Australian Dollar Forecast: Neutral

- The Australian Dollar has settled into a comfortable range for now

- The US Dollar has been jumping around on debt ceiling woes

- After several false breaks on the topside, AUD/USD may further consolidate

Recommended by Daniel McCarthy

Traits of Successful Traders

The Australian Dollar lost steam last week but managed to resurrect some gains going into the weekend. The machinations emanating out of the US debt ceiling debate could provide a spark for volatility.

The fundamental backdrop for the Aussie deteriorated slightly last week with the unemployment rate rising to 3.7% in April against the 3.5% anticipated and prior.

-4.3k Australian jobs were lost in the month, which was notably below the 25k anticipated to be added and 53.0k previously. Of note was the full-time job losses of -27.1k.

The year-on-year wage price index nudged slightly higher to 3.7% at the end of the last quarter, up from 3.3% previously and estimates of 3.6%.

For the RBA, an easing in the still tight labour market might assist its efforts to get inflation down from the uncomfortably high rate of 7.0%. However, if wage pressures continue to build, it could be a challenge to lower CPI.

On the domestic front, public sector wage increases are making headlines and if these workers get the salary lift that they are looking for, it may undermine the RBA’s efforts.

The interest rate futures market is pricing around 15 basis points of an easing of the cash rate target by September.

Recommended by Daniel McCarthy

How to Trade AUD/USD

Externally, the US debt ceiling issue continues to swirl and may further rattle markets as time rolls on toward the so-called X-date.

The US Dollar (DXY) index made a 2-month high last week, so the Aussie Dollar has held up reasonably well. The interest rate disparity between Australia and the US could also be a driving force in the week ahead.

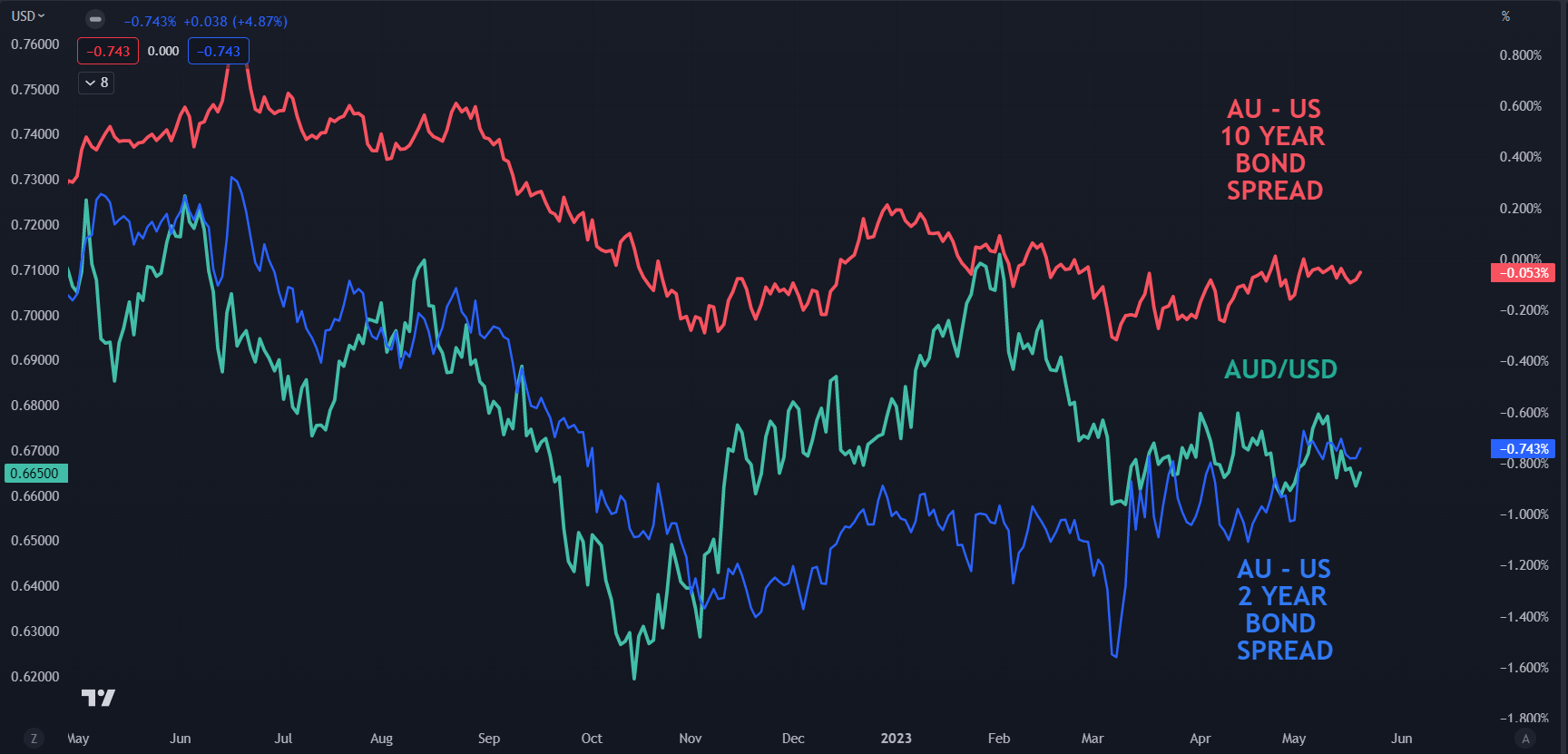

The stability seen in the 2- and 10-year bond spreads may go some way to explain the range trade type of set-up that AUD/USD has been in.

This week is light on for data releases but retail sales for April will be crossing the wires on Friday.

The economic calendar can be viewed here.

AUD/USD AGAINST AU-US 2- AND 10-YEAR GOVERNMENT BOND SPREADS

Chart created in TradingView

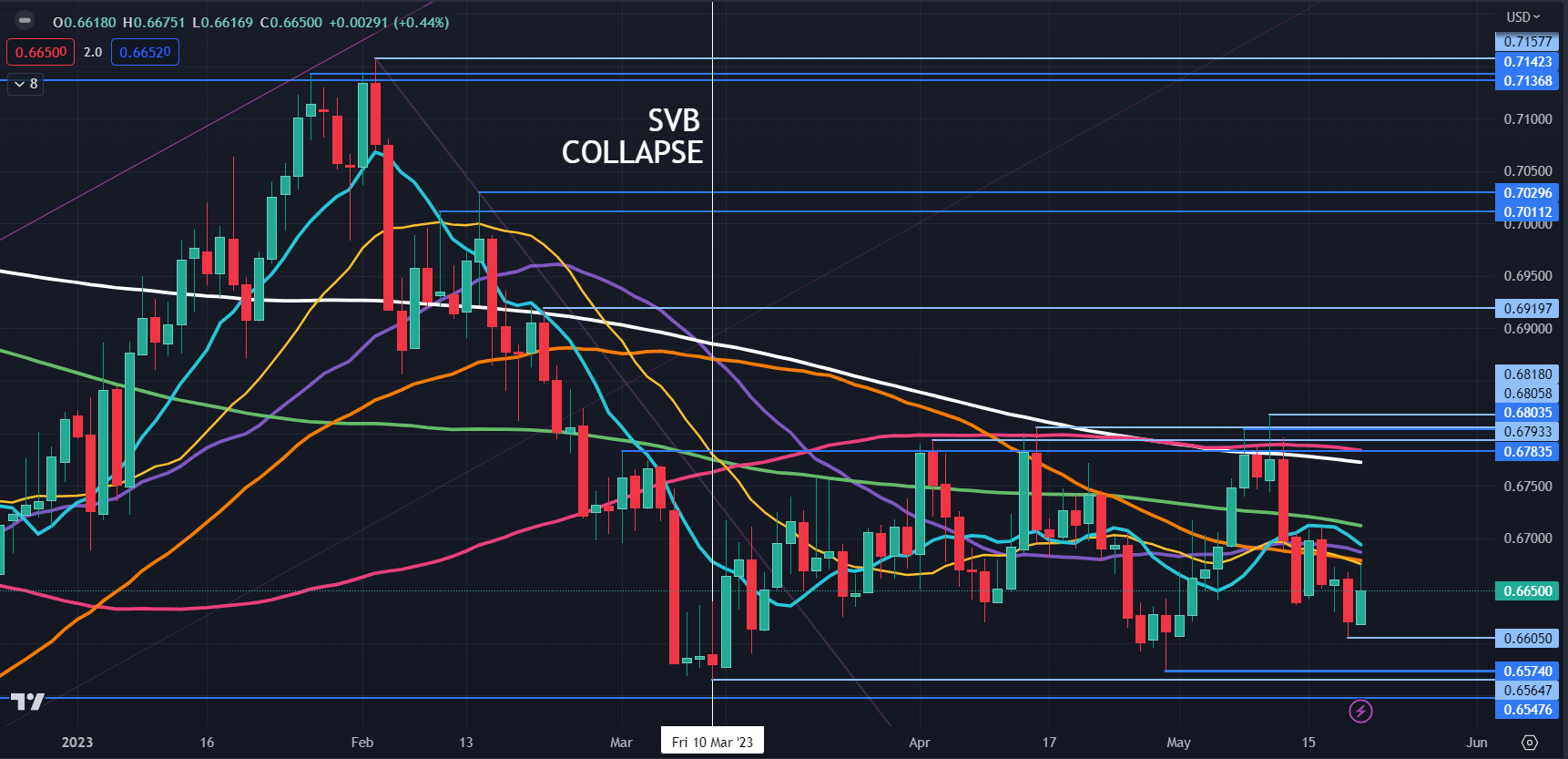

AUD/USD CHART

The AUD/USD chart below illustrates the range trading set-up that has been in play since late February.

The clustering of the daily Simple Moving Averages (SMA) across all time periods reflects the relative stability of the price.

The market is currently below all these SMAs and that may suggest some bearishness potentially persists for now and a test of the lower bound of the 0.6565 – 0.6818 range might unfold.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter