EURO FORECAST:

- EUR/USD jumps following the European Central Bank’s policy decision, recapturing a major trendline. Meanwhile, EUR/JPY soars to its highest level in nearly 15 years

- The ECB raised interest rates by 25 basis points and revised higher its inflation projections, signaling more tightening is on the horizon

- Euro’s technical bias is turning more constructive against some of its top peers

Recommended by Diego Colman

Get Your Free EUR Forecast

Most Read: Japanese Yen Outlook Rests on Bank of Japan Stance. USD/JPY Set to Blast Off?

The euro strengthened across the board on Thursday following the European Central Bank’s monetary policy announcement. In late afternoon trading, EUR/USD was gaining around 1.10% to $1.0945, its strongest level in five weeks. Meanwhile, EUR/JPY was performing even better, up 1.25% to ¥153.55, the highest mark in 15 years, a remarkable achievement for the common currency.

Focusing on the drivers, today’s move can be partly attributed to the ECB. The bank raised borrowing costs by 25bp, bringing its deposit facility rate to 3.50% – an unseen level in more than two decades. The institution also revised upwards its inflation forecasts for 2023, 2024 and 2025 by one-tenth of a percent, to 5.4%, 3.0% and 2.2%, respectively.

Regarding the policy outlook, President Lagarde noted that there is more ground to cover to restore price stability and that policymakers are “very likely” to deliver another hike at the July meeting, given that CPI is projected to stay “high for too long”. This guidance prompted a hawkish reassessment of the hiking cycle, with swaps assigning an 80% probability of rates reaching 4% by October.

While there is room for interest rate expectations to drift a little higher for now, the path upwards will be limited considering growing downside economic risks. For instance, if the EU economy continues to deteriorate heading into the summer, traders could begin to unwind hike wagers beyond the July meeting, creating headwinds for the euro, especially against the U.S. dollar.

Recommended by Diego Colman

How to Trade EUR/USD

EUR/USD TECHNICAL ANALYSIS

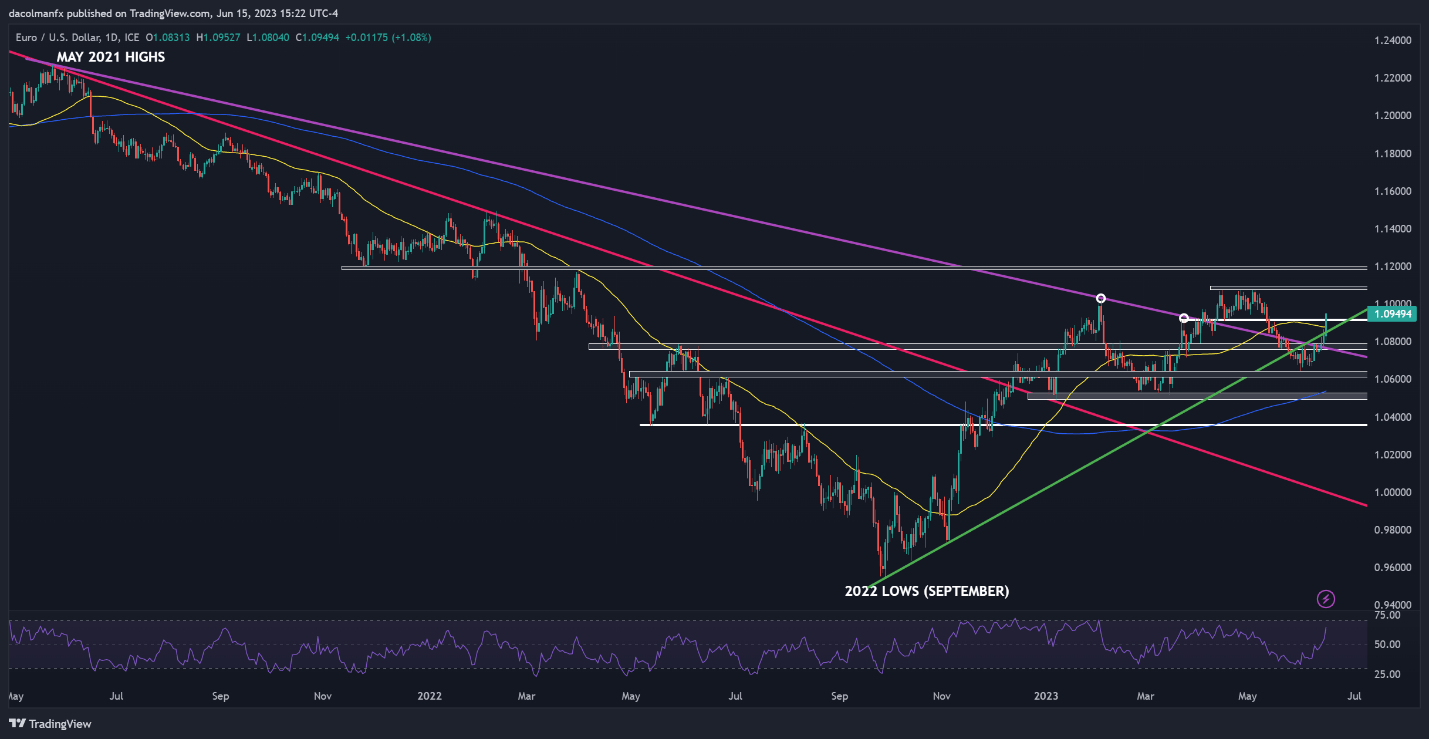

The technical outlook for EUR/USD has improved following the recent rally. The chart below shows two key bullish developments worth noting: 1) the pair has reclaimed the trendline that has guided it higher since late last year, and 2) prices have broken above the 50-day simple moving average.

With sentiment on the med, EUR/USD could continue its trek upwards in the near term, but to do so it needs to close the week above 1.0915. If it does so, buying interest could gain momentum, paving the way for a climb towards the 2023 highs near 1.1090. On further strength, the focus will shift to the psychological 1.1200 level.

On the other hand, if EUR/USD fails to sustain the recent breakout and slides below 1.0915 and then 1.0855, sellers could return to the market, setting the stage for a pullback towards 1.0790/1.0755. While prices may establish a base around these levels before rebounding, a breakdown would likely see a retest of the May lows.

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | 4% | 4% | 4% |

| Weekly | -42% | 34% | -11% |

EUR/USD TECHNICAL CHART

EUR/USD Technical Chart Prepared Using TradingView