Overnight, market participants seem to take comfort from a series of stronger-than-expected economic data out of the US, with economic resilience being the takeaway and calmed some nerves for an impending recession. A pull-ahead in US durable goods (1.7% versus -1% expected), rebounding consumer confidence (109.7 versus 104 expected) and surging new home sales to its highest in more than a year were all well-received by Wall Street, with traction returning to mega-cap tech stocks (DJIA +0.63%; S&P 500 +1.15%; Nasdaq +1.65%).

While economic resilience can build the case for tighter monetary policies, rate expectations thus far remain well-anchored for an impending end to the Fed’s tightening next month, with confirmation to be sought from the US core PCE price index later this week. The day ahead will leave comments from central bankers on watch once more, notably from US Fed Chair Jerome Powell. Little deviation from his comments last week seems likely, but nevertheless, his views on how recent US economic strength may raise the odds of rate hikes will be on watch.

Treasury yields were broadly higher overnight, which kept non-yielding gold prices on the backfoot (-0.6%). The US dollar weakened, with a failure to cross above the key 50 level for the Relative Strength Index (RSI) pointing to some exhaustion in buyers.

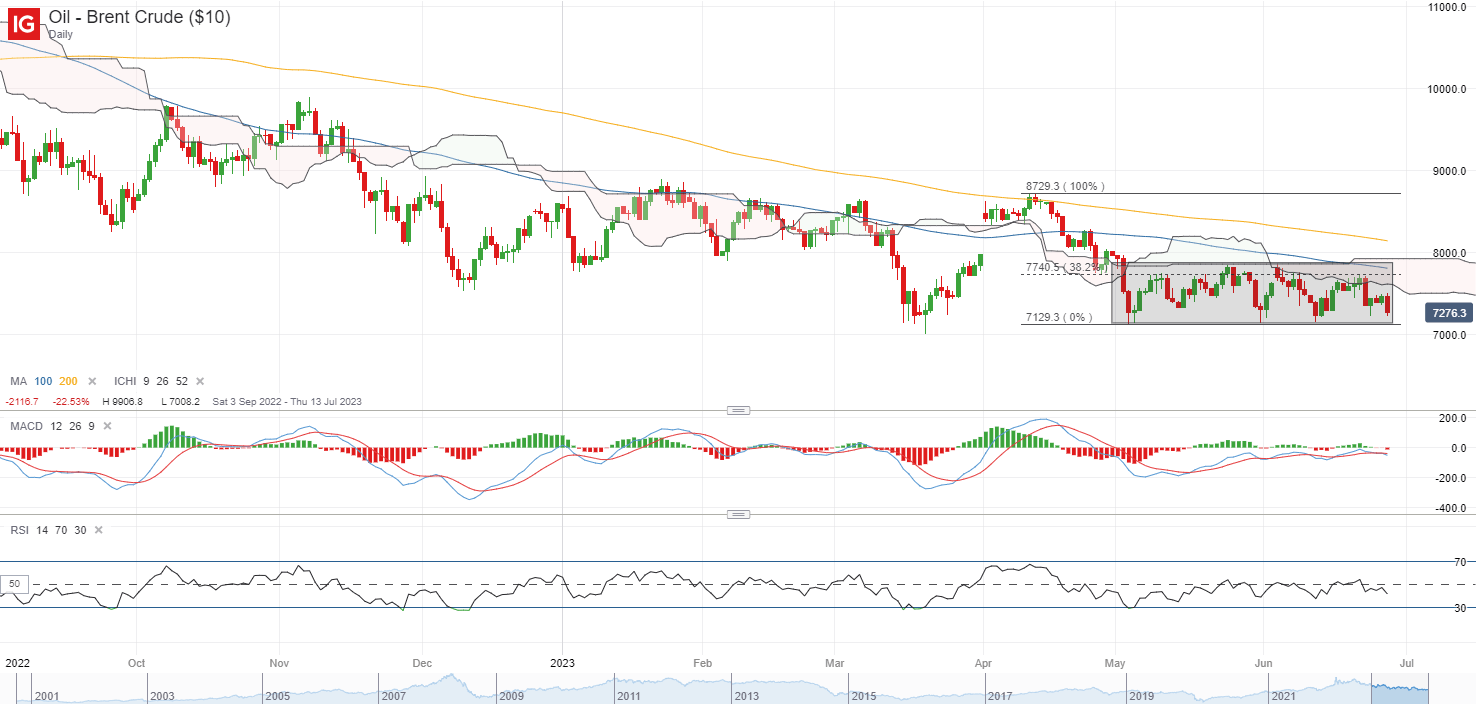

Brent crude prices may be on the radar. Having traded within a consolidation pattern over the past two months, prices are seemingly heading back to retest its lower bound once more at the US$71.30. The level has aided to support prices on at least four previous occasions, but multiple retests of support within a relatively short period of time may raise the chances of a downward break. Any breakdown of the level could mark a new 2023 low and leave the US$65.70 level on watch next.

Source: IG charts

Asia Open

Asian stocks look set to tap on the relief in Wall Street for a positive open, with Nikkei +0.77%, ASX +0.45% and KOSPI -0.04% at the time of writing. The Nasdaq Golden Dragon China Index was up more than 3% overnight, mirroring the strength in Chinese equities in the earlier session. With reopening optimism faded, sentiments are now highly sensitive to any prospects of government’s stimulus policies ahead. Reassuring comments from China’s premier Li Qiang of a stronger second-quarter gross domestic product (GDP) growth and reaching its 5% growth target for 2023 provided that cue yesterday, although whether gains are sustained will still revolve around any concrete details in the policies.

The key focus will be on the Australia’s monthly Consumer Price Index (CPI) indicator today. Despite a surprise rate hike from the Reserve Bank of Australia (RBA) early this month, follow-up minutes state that the recent rate decision was “finely balanced”, which seem to put some reservations behind the decision. Following the upside surprise in inflation back in April, market participants will be looking for any progress in its inflation fight. Current expectations are for a 6.1% read from previous 6.8%, and matching expectations may point to a new 12-month low in inflation, which may weigh on AUD while supporting the ASX.

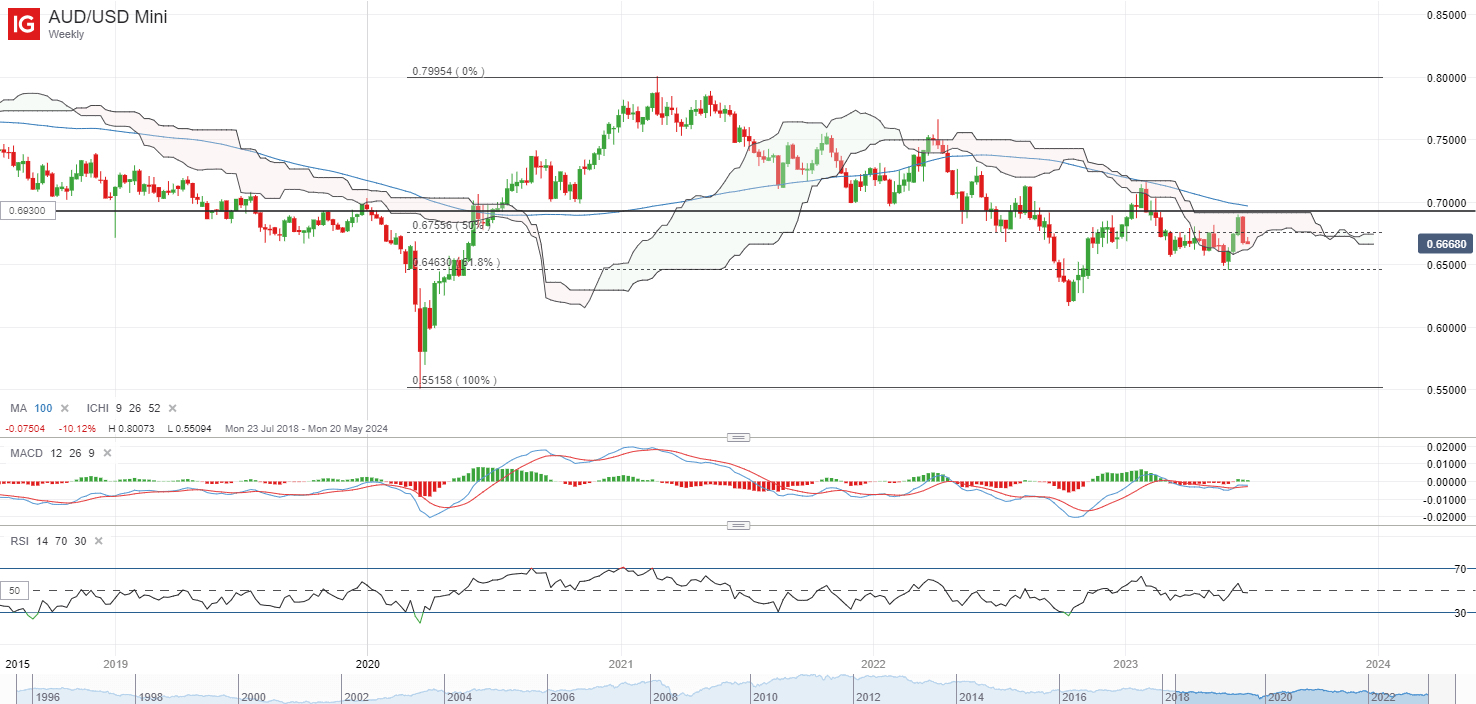

On the weekly chart, the AUD/USD remains weighed below its Ichimoku cloud pattern, failing to cross the upper edge of the cloud for the third occasion last week. The lower highs seem to put a downward trend in place for now, with the pair having to reclaim the 0.693 level to indicate a potential shift in trend and provide some conviction for the buyers.

