Recommended by Jun Rong Yeap

Get Your Free Equities Forecast

Market Recap

Better-than-expected earnings results from major US banks provided the go-ahead for the Wall Street rally to continue (DJIA +1.06%; S&P 500 +0.71%; Nasdaq +0.76%), with some catch-up gains in the value sectors (particularly, financials) while the technology sector received a boost from a 4% surge in Microsoft’s share price.

Morgan Stanley has beaten estimates on record wealth management revenues, while Bank of America rode on higher interest rates to deliver, despite some lingering caution guided around slower consumer spending, slower loan growth and increased deposit costs.

The economic data front saw a cooler-than-expected read in US June retail sales read (0.2% month-on-month versus 0.5% consensus). US industrial production has a weak showing as well, delivering a surprise contraction (-0.4% year-on-year) versus the 1.1% forecast. But nevertheless, as we tread in the Q2 earnings season, market sentiments are soaked in the potential bottoming out in corporate earnings to support a worst-is-over stance and pricing for a recovery over the coming quarters.

Tesla and Netflix’s earnings will be on the radar today to provide a first glimpse on mega-cap tech earnings. Netflix has previously guided for revenue growth to accelerate in the second half of 2023 on the broader rollout of its paid password sharing, while recent beats on deliveries by Tesla has also raised hopes for an upcoming outperformance. With the Nasdaq 100 index soaring more than 45% year-to-date, both earnings may be the key in determining whether the rally could find more legs this week.

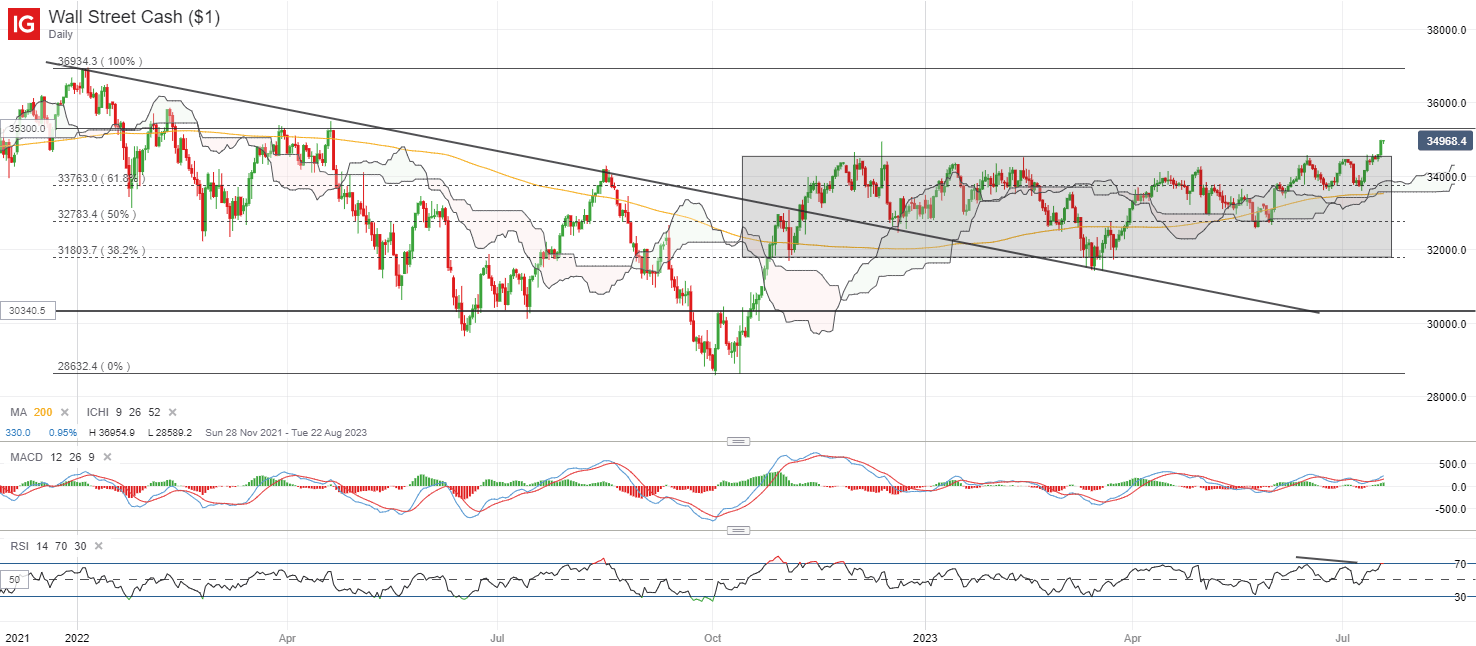

After trading within a broad consolidation pattern since November 2022, the DJIA has touched its 14-month high, with a breakout from the range reflecting buyers taking greater control. This may leave its April 2022 high on watch next for a retest. Further gains could be on the table, as historical occurrences suggest that the index tends to see positive performance during periods of rate pause from the Fed.

Source: IG charts

Asia Open

Asian stocks look set for a positive open, with Nikkei +0.67%, ASX +0.58% and KOSPI +0.28% at the time of writing, taking on the positive handover from Wall Street overnight. A divergence in performance was seen in Chinese equities however, with the lacklustre read in China’s economic conditions lately keeping investors shunning for now. The Nasdaq Golden Dragon China is down 3.3% overnight, following the 2% plunge in the Hang Seng Index (HSI) in the earlier session. The 18,100-18,200 level may be on watch for the HSI, with the formation of a weekly bullish pin bar at this level back in May 2023 reflecting it as one to defend from dip-buyers.

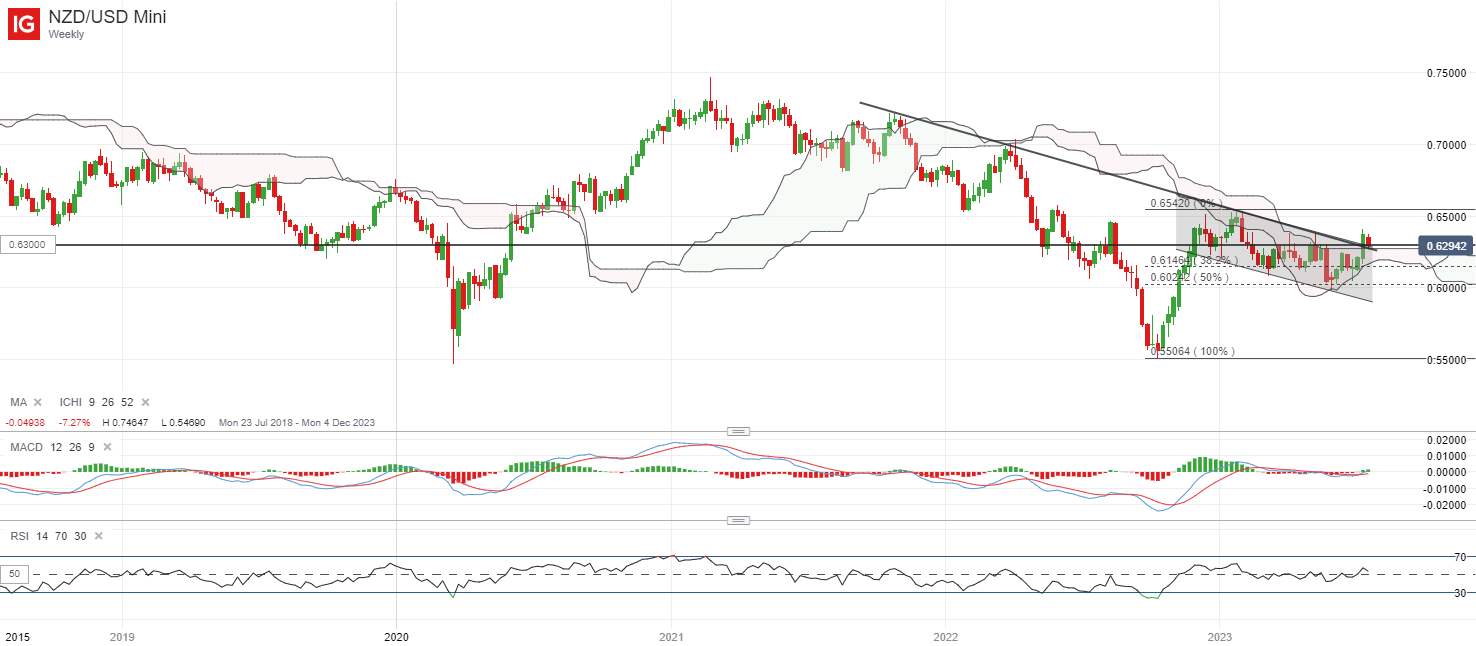

This morning saw a slightly higher-than-expected read in New Zealand’s Q2 inflation rate (6% YoY versus 5.9% forecast) but that has not been sufficient to sway market rate expectations for additional hikes from the Reserve Bank of New Zealand (RBNZ). Nevertheless, the NZD/USD is back to retest a key downward trendline support at the 0.630 level, which will have to see some defending for the formation of a higher low on the daily timeframe. Its daily Relative Strength Index (RSI) remained above the key 50 level, which suggests buyers still in control for now, with immediate resistance to overcome at the 0.638 level.

Discover what kind of forex trader you are

Source: IG charts

On the watchlist: GBP/USD on watch ahead of UK inflation release

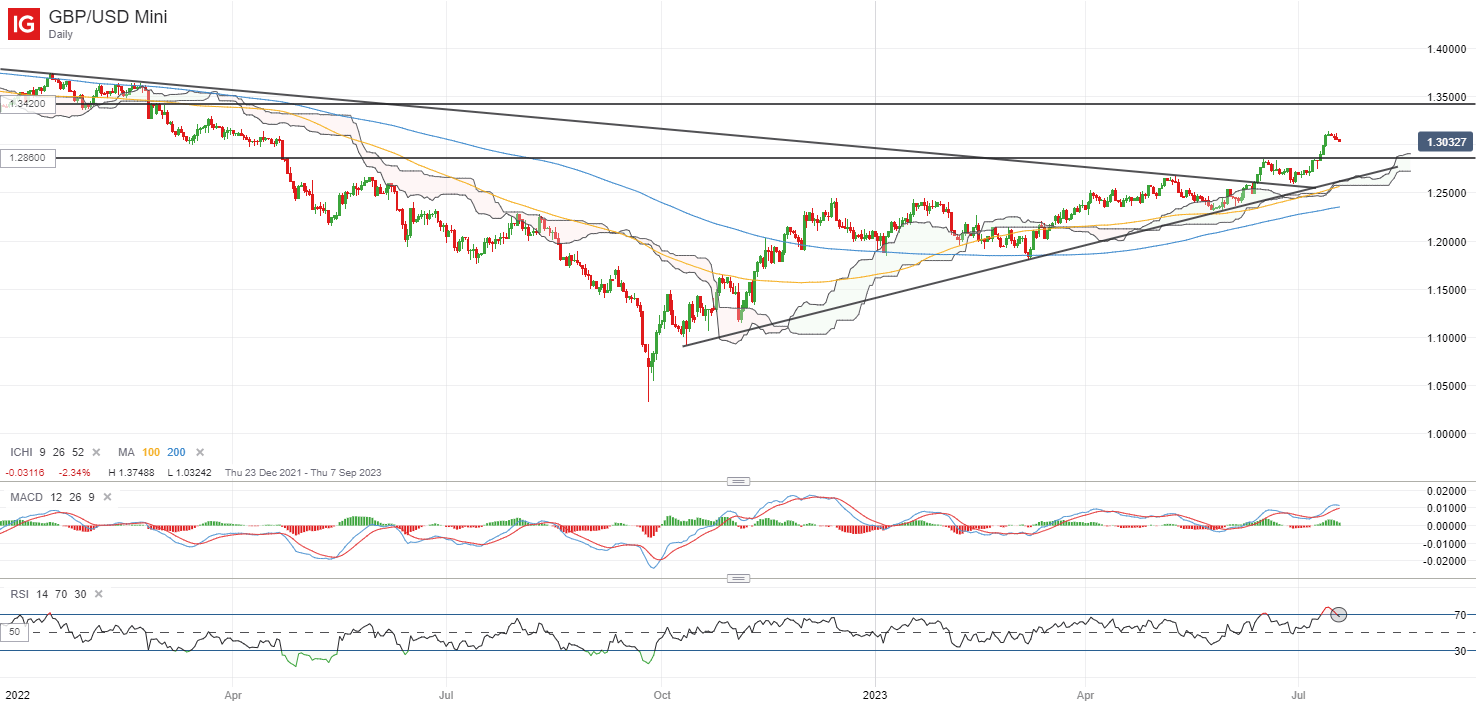

The UK inflation read for June will be released later today. With UK monthly GDP facing a 0.1% contraction in May, persistent pricing pressures may seem to add to the threat of stagflation for the UK economy, especially as headline and core inflation failed to make much progress in May.

For the upcoming reading, consensus are looking for headline inflation to moderate to 8.3% year-on-year from the previous 8.7%, but core aspect is expected to remain unchanged at 7.1%. The still-elevated inflation level could call for more progress to be seen and keep the hawkish tone in the Bank of England (BoE)’s forward guidance. Current rate expectations are pricing for at least another 100 basis-point (bp) worth of tightening by the central bank for the rest of the year.

Thus far, the series of higher highs and higher lows for the pair since September 2022 continue to put an upward trend in place. Oversold RSI level may call for a slight breather to its recent rally but any retracement may likely leave the 1.286 level on watch for any formation of a higher low. On any downside, a series of support lines could be on the radar as well, which includes its Ichimoku cloud support and its 100-day moving average (MA).

Recommended by Jun Rong Yeap

Get Your Free GBP Forecast

Source: IG charts

Tuesday: DJIA +1.06%; S&P 500 +0.71%; Nasdaq +0.76%, DAX +0.35%, FTSE +0.64%