Foundational Trading Knowledge

Macro Fundamentals

Recommended by Jun Rong Yeap

Market Recap

Market participants piled back into tech stocks overnight, as a retreat in the US 10-year Treasury yields from its 16-year high eases some market anxiety for a high-for-longer rate outlook. Downside surprises in US flash purchasing managers index (PMI) numbers have reflected a sharper moderation in demand for both the manufacturing (47 vs 49.3 forecast) and services (51 vs 52.2 forecast) sectors, which may challenge hawkish bets. This follows after bond yields turned lower in Europe on weaker-than-expected PMI readings as well. The S&P 500 now seems to be eyeing a reclaim of its 50-day moving average (MA), which has given way just last week.

Bullish bets on Nvidia have also paid off. While its valuation has been lofty (price-to-sales at 45), its outperformance on all fronts continue to show no signs of slowing in growth momentum, which provides the much-needed justification. Both its top and bottom-line have smashed expectations, while this quarter’s revenue guidance was also revised upwards ($16 billion versus $12.61 billion consensus) – 27% higher than estimates. To top it off, the company has authorised $25 billion in share buybacks.

Ahead, the next highlight on the calendar will be Federal Reserve Chair Jerome Powell’s speech at Jackson Hole, which will be due tomorrow (25 August, 10:05pm SGT). Until then, sentiments may continue to bask in the US AI/tech optimism, while keeping an eye on US jobless claims and durable goods orders, where any softer read may be looked upon to further cool tightening bets.

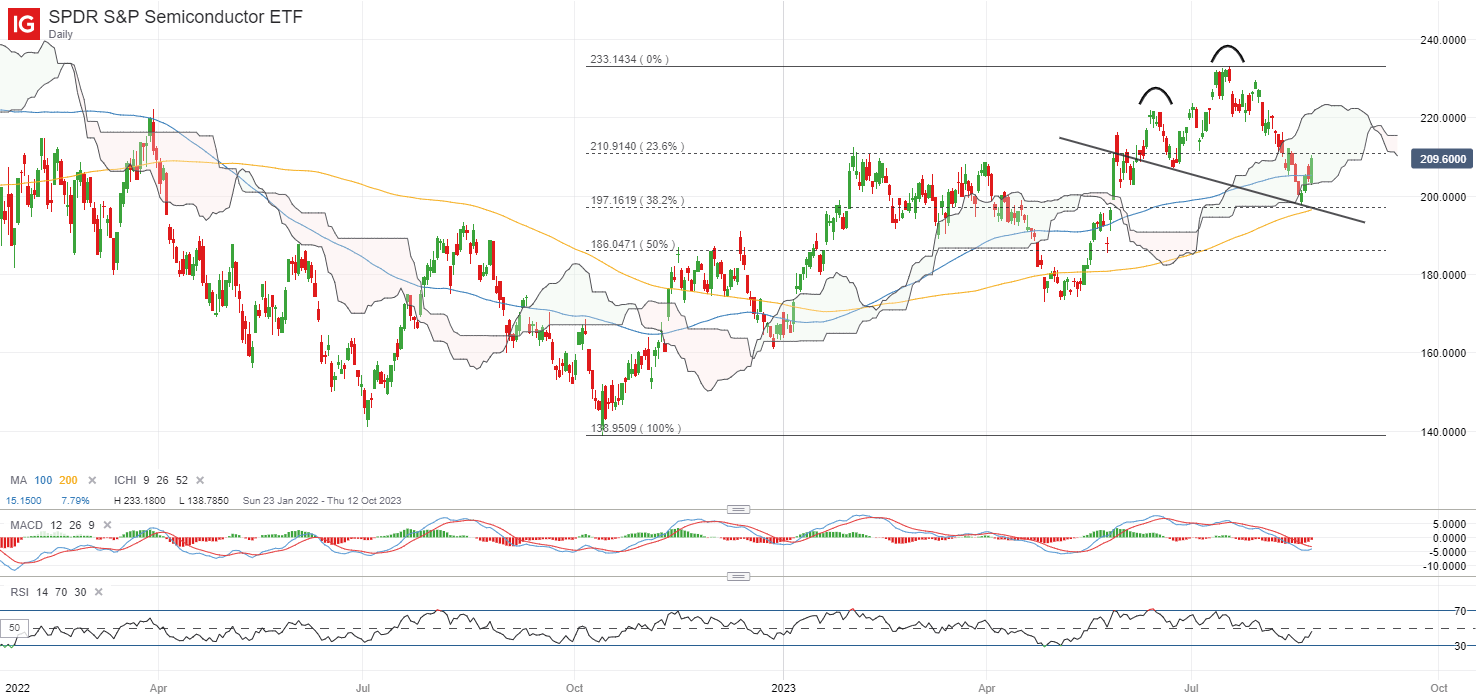

Perhaps one to watch may be the SPDR S&P Semiconductor ETF, which has seen a bounce off a support confluence lately (Ichimoku cloud support, 38.2% Fibonacci level). The February 2023 high at the 210.90 level will be an immediate resistance to overcome ahead, in order to pave the way to retest the 222.64 level next. A strong positive follow-through may be needed however, given that any turn lower could still run the risks of a potential head-and-shoulder formation.

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 0% | -1% |

| Weekly | 21% | -10% | 0% |

Source: IG charts

Asia Open

Asian stocks look set for a more lukewarm open, with Nikkei +0.27%, ASX +0.40% and KOSPI +0.73% at the time of writing. A retreat in US bond yields, alongside a weaker US dollar and a sharp decline in volatility (VIX -5.8%) may allow the risk environment to find some relief from recent bearish sentiments. The Nasdaq Golden Dragon China Index is up 1.5% overnight, potentially setting a more positive backdrop for Chinese equities into today’s session, although much await on any sustained follow-through, given the still-weak underlying fundamentals.

Interest rate decision was out from the Bank of Korea (BOK) this morning, largely meeting market expectations for further rate pause as inflation continues to moderate while growth conditions have been weaker-than-expected over the past month (downside surprises in 2Q GDP, industrial output, trade activities). The day ahead is expected to see interest rate decision from Bank Indonesia, with a no-change in policy rate likely to be the story as well.

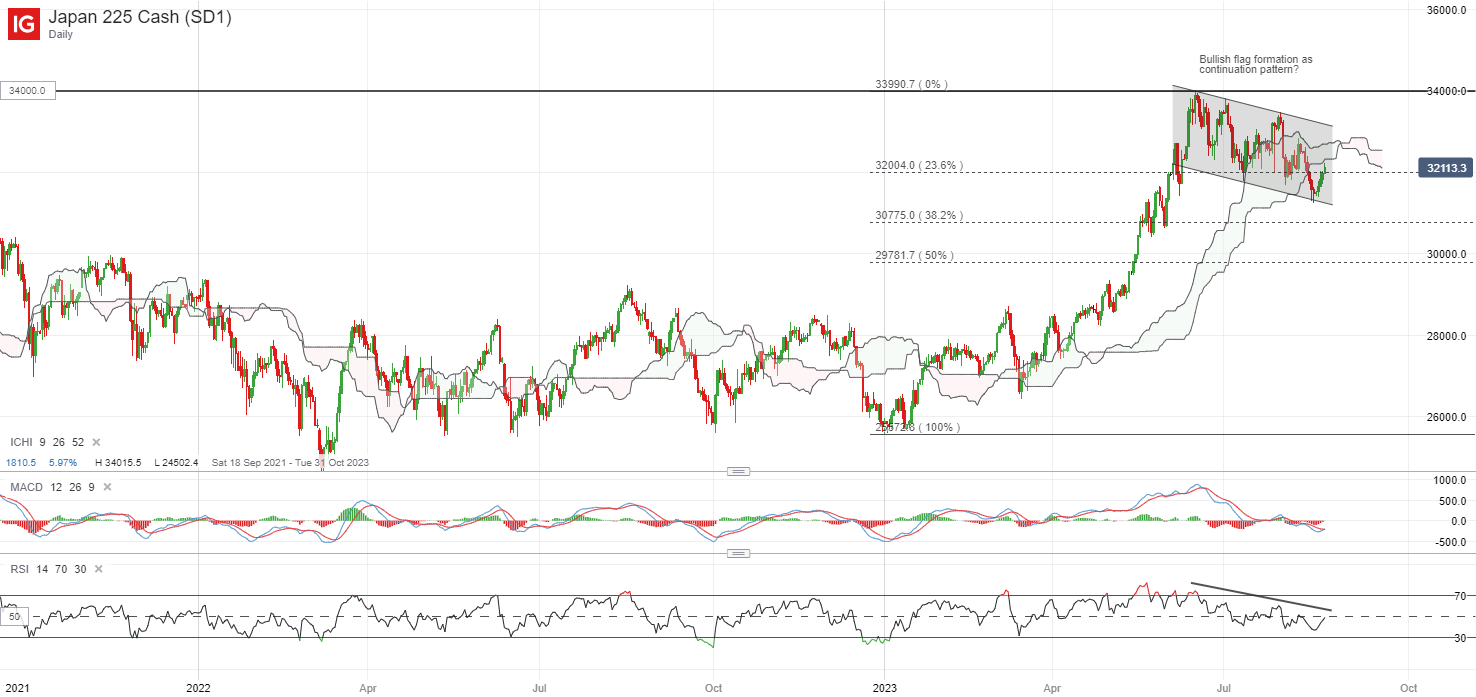

Aside, the Nikkei 225 index continues to trade within a bullish flag formation, recently finding its footing from the lower channel trendline support with some dip-buying (bullish hammer candlestick on daily chart). Any subsequent break above the channel pattern may be on watch to validate buyers in greater control, with the flag formation’s price target potentially leaving a retest of its all-time high at the 38,195 level on the table. On the other hand, any failure for the lower channel trendline support to hold may leave the 30,400 level on watch next.

Source: IG charts

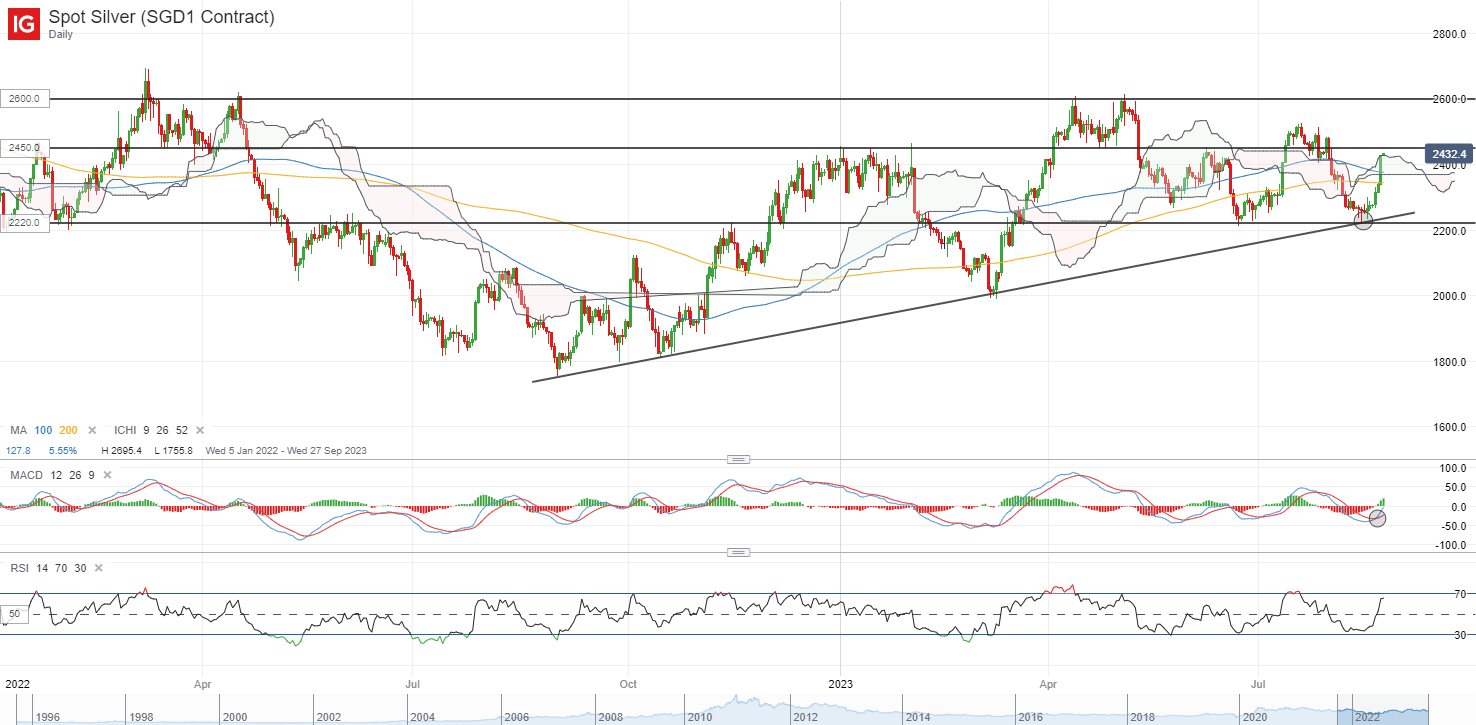

On the watchlist: Can silver prices retest its year-to-date high?

Silver prices have been gaining for the fifth straight day, with lower US bond yields and a weaker US dollar overnight providing the catalysts for another 3.8% jump, extending its gains for the week to 6.9%. This follows after bouncing off a support confluence at the US$22.20 level, with a bullish crossover formed on its moving average convergence/divergence (MACD) on the daily chart. Immediate resistance at the US$24.50 level will be on watch next, where moving past this level may potentially pave the way to retest its year-to-date high at the US$26.00 level.

Recommended by Jun Rong Yeap

Building Confidence in Trading

Source: IG charts

Wednesday: DJIA +0.54%; S&P 500 +1.10%; Nasdaq +1.59%, DAX +0.15%, FTSE +0.68%