US Dollar Weekly Forecast: Bullish

- The US Dollar experienced the best week of the year so far

- CPI & consumer inflation expectations cooled Fed rate cut bets

- Focus shifts to retail sales, jobless claims, Jerome Powell’s speech

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

Fundamental Analysis

The US Dollar roared higher against its major counterparts this past week, seeing the best 5-day period this year so far. Looking at EUR/USD, for example, the pair rocketed higher by about 1.6%, representing a somewhat rare event. By far the worst-performing currencies were the sentiment-linked Australian and New Zealand Dollars, with AUD/USD and NZD/USD sinking this past week.

As the week wrapped up, much attention was placed on the latest University of Michigan Sentiment report. It showed that consumer expectations for inflation 1 year out, and 5-10 years about, surprised higher than expected. This is despite the sentiment gauge itself missing expectations. Most Americans are still concerned about rising prices, and that may have economic consequences down the road.

Earlier in the week, the latest US CPI report crossed the wires. While headline inflation surprised slightly lower at 4.9%, the core gauge (which excludes volatile components) was in-line at 5.5%. This means that underlying price pressures are remaining sticky. As a result, this past week, traders continued to slowly price out near-term Federal Reserve rate hike expectations.

Treasury yields climbed on Friday and risk appetite soured, pushing higher the US Dollar. The US economic calendar notably quiets down in the week ahead. Key data to watch for includes retail sales, MBA mortgage applications and initial jobless claims. The latter is slowly creeping higher, an early sign of the labor market beginning to deteriorate, although it remains tight.

Things will probably get the most interesting at the end of the week. Fed Chair Jerome Powell and former Chair Bernanke will be participating in a policy panel. If Mr. Powell continues to pour cold water on near-term rate cut expectations, financial markets could be heading for a volatile week. That stands to bode well for the haven-linked and policy-sensitive US Dollar.

Recommended by Daniel Dubrovsky

Top Trading Lessons

Technical Analysis

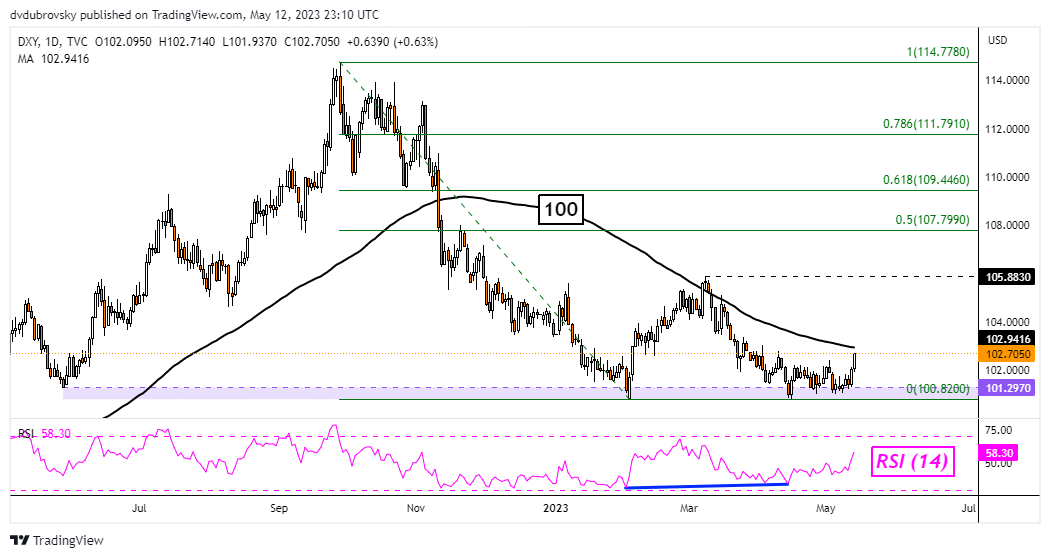

On the daily chart, the DXY Dollar index soared 1.4% this past week. This represented the highest close since late March. Once again, prices were unable to breach the critical 100.82 – 101.29 support zone from last year. Immediate resistance seems to be the 100-day Simple Moving Average (SMA). The latter could reinstate the dominant downtrend, as it did in March. Otherwise, extending higher exposes 105.88.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

DXY Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com