Euro, EUR/USD, US Dollar, Yellen, China, ECB, Nagel, Fed, FOMC, RBA – Talking Points

- Euro support remains for now as another new high is eclipsed

- The has halted its slide with Treasury yields also stabilising

- The Fed and ECB meet next, will they trigger EUR/USD volatility?

Recommended by Daniel McCarthy

Get Your Free EUR Forecast

The Euro made a fresh 17-month peak against the US Dollar on Tuesday as the bullish run continues for the single currency.

The move above 1.1250 comes as the market prepares for an easing in tomorrow’s Euro-wide CPI with a Bloomberg survey of economists estimating a final reading of 5.5% year-on-year to the end of June.

The European Central Bank will be meeting next week and the interest rate market has a 25 basis point hike priced in.

Bundesbank President and ECB Governing Council member Joachim Nagel agreed with this assessment in an interview yesterday.

On the soft commodity front, Russia announced that they will end the agreement to allow the safe passage of Ukrainian crops from its key port of Odesa. There has been little reaction in futures markets to the news.

APAC equities have had a mixed day with the exception of Hong Kong’s Hang Seng Index (HSI) that fell over 2%.

The demise could be attributed to it being closed for business yesterday due to a typhoon on a day that saw China’s mainland indices slide lower after disappointing GDP figures.

US Treasury Secretary Janet Yellen was speaking at the G-20 in India yesterday, and she said China’s slowdown risks rippling across the globe, but she doesn’t see a recession for the US

Treasury yields have been relatively steady so far week after rolling over last week on data that showed an easing of price pressures in both the CPI and PPI gauges.

The US Dollar has also paused in its bearish run as the market looks toward next week’s Federal Open Market Committee (FOMC) meeting on July 26th.

The Reserve Bank of Australia’s (RBA) meeting minutes were released today and noted that the debate centred on keeping rates on hold, which they did, or raising them by 25 basis points.

The board saw no change as the stronger argument given the tightening that had been done already and that there will be several key data points ahead of the August gathering.

The market will be focused on the second quarter Australian CPI that will be released on July 26th.

Crude oil has steadied so far on Tuesday after starting the week on the back foot. The WTI futures contract is near US$ 74.25 bbl while the Brent contract is a touch below US$ 79 bbl.

Spot gold firmed slightly on Tuesday as it moved toward US$ 1,960.

Looking ahead, US retail sales and Canadian CPI are likely to hold the market’s attention.

The full economic calendar can be viewed here.

Discover what kind of forex trader you are

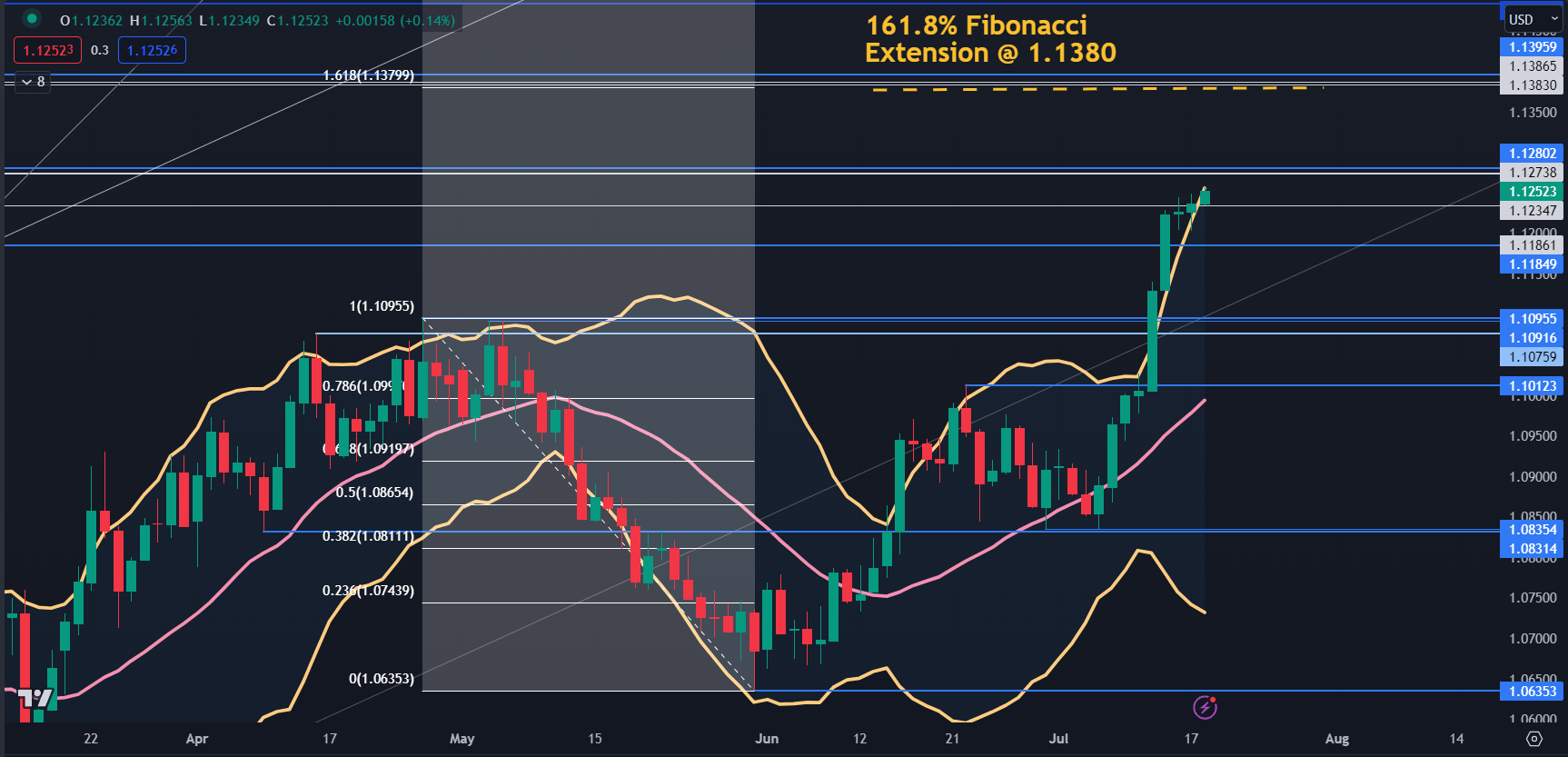

EUR/USD TECHNICAL ANALYSIS

The current rally has broken above the upper band of the 21-day simple moving average (SMA) based Bollinger Band. A close back inside the band might signal a pause in the bullish run or a potential reversal.

Resistance could be at the historical breakpoints in the 1.1270 – 80 area ahead of the Fibonacci Extension of the move from 1.1095 to 1.0635 at 1.1380.

On the downside, support may lie at the breakpoint of 1.1185 or further below at the breakpoints in the 1.1075 – 1.1095 zone.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter