Gold (XAU/USD) AnalysisUS dollar and yields remain central ahead of US CPI printGold set for weekly decline as price action hovers around key 200 DMAUS CPI remains the key risk

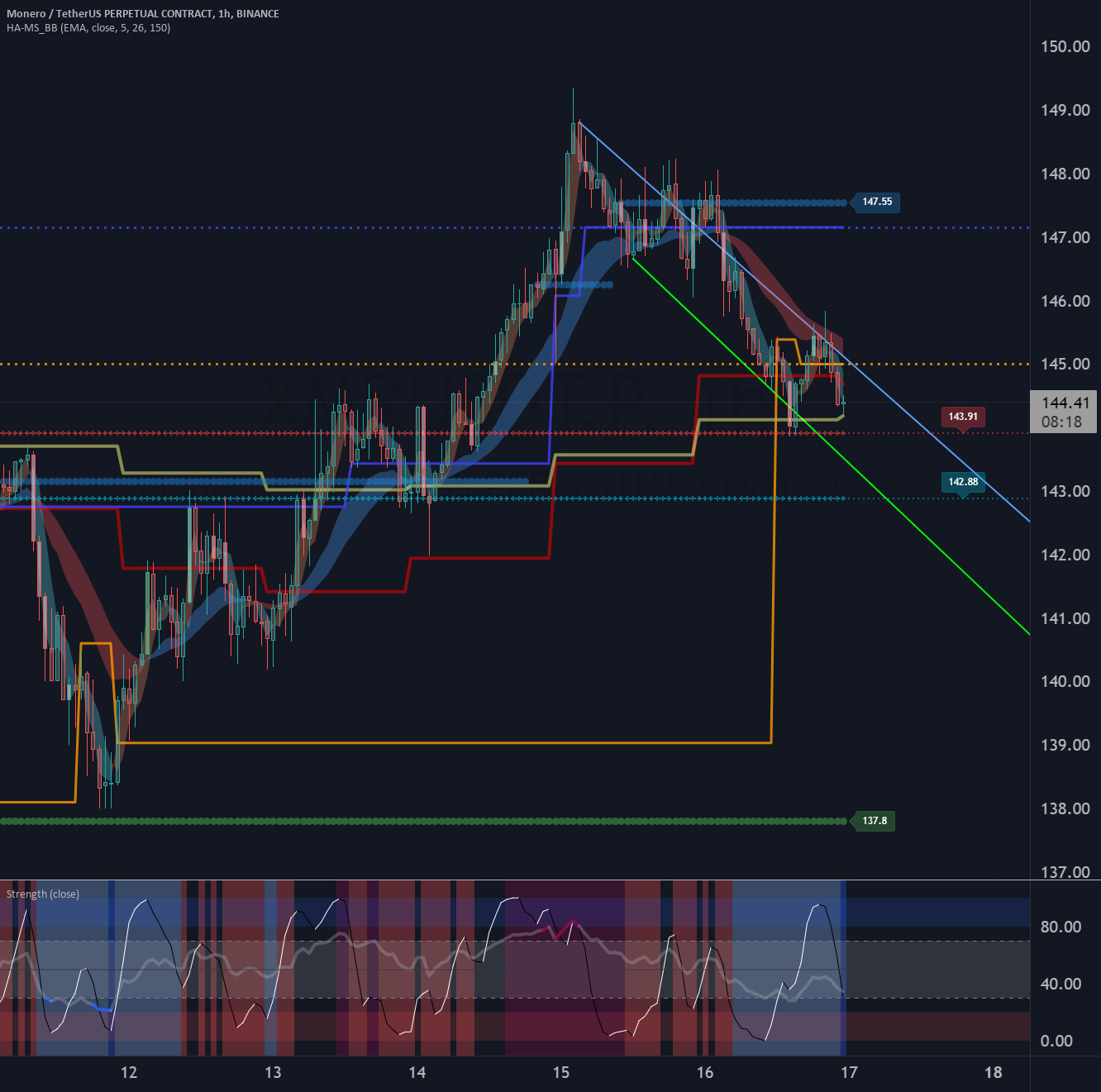

Hello? Hello traders! If you "Follow" us, you can always get new information quickly. Please also click “Boost”. Have a good day. ------------------------------------- (XMRUSDT chart) (1D chart) To continue the

Spot gold made headway today with China’s property sector revisiting its debt profile as markets contemplate central bank actions this week. Will XAU/USD break the range?Gold, XAU/USD, US Dollar, China,

snp on daily would not want to see a break on the recent uptrendline. If it does so, likely there would be more down side. Friday's selling removed the whole

K3 break up and closed upon K1, it seems that the uptrend will accelerate here. K3 is also the first successful test (relatively low volume) of the nearest support. But,

Hello? Hello traders! If you "Follow" us, you can always get new information quickly. Please also click “Boost”. Have a good day. ------------------------------------- (ONTUSDT chart) (1W chart) The key is

US DOLLAR OUTLOOKThe U.S. dollar index advanced and settled near its highest level since early March on Friday, rising for the eighth consecutive weekThe greenback's recent upward momentum has been

Article by IG Senior Market Analyst Axel RudolphFTSE100, DAX 40, S&P 500 Analysis and ChartsFTSE 100 recovery underwayThe FTSE 100 is recovering from this week’s low at 7,369 amid rising

Australian Dollar Forecast: NeutralThe Australian Dollar is caught in global crosswinds for nowMarkets have been buying risk assets elsewhere but not AUD/USDVolatility is low. If there’s a Fed surprise this

Gap down below a rising wedge here. Has been distributing since late June. Early in the week I'm looking for a retest of 334-336 max. After that retest I think