Australian CPI, AUD Analysis

- Australian CPI rose more than expected in May, sending AUD higher on the possibility of another RBA hike

- Large speculators still need convincing when it comes to AUD

- AUD/USD rises, AUD/NZD extends the bullish reversal but overheating risks may soon appear

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

How to Trade AUD/USD

Australian CPI Indicator Justifies Possibility of RBA Hike

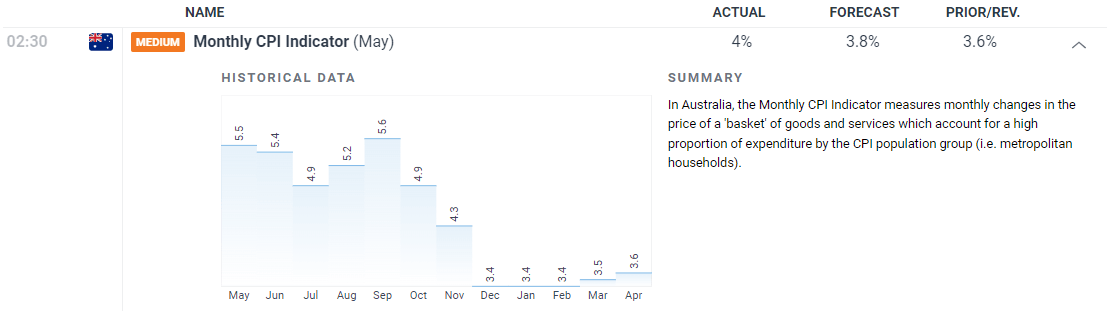

Australia’s monthly CPI indicator for May rose higher than expected in the early hours of Wednesday morning. The 4% reading exceeded the expectation of 3.8% and the April print of 3.6%, to add to the building narrative that the Reserve Bank of Australia (RBA) will have to seriously consider raising the cash rate again in August.

Customize and filter live economic data via our DailyFX economic calendar

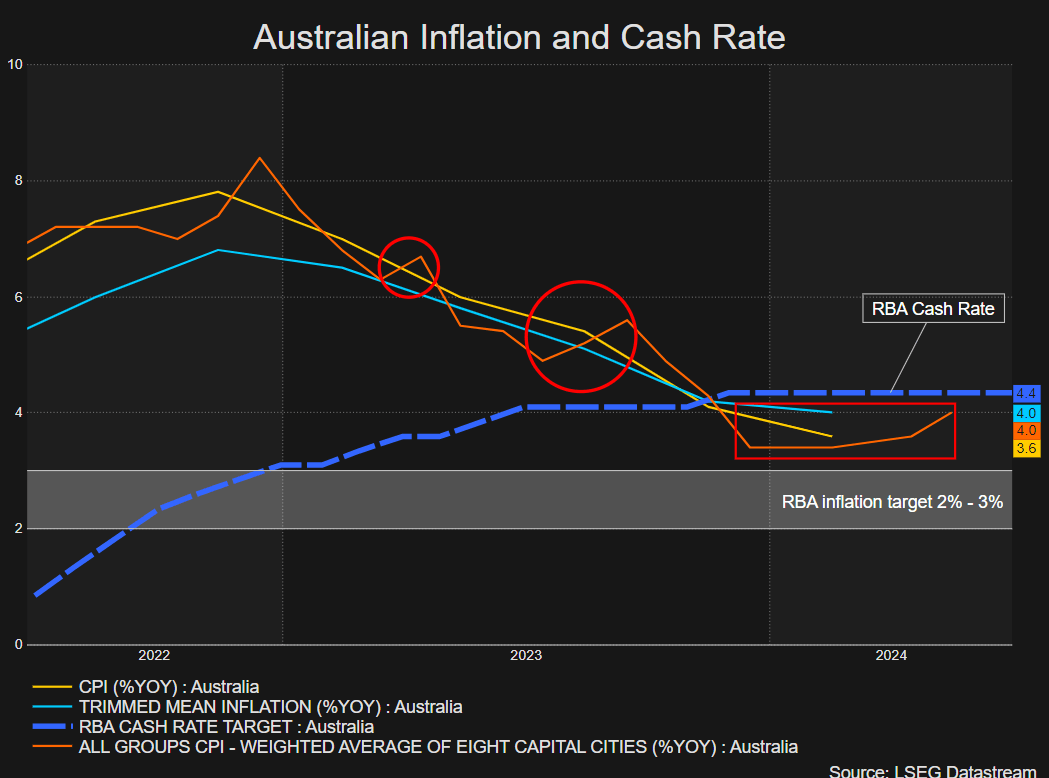

Aussie inflation appears to be heading lower when observing the quarterly measures for both headline and the trimmed median (core) calculations of price pressures. However, the rise in the timelier monthly CPI indicator suggests inflation pressures have reemerged, taking the chance of a rate hike in August to 35% and 54% by September, according to market implied expectations. The RBA has already had to resume the rate hiking cycle in November of last year after the committee judged it was appropriate to hold interest rates from June onwards and may have to follow the same course of action in Q3.

Source: Refinitiv, prepared by Richard Snow

Large Speculators still Need Convincing when it comes to AUD

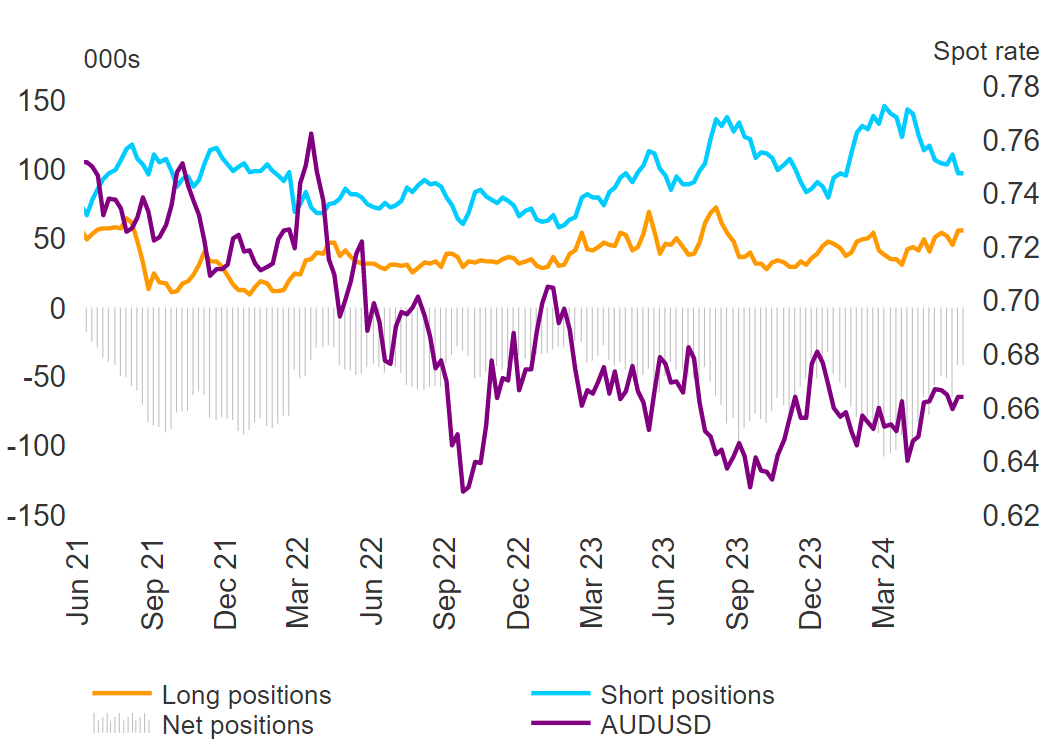

Aussie net-short positioning is being reeled in, mainly via a reduction of short positions as opposed to an increase in longs. However, the trend of rising CPI data via the monthly indicator may persuade a greater adoption of the Aussie dollar but clearly the negative effect of a weaker Chinese economy is weighing on the Australian economic outlook and confidence in a stronger AUD. However, the Aussie has enjoyed some recent strength after the RBA minutes confirmed that group discussed a rate hike during the June meeting. Most developed central banks are contemplating rate cuts or have already sone so, highlighting the divergence in monetary policy that is growing between Australia and the rest of its peers.

Aussie Net-Short Positioning Being Reduced via the CoT Report, CFTC

Source: Refinitiv, prepared by Richard Snow

Discover the power of crowd mentality. Download our free sentiment guide to decipher how shifts in AUD/USD’s positioning can act as key indicators for upcoming price movements. Beware the difference between client positioning and ‘smart money’ positioning

Recommended by Richard Snow

Improve your trading with IG Client Sentiment Data

AUD Market Reaction

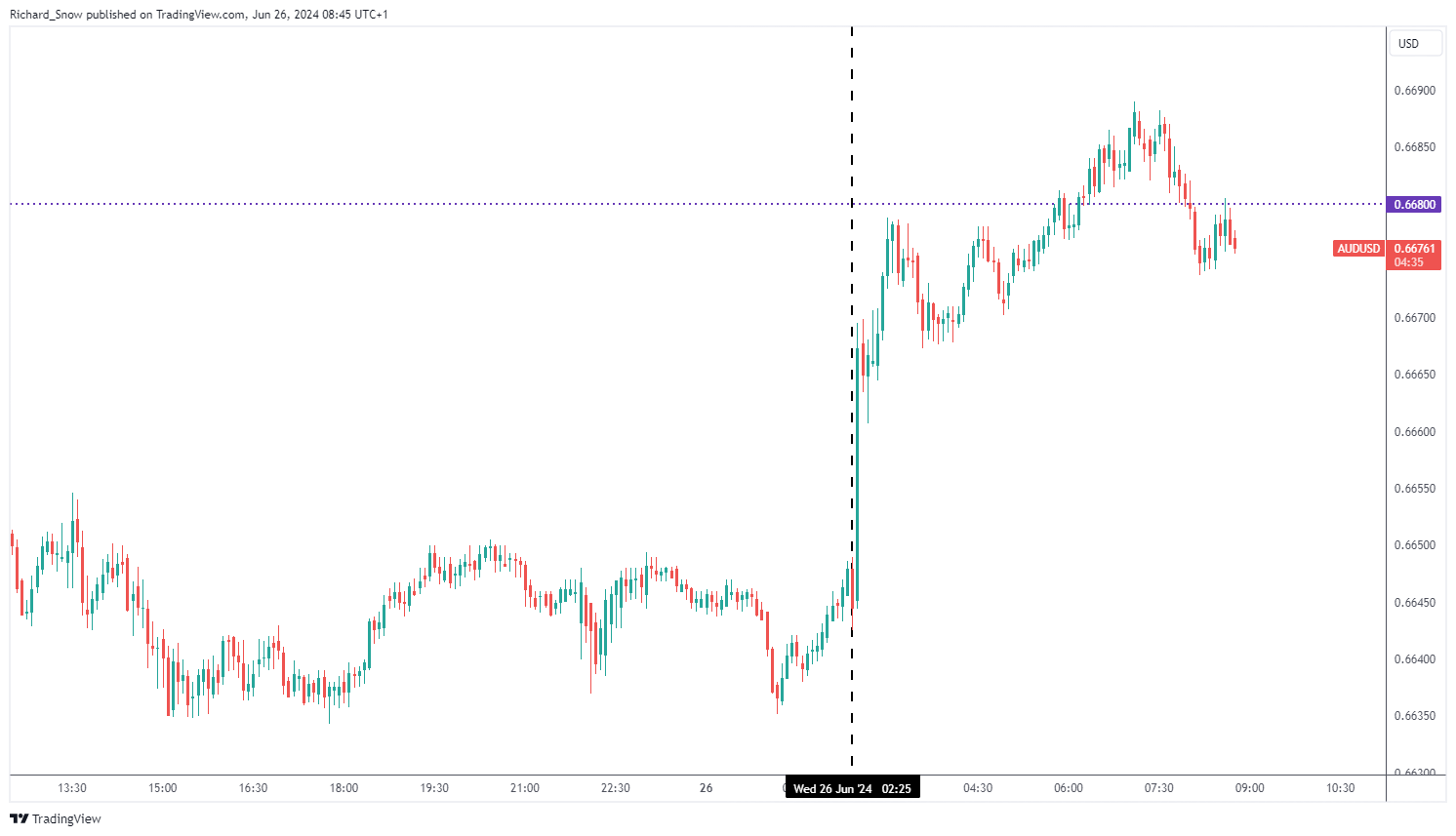

Unlike the Canadian dollar yesterday, the unexpected rise in Australian inflation sent AUD higher across a wide range of currencies after the data release as seen below via the 5-minute AUD/USD chart.

AUD/USD 5-Minute Chart

Source: TradingView, prepared by Richard Snow

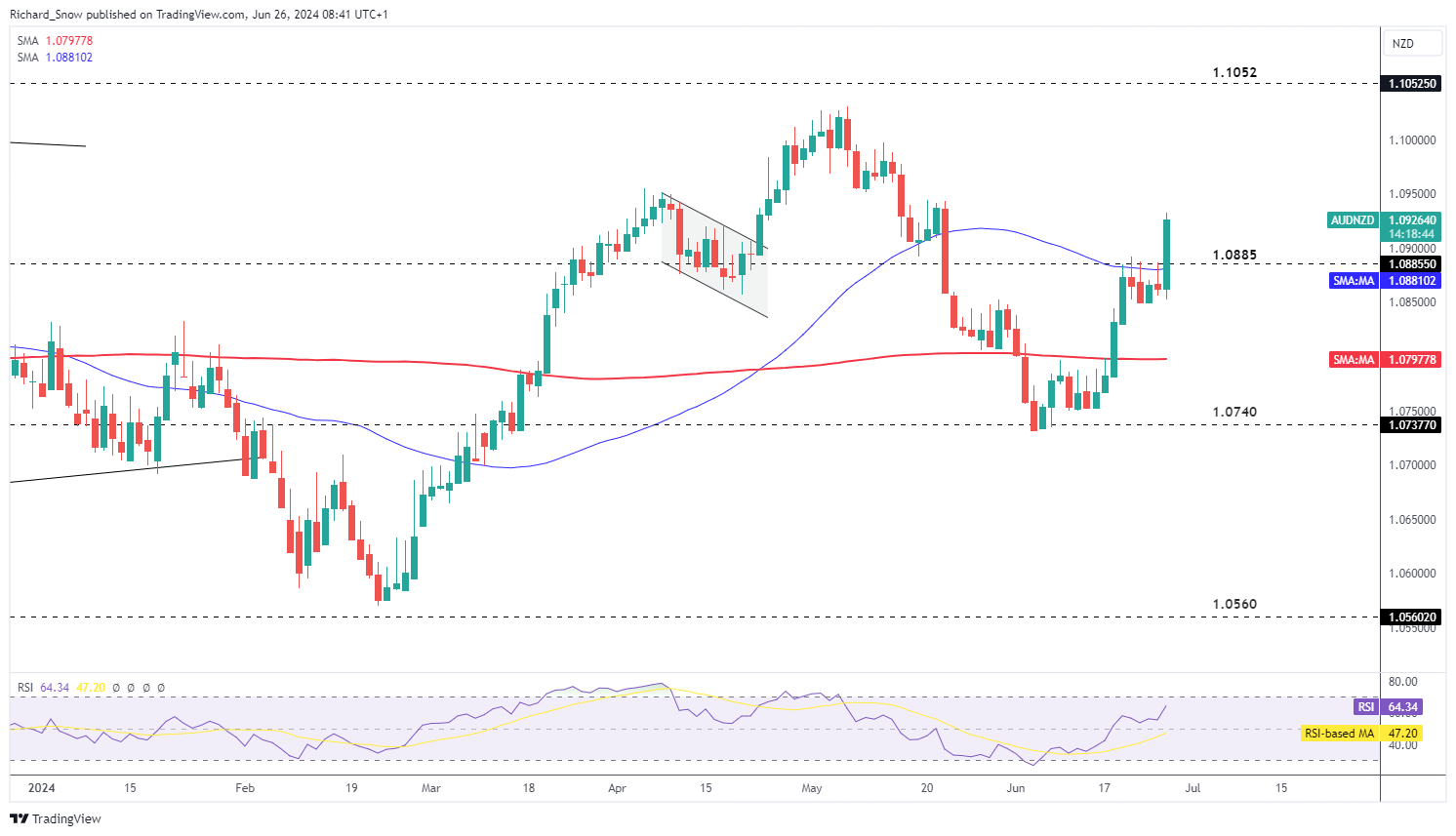

AUD/NZD saw a notable move higher, rising above the 50 SMA and the 1.0885 marker with ease. The pair has traded higher since the bullish reversal at 1.0740 but the pair is at risk of overheating soon as the RSI approaches overbought territory. The pair market notable pullbacks and even a reversal after recovering from overbought territory the last two instances so this is a development worth monitoring.

AUD/NZD Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX