Gold, XAU/USD, US Dollar, Crude Oil, OPEC+, Russia, HSI – Talking Points

- The gold price is struggling today with markets reeling from OPEC+ news

- The cartel cut its production target by 1.1 million barrels a day

- If the oil supply is squeezed and inflation reaccelerates, will it sink XAU/USD?

Recommended by Daniel McCarthy

How to Trade Gold

The gold price is under pressure to start the week against a US Dollar that is stronger across the board. Higher Treasury yields all along the curve underpinned the greenback but it is the crude oil price that has gone to moon on Monday.

On Sunday, OPEC+ announced a 1.1 million barrel per day reduction to its output target. Russia has recently confirmed that they will maintain their 500k fewer barrels per day target through to the end of the year.

The squeeze on supply was already impacting markets with a gain of over 9% last week fuelled by the news that Turkey will no longer be able to have pipeline access from Kurdistan

Black gold opened over 8% high first thing but has since retreated. The WTI futures contract traded at US$ 81.69 bbl early on, while the Brent contract notched a peak of US$ 86.44.

Not surprisingly, APAC energy stocks posted solid gains. The broader Asian equity indices are mostly higher with the exception of Hong Kong’s Hang Seng Index (HSI) which is in the red.

This is despite the Evergrande property group announcing a debt restructure that has been well received by the market with its various stock listings and bonds rallying.

China’s March Caixin manufacturing PMI disappointed, coming in at 50.0 rather 51.4 forecast and 51.6 prior.

French President Emmanuel Macron will be visiting China this week.

The US Dollar consolidated higher against most major currencies with the exception of the oil-linked Canadian Dollar and the Norwegian Krone.

Treasury yields recovered from losses seen going into the close on Friday. The jump in oil prices seems to have added to concerns for inflation going forward and what that may mean for the Fed’s rate path.

Looking ahead, after Swiss CPI and multiple European PMIs, the market will focus on US manufacturing ISM. The RBA will be making its rate decision tomorrow and the market is pricing for the bank to leave the cash rate where it is at 3.60%.

The full economic calendar can be viewed here.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

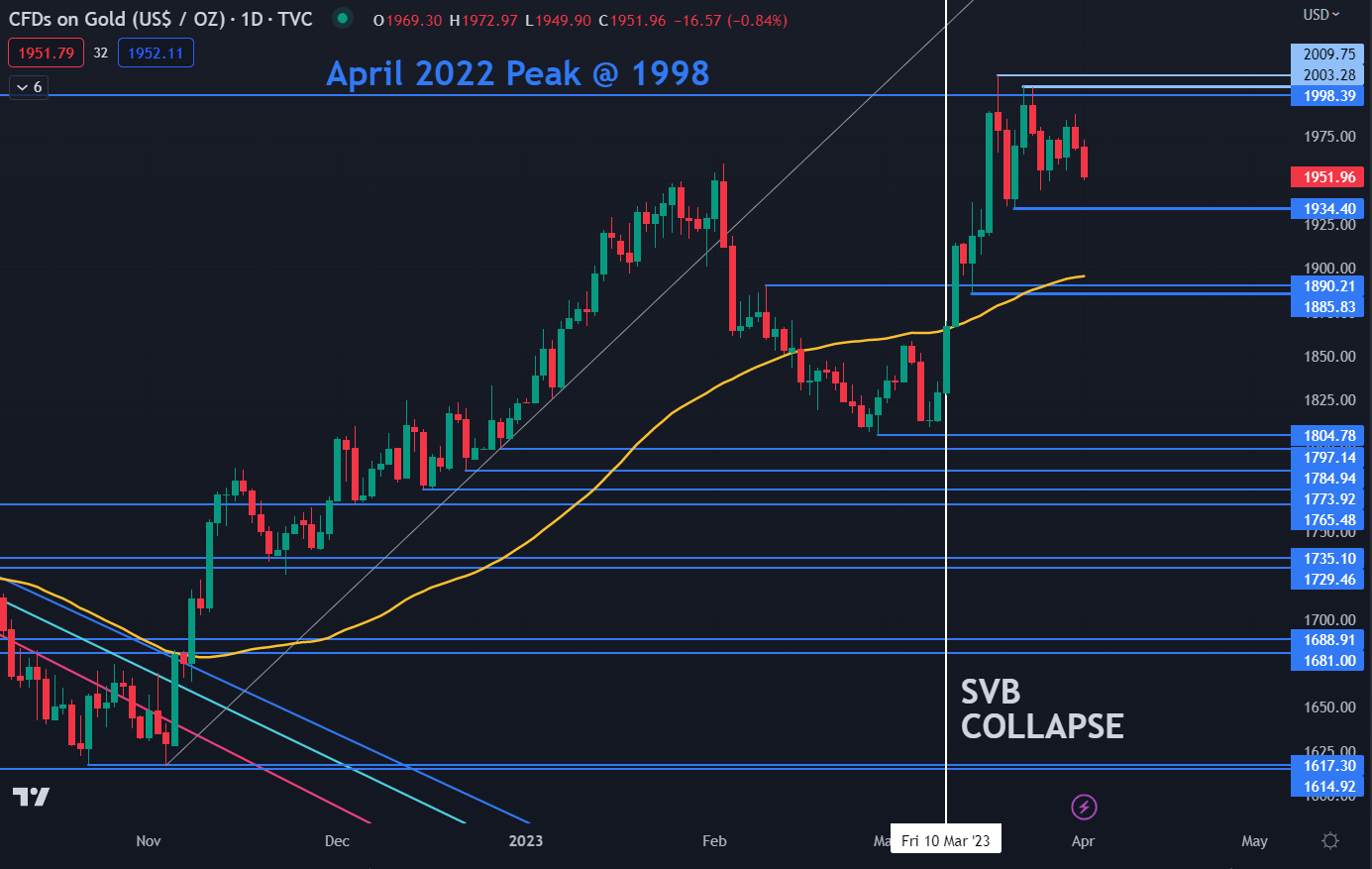

GOLD TECHNICAL ANALYSIS

Gold sunk below USD 1,950 today as it consolidates within its two-week range.

Nearby support could be at the recent lows and breakpoint of 1,934, 1,890 and 1,886. The 55-day Simple Moving Average (SMA) may lend support at 1,895.

On the topside, resistance might be at the previous peaks of 1,998, 2,003 and 2010.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter