Crude Oil, WTI, US Dollar, Fed, Powell, EIA, Stockpiles – Talking Points

- Crude oil continues to recover going into the Thursday session

- The sizable drop in stockpiles provided some impetus for gains

- If Western monetary policy remains tight, where will WTI demand merge from?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The crude oil price bounced off support levels overnight and has consolidated going into Thursday’s trading session as mitigating factors play out.

Speaking at a central bank gathering in Portugal yesterday, Federal Reserve Chair Jerome Powell made it clear that tight monetary conditions are here for the foreseeable future.

He said, “Although the policy is restrictive, it may not be restrictive enough and it has not been restrictive for long enough.”

The sentiments were echoed by European Central Bank President Christine Lagarde and Bank of England Governor Andrew Bailey as inflation remains persistently high across those economies.

From a macroeconomic perspective, the need for suppressing demand to rein in price pressures has been a headwind for crude for some time and doesn’t like abating anytime soon.

A potential source of growth may emerge from China, but the world’s second-largest economy has struggled to gain traction since remerging from pandemic restrictions.

Overnight saw Energy Information Agency (EIA) data reveal that US stockpiles had dropped by 9.603 million barrels in the week ended June 23rd. This was notably larger than the 1.757 million barrels decrease that was anticipated.

The aftermath saw prices recover and the range trading environment appears to be intact for now. Updated crude oil prices can be found here.

Recommended by Daniel McCarthy

How to Trade Oil

WTI CRUDE OIL TECHNICAL ANALYSIS

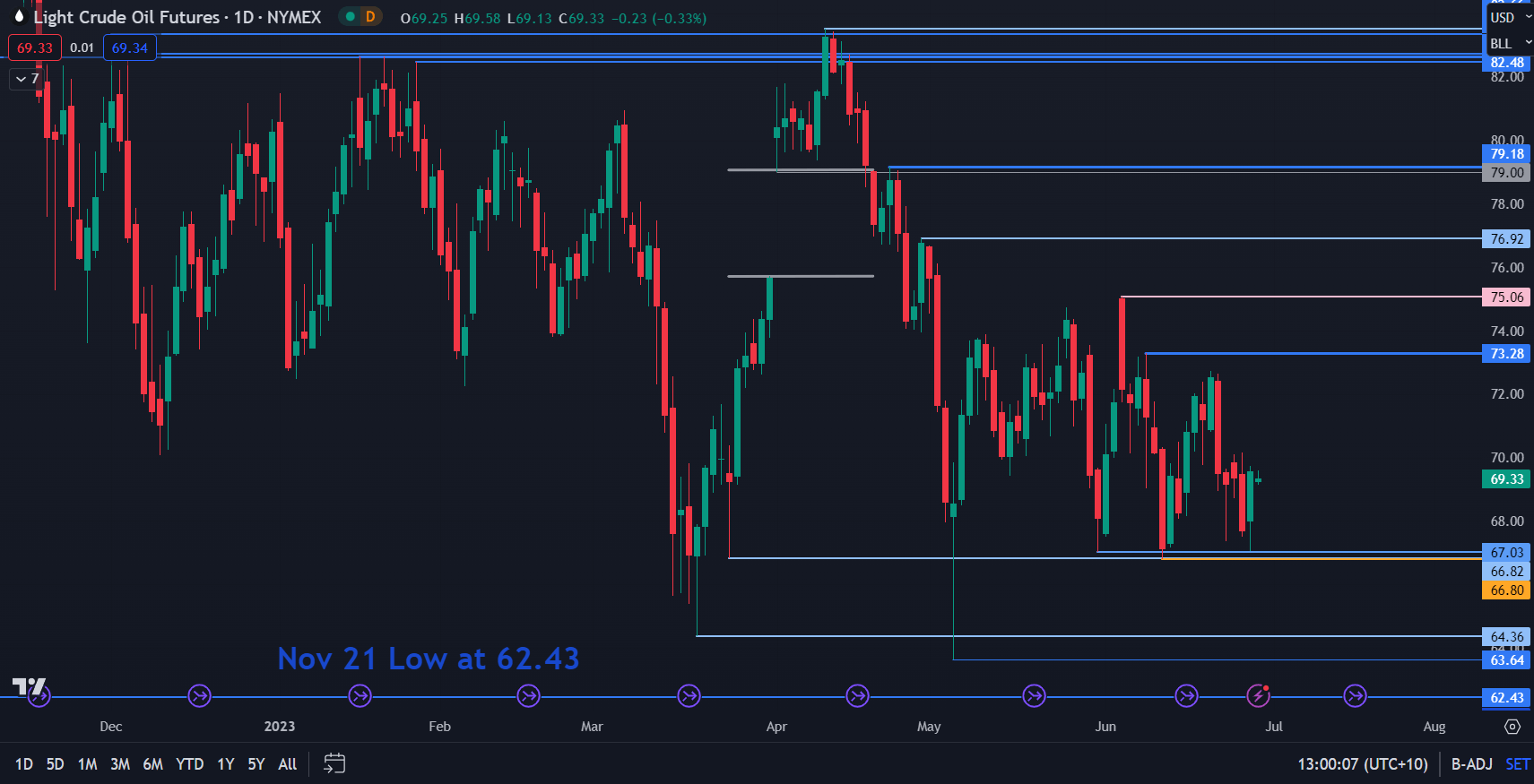

WTI crude continues to range trading conditions with the price contained within 66.80 – 75.06 for more than 9 weeks. More broadly, it has traded between 63.64 and 83.53 for seven months.

With this in mind, previous highs and lows might provide resistance and support respectively.

On the downside, support may lie at 67.03, 66.82, 66.80, 64.36, 63.64 or at the November 2021 low of 62.43.

On the topside, resistance could be at 73.28, 75.06, 76.92 and 79.18 ahead of a cluster of breakpoints and prior peaks in the 82.50 – 83.50 area.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter