Crude Oil, WTI, Brent, Iran, US Dollar, US CPI, EUR/USD, Euro, ECB, Gold – Talking Points

- Crude oil has held onto recent gains ahead of inventory data

- US CPI could tilt rate hikes expectations for the Fed next week

- The Euro has bounced off recent lows with the focus on the ECB this Thursday

Recommended by Daniel McCarthy

Understanding the Core Fundamentals of Oil Trading

Crude oil continues to eye a new high going into Tuesday’s trading session as markets ponder the direction for the US Dollar ahead of US CPI on Wednesday.

The WTI futures contract is back above US$ 87.50 bbl while the Brent contract is near US$ 91 bbl.

There are reports emerging today that the US will waive sanctions against Iran which will pave the way for the release of up to US$ 6 billion of oil revenue in exchange for the release of 5 American citizens.

If talks continue to positively progress between the countries, it might lead to more supply potentially entering global trade.

The 10-month peak seen yesterday is within grasp ahead of the American Petroleum Institute (API) report due today. Further depletion of stockpiles may see an uptick in volatility.

Recommended by Daniel McCarthy

How to Trade Oil

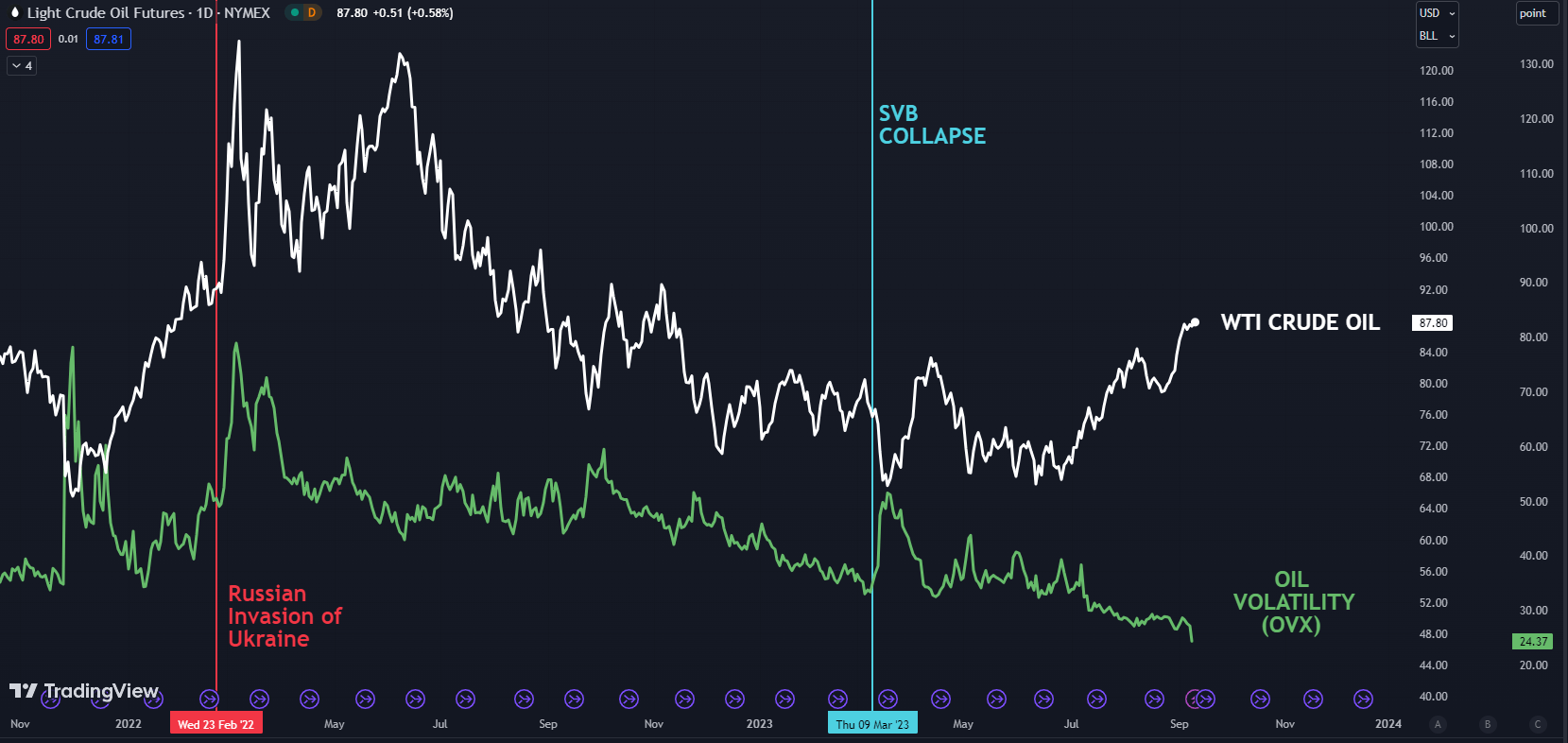

The OVZ index measures volatility in the oil price in a similar way that the VIX index gauges volatility on the S&P 500.

The chart below shows that WTI oil volatility has been languishing despite the run-up in prices.

WTI CRUDE OIL AND VOLATILITY (OVX)

Chart created in TradingView

It will be followed by the US Energy Information Agency’s (EIA) weekly petroleum status report on Wednesday. The EIA will also release its monthly report this week, as will OPEC+.

