US Dollar, USD, US CPI, Japanese Yen, USD/JPY, Hang Seng Index – Talking Points

- The US Dollar slid slightly lower today with all eyes on US CPI

- Several Fed speakers crossed the wires with different perspectives

- If US CPI misses estimates, will USD/JPY break higher?

Recommended by Daniel McCarthy

Get Your Free USD Forecast

The US Dollar dipped in the Asian session ahead of US CPI data due out later today. Most currency pairs appear to be in somewhat of a holding pattern, except for USD/JPY. It leapt to a new high for the month above 134.00,

Most APAC equity indices saw slight gains on Wednesday although Hong Kong’s Hang Seng Index (HSI) slipped into the red.

Tencent weighed on the index after it was revealed that the large tech investor, Prosus, was preparing to sell a slice of its investment that would be around 1% of the market cap.

US Treasury Secretary Janet Yellen believes that the world’s largest economy is performing exceptionally well while a couple of Fed speakers appear to be at odds with each over potential further rate hikes from the bank.

New York Fed President John Williams saw scope for another hike to rein in inflation and Minneapolis Fed President Neel Kashkari maintained his hawkish credentials in comments overnight.

Conversely, Chicago Fed President Austan Goolsbee hinted toward a dovish stance citing the recent banking crisis and IMF’s latest report as a reason to be cautious with monetary policy. He was joined by Philadelphia Federal Reserve Bank President Patrick Harker that could also be seen as less hawkish.

Nonetheless, US CPI will be watched closely later today for more definitive clues on the Fed’s rate path. Interest rate markets are pricing a better-than-even chance of a lift to the target cash rate at the next Federal Open Market Committee (FOMC) meeting in early May.

The WTI futures contract is near USD 81.50 bbl while the Brent contract is a touch above USD 85.50 bbl.

Silver made a 12-month high today above USD 25.40 a Troy ounce. Gold is also eyeing last week’s peak of USD 2,032 per ounce

Looking ahead, after the US CPI print, the Bank of Canada will be making its decision on interest rates. According to a Bloomberg survey of economists, the bank is anticipated to maintain rates at 4.50%

The full economic calendar can be viewed here.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

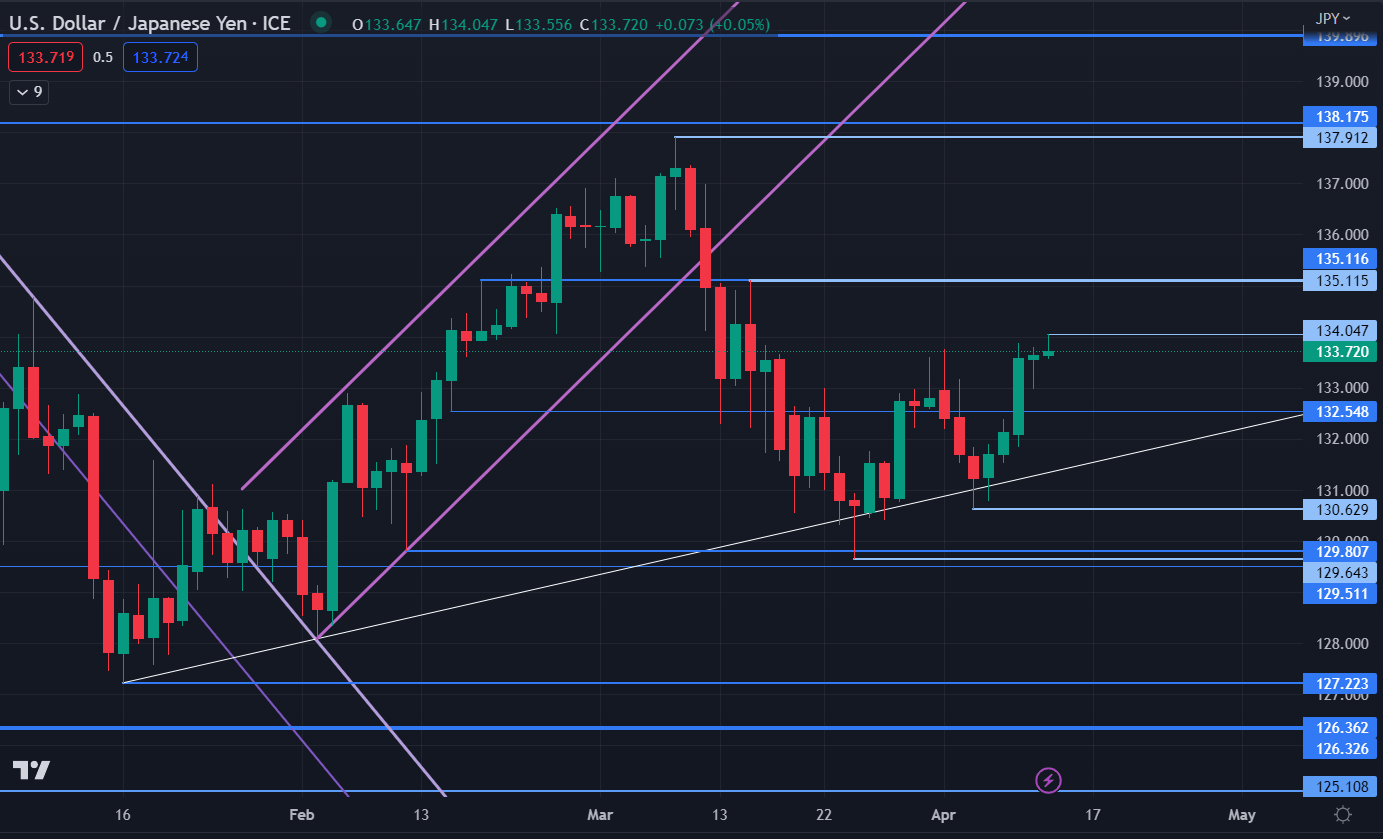

USD/JPY TECHNICAL ANALYSIS

USD/JPY remains above an ascending trend despite trying to move below it last week.

Resistance might be at the breakpoint of 135.12 or further up at the prior peaks of 137.91 and 138.18.

On the downside, support could be at the previous lows of 130.63, 129.81 and 129.64.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter