GBP Technical and Fundamental Forecast: Mixed

- UK economic data fails to inspire: GDP failed to grow in the month of February

- Markets gear up for a 25 basis point hike in May as rate differential supports GBP/USD

- Main risk events ahead: UK CPI and employment data and high profile US earnings

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free GBP Forecast

UK Economic Data Fails to Inspire – GDP Growth Remains Sluggish

This week, continuing disinflation in the US (headline, not core inflation) saw markets continue to sell dollars which spurred cable to a new yearly high. However, when you look elsewhere, like GBP/CHF or EUR/CHF, the ‘mixed’ performance of sterling is clearer to see.

Chatter from monetary policy committee (MPC) members within the Bank of England (BoE) this week referenced the UK lending conditions, bumpier than expected inflation, and not so exciting fundamental data – UK GDP.

UK GDP showed a modest improvement year on year but the UK economy failed to grow in the month of March but at the same time avoided a contraction, coming in at 0%. The BoE’s Chief Economist Huw Pill mentioned that lending conditions were observed to have “slowed only slightly”, while the MPC remain confident that inflation will be lower in Q2 despite last months failed attempt to bring inflation below double digits.

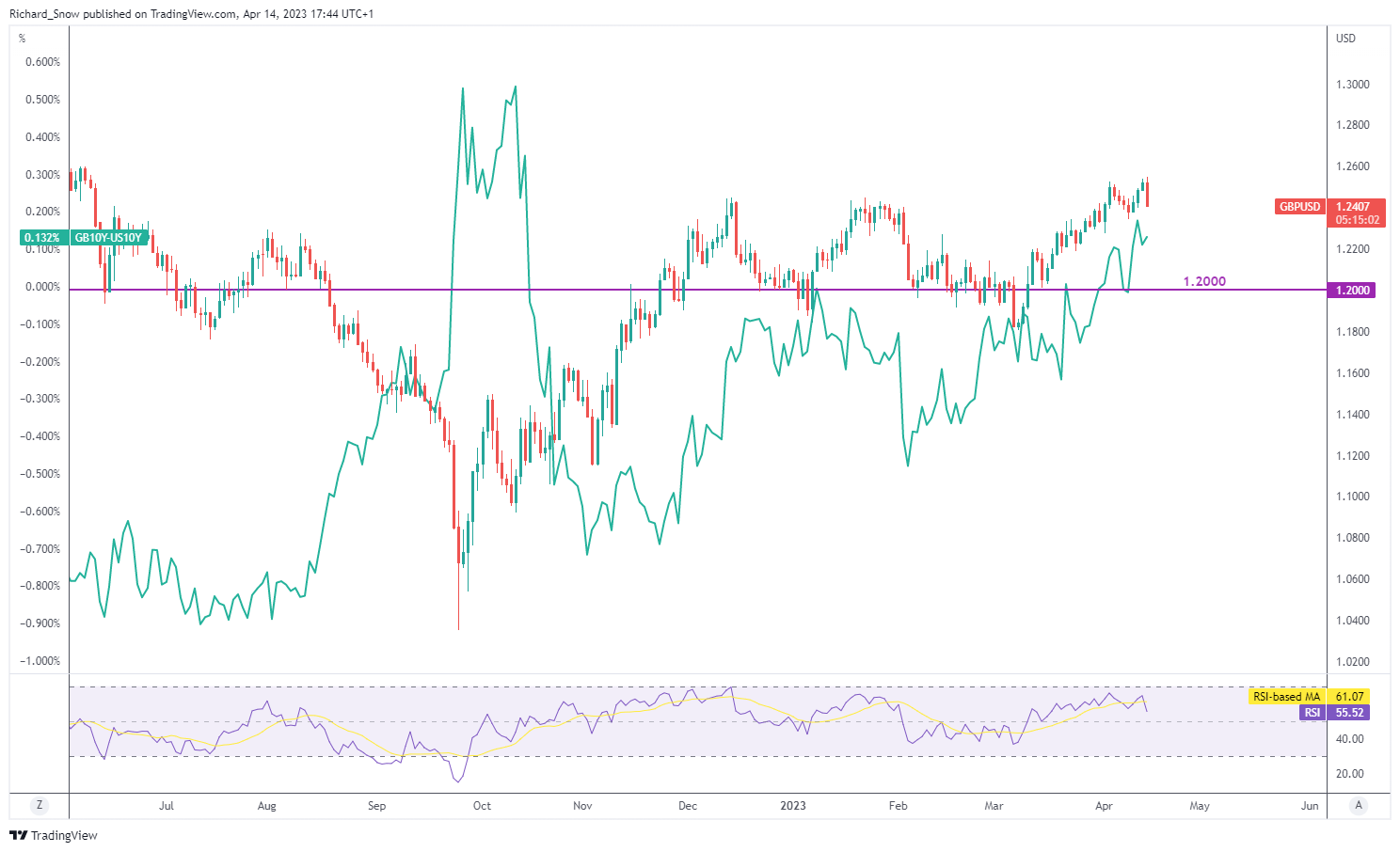

One thing the pound has going for it is a positive and rising interest rate differential against the US. Stronger levels appear to be supporting cable higher at the same time markets are dumping the dollar.

GBP/USD Daily Chart with Interest Rate Differential (Green line)

Source: TradingView, prepared by Richard Snow

Markets Favour a 25 bps Hike in May

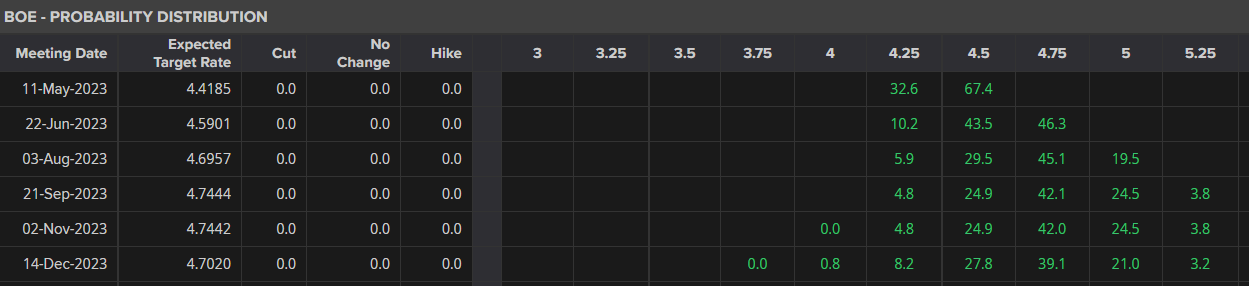

The BoE has another difficult decision to make next month as it considers another potential rate hike, although, the recent stability in the banking sector may have afforded the MPC more room to hike. Dovish BoE member Tenreyro mentioned on Friday that “we need to be patient over the impact of past rate rises on inflation”, signaling that we could see another split vote come May.

Implied market probabilities reveal a growing expectation of a 25-bps hike in May (67% implied probability).

Bank of England Implied Rate Probabilities

Source: TradingView, prepared by Richard Snow

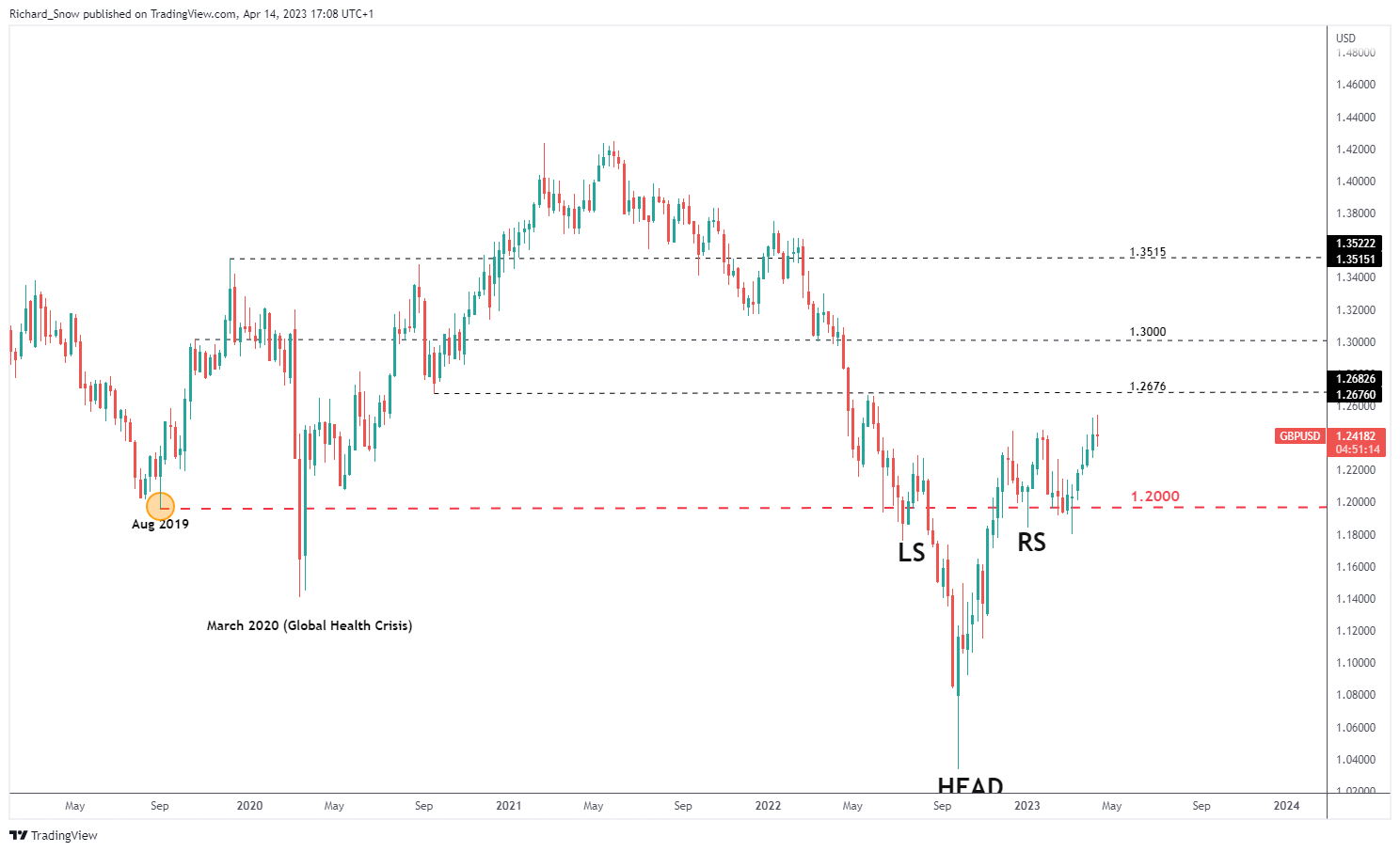

Cable is showing signs of bullish fatigue on a weekly basis as a fairly long upper wick has developed towards the end of the week. GBP/USD bulls will be looking for continuation setups that see resistance around 1.2676, followed by the psychological level all the way at 1.3000. In the event the pair is due for a move lower, support rests at 1.2000.

GBP/USD Weekly Chart

Source: TradingView, prepared by Richard Snow

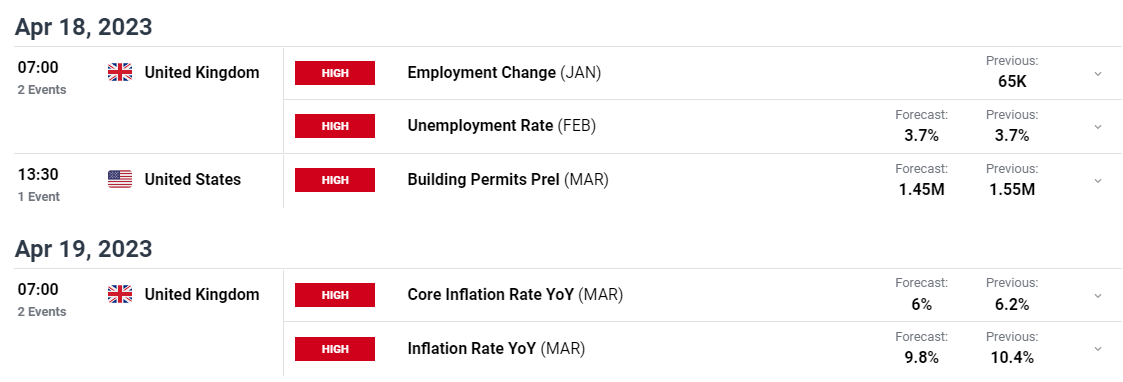

Scheduled Risk Events Ahead

Next week the economic calendar shifts from prior USD data dependence to a more UK centric approach. UK employment data becomes due and later in the week the all-important inflation data for March will reveal if stubbornly high UK prices have cooled below double digits.

Customize and filter live economic data via our DailyFX economic calendar

Another mention is to look out for major US earnings next week from major banks like Goldman Sachs to tech heavyweights like Netflix and Tesla which can all have an impact on the dollar. Stay up to date with the latest releases via our new earnings calendar.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX