Party swiftly rallied around Kamala Harris, with endorsements pouring in from state governors and, ultimately, the Obamas. By the end of the week, Harris appeared to have secured the nomination. The political developments contributed to a ‘Trump-trade’ sentiment, with small-cap value stocks continuing to outperform mega-cap technology shares. The cool June CPI and subsequent soft data points have also fueled expectations of Fed rate cuts later this year, underpinning this market rotation.

The US yield curve steepened notably, with the 2-10 year spread popping above -15 bps, while the VIX rose sharply through Thursday. A letter from former NY Fed President Dudley may have increased investors’ expectations for a Fed rate cut. The Bank of Canada cut rates for the second straight meeting, while global PMI readings indicated some softening, particularly outside the services sector. Pulte’s home orders fell short of analyst expectations, and June existing home sales missed targets despite rising supply levels. Richmond Fed data was weak, and several major industrial and chemical companies cut their outlooks. June PCE data indicated “further progress” for the Fed, echoing concerns about discretionary spending and a softening consumer pushing back against price hikes.

**Stock Market Performance:**

– S&P 500: Down by 0.8%

– Dow Jones: Up by 0.8%

– NASDAQ: Down by 2.1%

– Russell 2000: Up by 3.3%

**Economic Indicators:**

– **US Yield Curve:** Steepened significantly with the 2-10 year spread popping above -15 bps.

– **June Existing Home Sales:** Missed expectations despite rising supply levels.

– **Richmond Fed Data:** Indicated economic weakness.

– **June PCE Data:** Showed progress in cooling inflation.

– **Bitcoin Prices:** Climbed ~5% ahead of Former President Trump’s appearance at a crypto conference.

– **Dollar and Yen:** The dollar remained steady, while the Yen rose amid speculation of a potential BOJ rate hike.

**Corporate News:**

– **Google and Tesla:** Earnings reports did little to curtail volatility. Tesla missed estimates and Google’s YouTube ad revenues fell short, leading to a decline in AI enthusiasm as Google’s AI monetization efforts didn’t meet investor expectations.

– **Ford Motor:** Shares tumbled after a significant earnings miss, with the company continuing to lose money on each EV it produces.

– **3M:** Shares surged after posting a big earnings beat, despite noting softness in consumer discretionary demand and mixed industrial end markets.

**Looking Ahead:**

Next week will feature several key events:

– **Fed Rate Decision**

– **Powell Press Conference**

– **U.S. Jobs Report**

– **Earnings Reports:** Microsoft ( MSFT ), Apple (

AAPL ), Meta (

META ), Amazon (

INTC ), ExxonMobil (

XOM ), Chevron (

CVX ), Boeing (

BA ), and McDonald’s (

MCD ).

As we look forward, these developments will be crucial in shaping market sentiment and guiding investment decisions. If you have any questions or need further insights, feel free to reach out. Here’s to another week of informed investing and strategic decision-making!

### **Market Forecast (Updated 07/28/2024)**

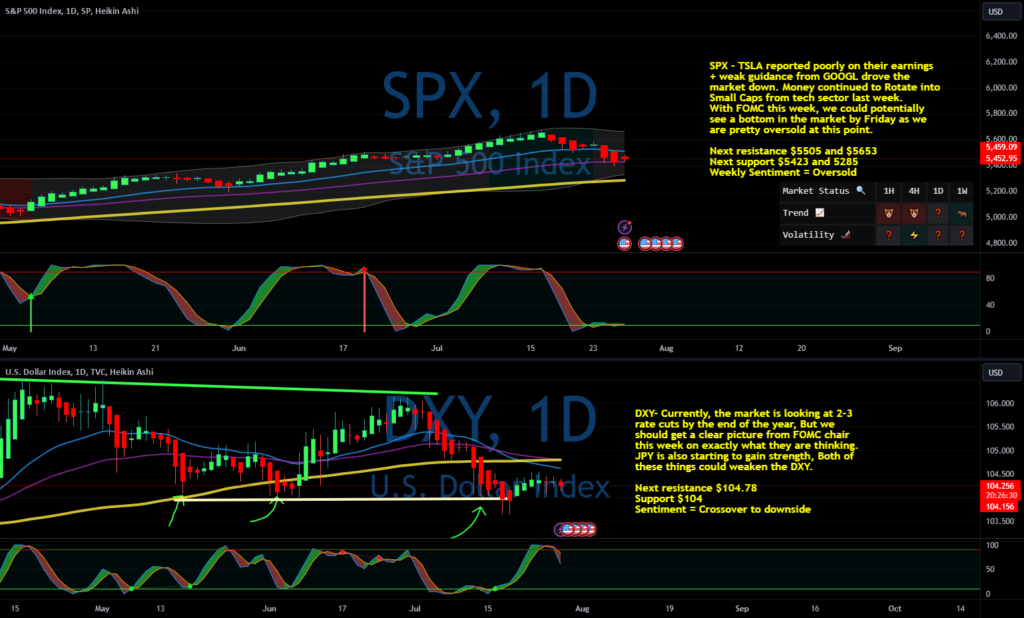

**SPX** – TSLA reported poorly on their earnings + weak guidance from GOOGL drove the market down. Money continued to Rotate into Small Caps from tech sector last week.

With FOMC this week, we could potentially see a bottom in the market by Friday as we are pretty oversold at this point.

Next resistance $5505 and $5653

Next support $5423 and 5285

Weekly Sentiment = Oversold

**Chart Analysis:**

(www.tradingview.com/x/E9rL9T1o/)

**Dollar Index:** DXY-Currently, the market is looking at 2-3 rate cuts by the end of the year, But we should get a clear picture from FOMC chair this week on exactly what they are thinking.

JPY is also starting to gain strength, Both of these things could weaken the DXY.

Next resistance $104.78

Support $104

Sentiment = Crossover to downside

**Put to call Ratio: 1.15—> 1.28

Next FOMC date: July 31, 2024**

**Fear & Greed Index: 49—>45**

!(prod-files-secure.s3…4ee0c70/Untitled.png)

**BTC:** Crypto market has been pretty strong and testing resistance, Trump spoke very highly of crypto as well but he also flip-flops a lot.

The key thing to watch here is the Dollar index, if that continues to drop, we could see btc test new highs.

However, we have a huge trendline at 68k and if we can break over it, it could start a bigger bull run as well.

Google our “DIYWALLST 2024 Crypto Forecast” for our favorite alt coins.