Source: IG charts

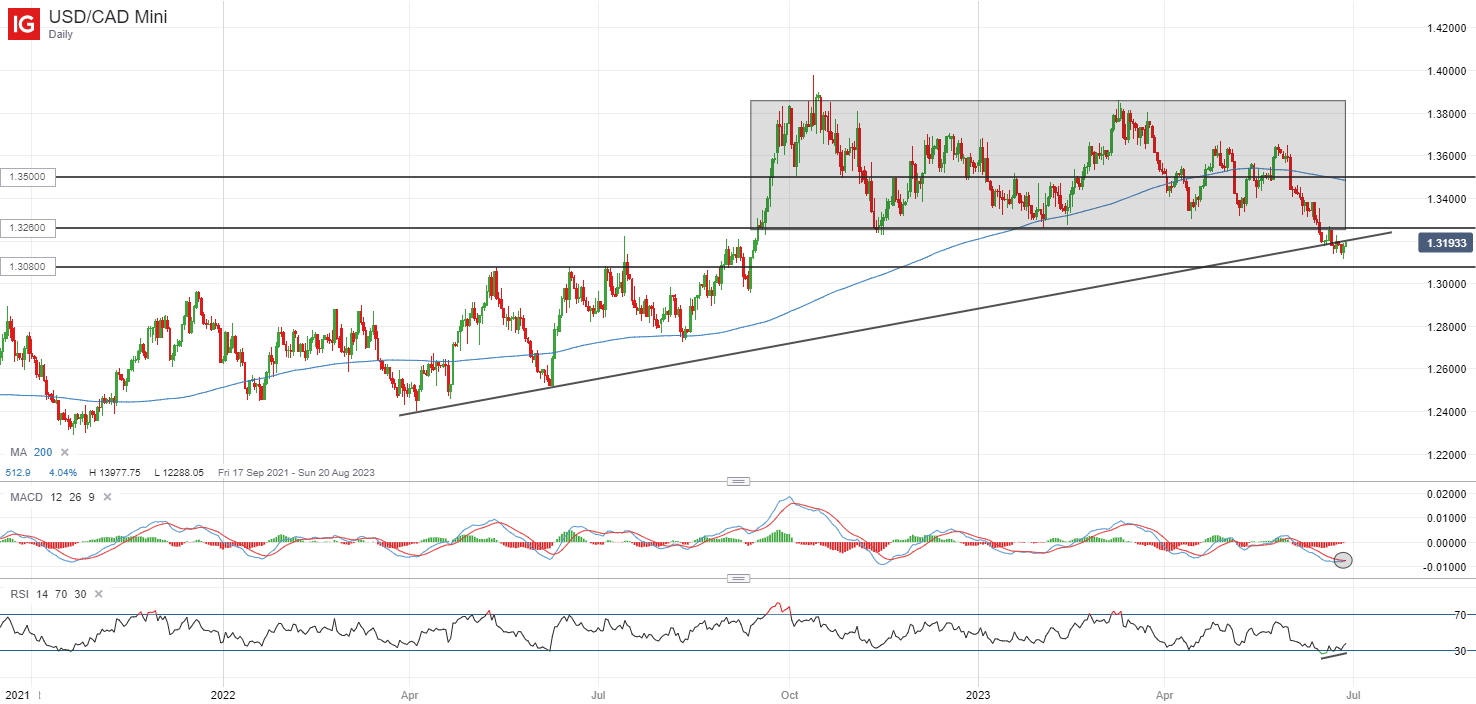

On the watchlist: USD/CAD stays resilient on lower-than-expected Canada’s inflation

Despite some weakness in the US dollar, the USD/CAD has held up well overnight (+0.4%), supported by a lower-than-expected core inflation print in Canada. The moderation to 3.7% from previous 4.1% indicates further progress from tighter monetary policies, while the headline came in softer at 3.4% versus the previous 4.4% as well. The data marked the six consecutive month of downside surprise in the core reading, which may weaken the case for more rate hikes needed.

On the technical front, a bullish crossover on MACD and short-term bullish divergence on the RSI points towards building upward momentum, but having broken below its long-ranging pattern two weeks back to form a new nine-month low, greater conviction may have to come from a move back above the 1.326 level. Overcoming this level may support a move towards the 1.350 level. On the downside, the 1.308 level may serve as the next near-term support on watch.

Source: IG charts

Tuesday: DJIA +0.63%; S&P 500 +1.15%; Nasdaq +1.65%, DAX +0.21%, FTSE +0.11%