Recommended by IG

Traits of Successful Traders

With the conclusion of the recent Federal Open Market Committee (FOMC) meeting, a series of hawkish Fedspeak is lined up on the horizon. We have a glimpse from Fed Governor Christopher Waller and Richmond Fed President Thomas Barkin last Friday, with persistent core inflation still at the top of their minds and that more tightening may need to be done.

Nevertheless, market participants continue to have their doubts, with interest rate futures firmly in the camp that the Fed will head towards its final phase of tightening with one last 25 basis-point (bp) move in July and rate cuts as early as next year. All eyes will be on Fed Chair Jerome Powell, who will have the opportunity to justify his hawkish stance with his testimony to the US Senate Banking Committee this week. Sticking to his usual script may potentially have limited impact in swaying rate expectations and he will have to provide greater conviction that his guidance at the Fed meeting is more than just a jawbone.

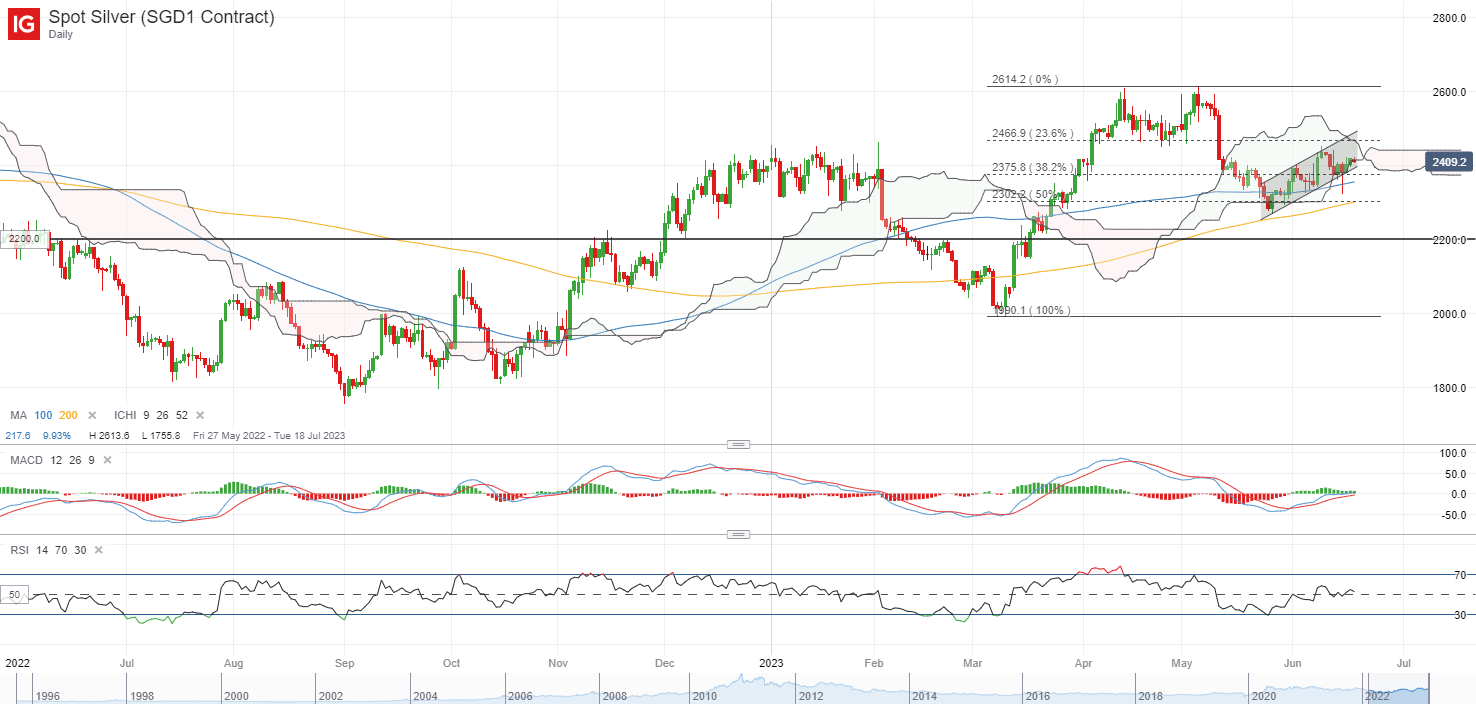

US market will be off for the Juneteenth holiday today, which could bring a quiet start to the new trading week for global markets. Treasury yields largely held firm last Friday, with the two-year and ten-year yields up 8 bp and 5 bp respectively, allowing the US dollar some slight reprieve following recent post-Fed sell-off. Perhaps one to watch will be silver prices, which saw some dip-buying with a long-tailed candle last week. Thus far, buyers have managed to defend a key support confluence at a lower trendline of a rising channel pattern (US$23.80 level), along with the lower edge of its Ichimoku cloud on the daily chart. That may leave the US$24.70 level on watch as the next resistance to overcome, while on the other hand, any breakdown of the channel pattern may place the US$23.00 level in sight.

Source: IG charts

Asia Open

Asian stocks look set for a mixed open, with Nikkei -0.38%, ASX +0.24% and KOSPI -0.70% at the time of writing. US Secretary of State Antony Blinken’s visit to Beijing has been on the radar, with extended “candid” and “constructive” talks on Sunday at least showing some willingness to cooperate, although whether that will lead to any actual positive outcomes still awaits to be seen. Any inaction on that front could still see any optimism fizzle out eventually.

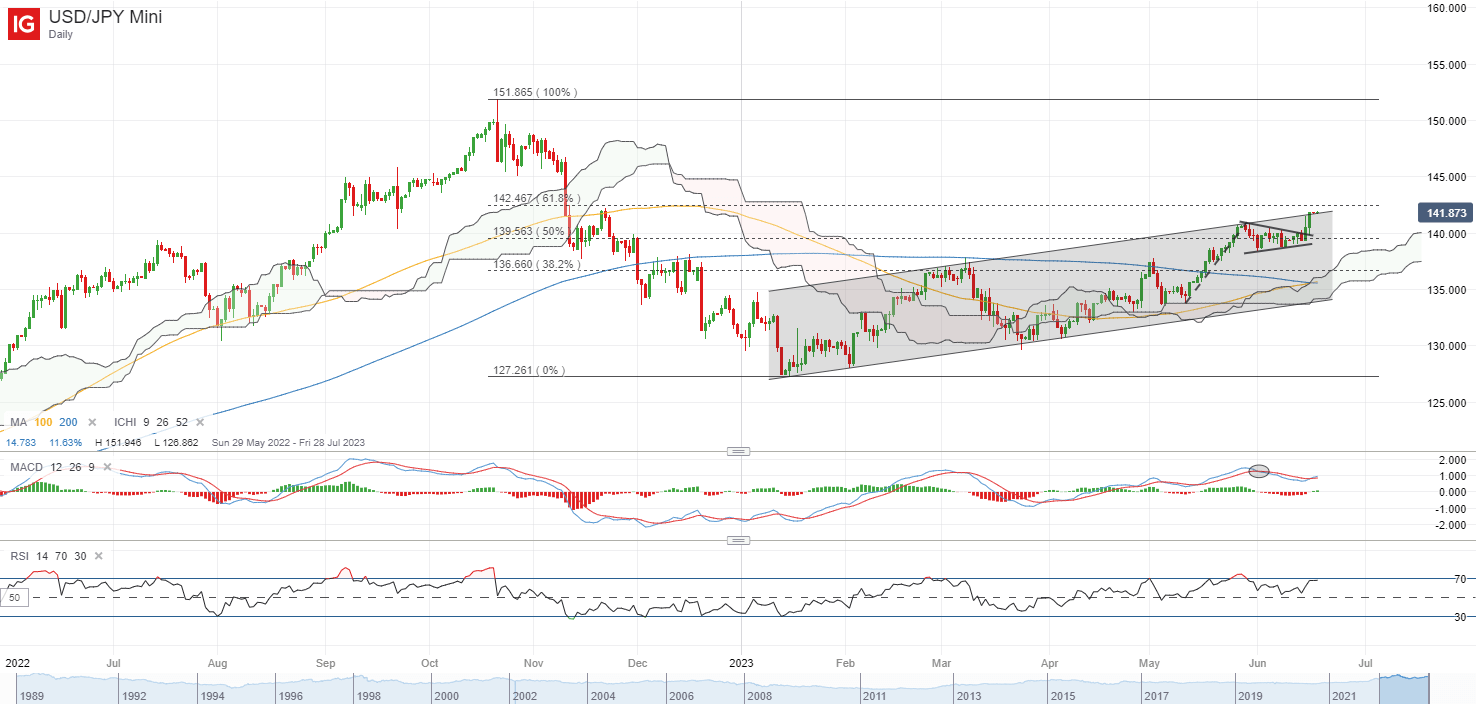

To conclude last week, the Bank of Japan (BoJ) has kept rates on hold in a widely-expected move, with its yield curve control held unchanged as well. Any tweak to its yield curve control policy will likely come as a surprise in the likes of that in December last year, but at least for now, maintaining their view that inflation will slow over the coming months seem to suggest that it will take some time. The USD/JPY is back to retest an upper channel trendline resistance currently, with a bullish crossover formed between its 100-day and 200-day moving average (MA). Any successful move past the channel resistance may then leave the 145.20 level on watch next.

Source: IG charts

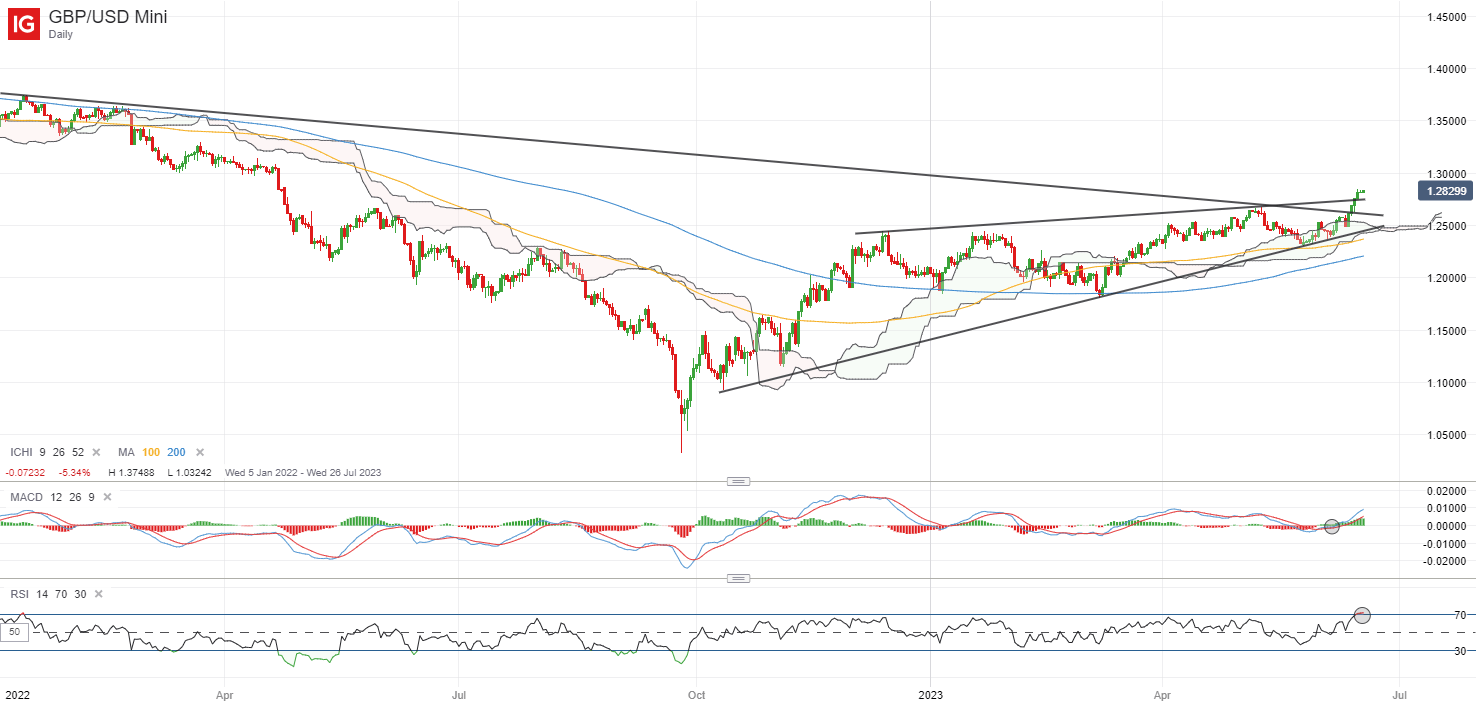

On the watchlist: GBP/USD at 13-month high ahead of Bank of England (BoE) meeting this week

Ahead of the BoE meeting this week, more persistent pricing pressures in the UK has led markets to price for another relentless grind higher in interest rates from the BoE, with 125 bp worth of tightening expected over the coming months. In the Governor Andrew Bailey’s own words, inflation is ‘taking a lot longer’ than hoped to come down, as UK April core inflation rose to the highest since records began in 1992 (6.8%).

This contrasts with broad expectations for one last 25 bp hike from the Fed in July, paving the way for GBP/USD to push to its 13-month high on the Fed-BoE policy divergence. Further validation from the BoE this week that rates will go higher-for-longer may provide room for more upside in the GBP.

Recent upmove for the pair has marked a break above a rising wedge pattern on the daily chart, along with a key downward trendline resistance in place since June 2021. Its RSI hangs above the key 50 level, while an increasing MACD points to building upward momentum. The formation of higher highs and higher lows suggest that the overall trend remains up, placing the 1.316 level on watch next for a retest. On the downside, a series of support lines remain in focus to potentially underpin a higher low (200-day MA, Ichimoku cloud, lower wedge trendline), with immediate support at the 1.265 level.

Source: IG charts

Friday: DJIA -0.32%; S&P 500 -0.37%; Nasdaq -0.68%, DAX +0.41%, FTSE +0.19%