The US Dollar continues to struggle today after a rout on Monday ahead of CPI tomorrow. A Bloomberg survey of economists is estimating the headline print to be 3.6% year-on-year to the end of August. Forecasts for core CPI are 4.3%.

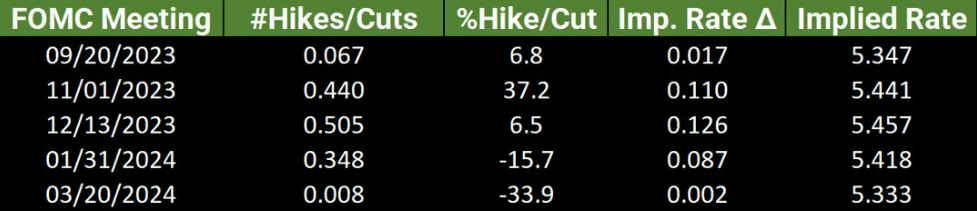

Interest rate markets are unsure if the Federal Reserve will hike or not by the end of the year, attaching around a 50% probability of a 25 basis point lift. An outlier in CPI could see these odds shift significantly and might flow into demand or otherwise for the US Dollar.

US FEDERAL RESERVE TARGET RATE MARKET PRICING

Source; Bloomberg and tastyrade

Overnight, Morgans Stanley upgraded Tesla to buy from neutral, which saw the TSLA stock price rally over 10%, boosting the Nasdaq to close its cash session 1.14% higher.

The rest of Wall Street posted smaller gains and APAC equity indices have had a quiet day. Futures are pointing toward a quiet start to the European and North American day session.

Spot gold and silver are trading near US$ 1,920 and US$ 23.20 respectively an ounce.

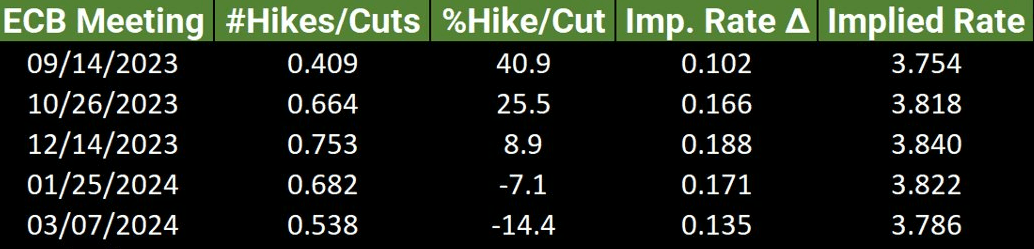

EUR/USD is trading near 1.0750 at the time of going to print. The interest rate market is ascribing around a 40% chance of a 25 bp hike by the European Central Bank this Thursday.

ECB TARGET RATE MARKET PRICING

Source; Bloomberg and tastyrade

After UK jobs data, Germany will see the results of the ZEW survey while in the US, there is much anticipation for the launch of the iPhone 15 and iPhone 15 pro later today.

The full economic calendar can be viewed here.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter