Australian Dollar, AUD/USD, US Dollar, China, CPI, PPI, Crude Oil, Gold – Talking Points

- Australian Dollar narrowly gained support today in anaemic market conditions

- China’s CPI and PPI missed estimates and it raises the spectre of Government action

- If a new low is not seen in AUD/USD on this dip, how much longer will the range hold?

Recommended by Daniel McCarthy

Trading Forex News: The Strategy

The Australian Dollar steadied today after making a two-month low yesterday on a stronger US Dollar and amid growing concerns for the outlook of its major trading partner, China.

Year on year Chinese CPI turned negative for the first time since early 2021, coming in at -0.3%. At the same time, PPI printed below forecasts at -4.4% year on year to the end of July.

Today’s data comes on the back of disappointing trade data yesterday that saw both imports and exports shrink dramatically.

Compounding matters undermining market sentiment, one of China’s larger companies, Country Garden, defaulted on US Dollar bond coupon payments. They were due over the weekend and have not been paid as of Tuesday, although there is a 30-day grace period.

Last month’s Politburo gathering inspired some hope toward Beijing implementing measures to stoke the flames of growth.

There appears to be a degree of anticipation toward action from the Central Government before markets can be convinced that a turnaround for the world’s second-largest economy will materialise.

In any case, APAC equities have had a benign day with most indices slightly lower although Korea’s Kospi index was the only bright spot, gaining over 1%.

Futures are pointing toward Wall Street starting their cash session at levels close to where they left it yesterday.

In a similar vein, currency markets have been somewhat subdued to start Wednesday. The US Dollar has mostly held onto overnight gains.

At the time of going to print, gold has nudged slightly higher while crude oil has slipped a touch. Live prices can be found here.

Treasury yields are little changed today after dipping in the North American trading day, particularly from 5 years and beyond.

Later today the US will see some data on mortgage applications.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade AUD/USD

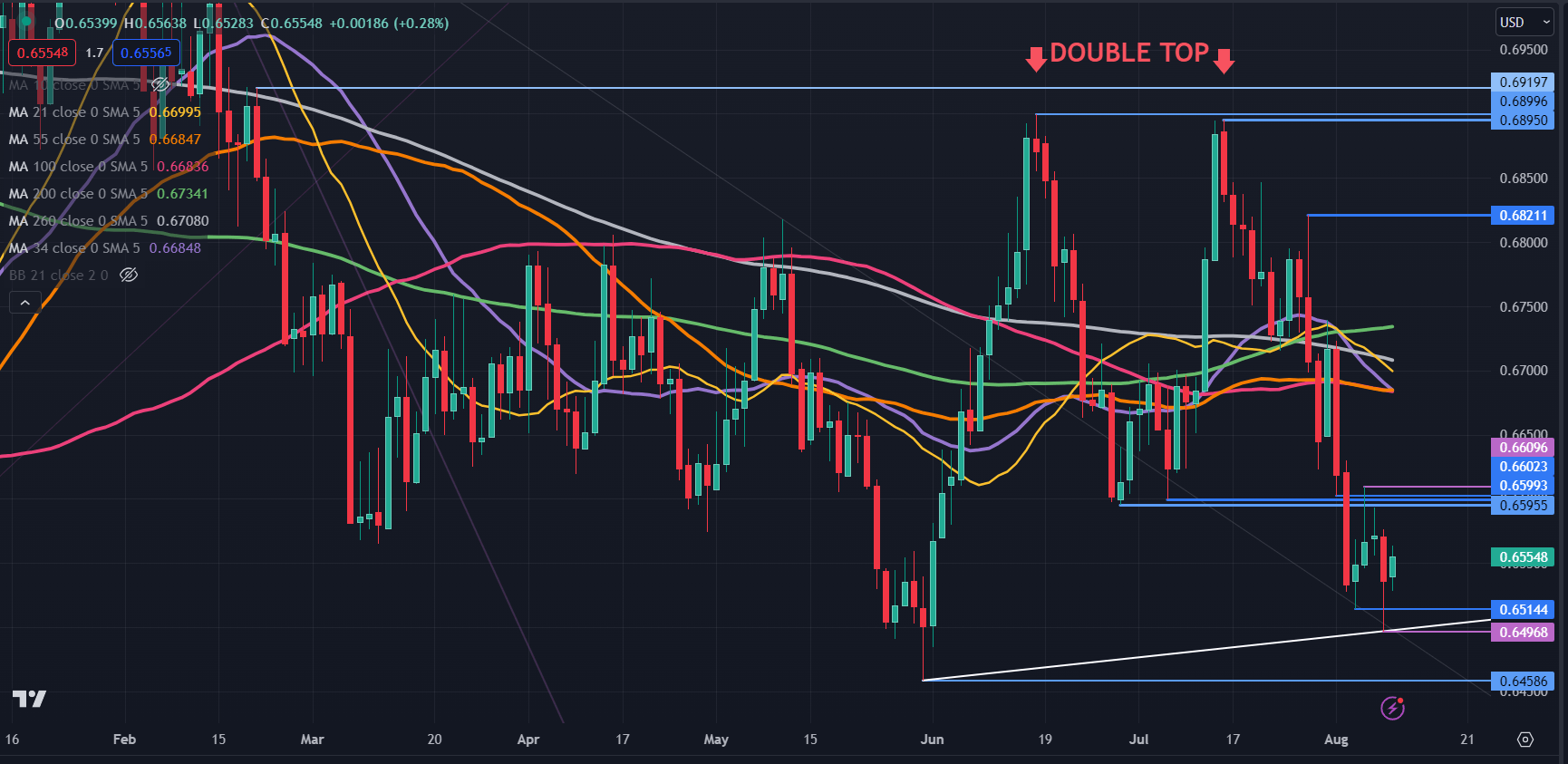

AUD/USD TECHNICAL ANALYSIS

Overall, AUD/USD remains in the six-month trading range of 0.6459 – 0.6900.

Nearby resistance could be at a cluster of breakpoints in the 0.6595 – 0.6600 area ahead of the SMAs.

On the downside, support might be near the recent lows of 0.6514 and 0.6459.

The price remains below 21-, 34-, 55-, 100-, 200- and 260-day simple moving averages (SMA).

Technicians would typically note this as potentially bearish. However, they all lie between 0.6683 and 0.6734, a historically narrow range of around 50 tics.

The price action seems to have been gravitationally pulled toward them recently and if the range holds, they might cross the SMAs yet again.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter