Fundamental Forecast for the US Dollar: NeutralFed policymakers will be on the lecture circuit all week long, saturating the economic calendar in a month without a Fed rate decision.No data

Japanese Yen, USD/JPY, US Dollar, Crude Oil, FOMC, Fed, Gold - Talking PointsThe Japanese Yen appears to be at a crossroads with lower oil pricesThe Fed minutes reminded markets that

Fundamental Forecast for the Euro: NeutralThe Euro saw mixed gains across the board amid another meltdown by the Japanese Yen and a tentative rebound by the British Pound.The economic calendar

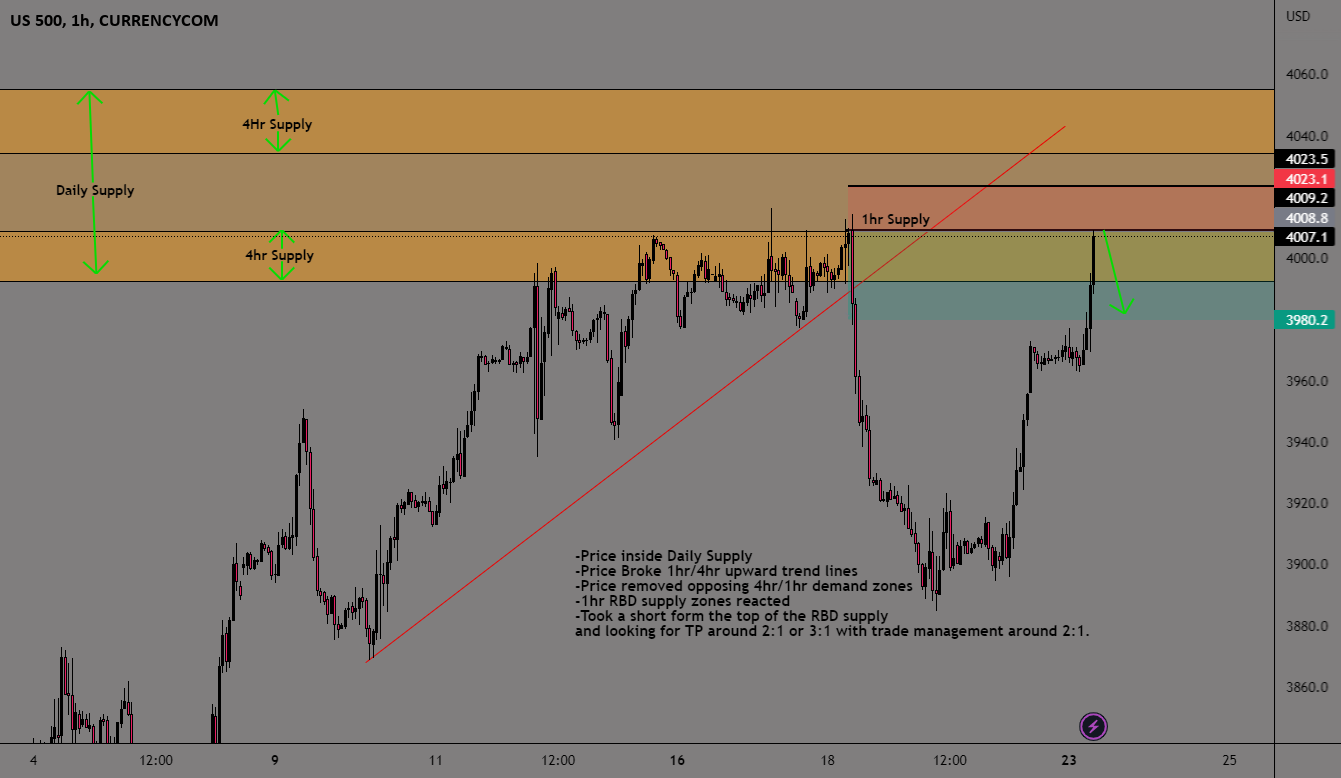

-Price inside Daily Supply -Price Broke 1hr/4hr upward trend lines -Price removed opposing 4hr/1hr demand zones -1hr RBD supply zones reacted -Took a short form the top of the RBD

JAPANESE YEN WEEKLY FORECAST: NEUTRALYen swings by nearly 4% after touching a 32-year low against the US DollarJapanese officials almost certainly intervened in FX markets to check sellersBank of Japan

AUDUSD, NZDUSD, Dollar and AUDNZD Talking Points:The Market Perspective: AUDUSD Bearish Below 0.6850; NZDUSD Bearish Below 0.6200; AUDNZD Bullish Above 1.0875The Australian and New Zealand 2-year yields have been rising

ATOM was struggling to break the trendline resistance (black line). While the breakout is still a question and depending much on the strengh of BTC , some sign of weakness

Fundamental Forecast for the US Dollar: NeutralThe DXY Index fell back sharply at the end of the week around two key developments: the resignation of UK Prime Minister Liz Truss,

S&P 500, Volatility, Dollar, Rate Forecast, Recession, CPI and Earnings Talking Points:The Market Perspective: S&P 500 Bearish Below 3,800; USDCNH Bearish Below 7.0000Fed Chairman Powell’s remarks and the NFIB business

Not trading today, but figured I'd post an update MFI now overbought, and RSI is just touching. I think it goes a little further beofre we get a dip. With