US Dollar, ISM Manufacturing, RBA, Bear Flag – Asia Pacific Market Open:

- The US Dollar declined following softer ISM Manufacturing data

- Traders are focused on the Fed pivot rather than recession woes

- RBA in focus during Tuesday Asia trade, DXY eyeing key support

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

Asia-Pacific Market Briefing – Eyes on the RBA

The US Dollar underperformed against its major counterparts on Monday, with the DXY Dollar Index falling about 0.5%. That was the worst single-day performance since March 22nd and continues the string of losses since the most recent top in early March. Meanwhile, the sentiment-linked Australian Dollar outperformed its major counterparts.

Over the past 24 hours, the latest US ISM Manufacturing Index crossed the wires, and it was rather disappointing. In March, the reading clocked in at 46.3 compared to the 47.5 estimated, down from 47.7 in February. Readings below 50 indicate increasingly contracting economic activity. Factory activity continued weakening amid rising interest rates and concerns about tighter lending conditions.

However, markets were not terribly concerned about the downside implications as Wall Street mostly finished in the green. The 2-year Treasury yield took a lot of damage, falling 1.41%. That continued speaking to increasingly dovish Federal Reserve policy expectations. That said, the US Dollar was higher y/y in Q1 2023 as ISM weakened, underscoring the US Dollar Smile Theory.

Turning to Tuesday’s Asia-Pacific trading session, the key event risk will be the Reserve Bank of Australia’s interest rate announcement. The 11-month tightening cycle is expected to pause with interest rates set to be left unchanged at 3.6% following recent signs of ebbing inflation and growth. That said, markets are still cautiously pricing in a potential hike in April or May. This means that if the RBA strongly hints at concluding its tightening cycle, then AUD/USD could be poised to rally.

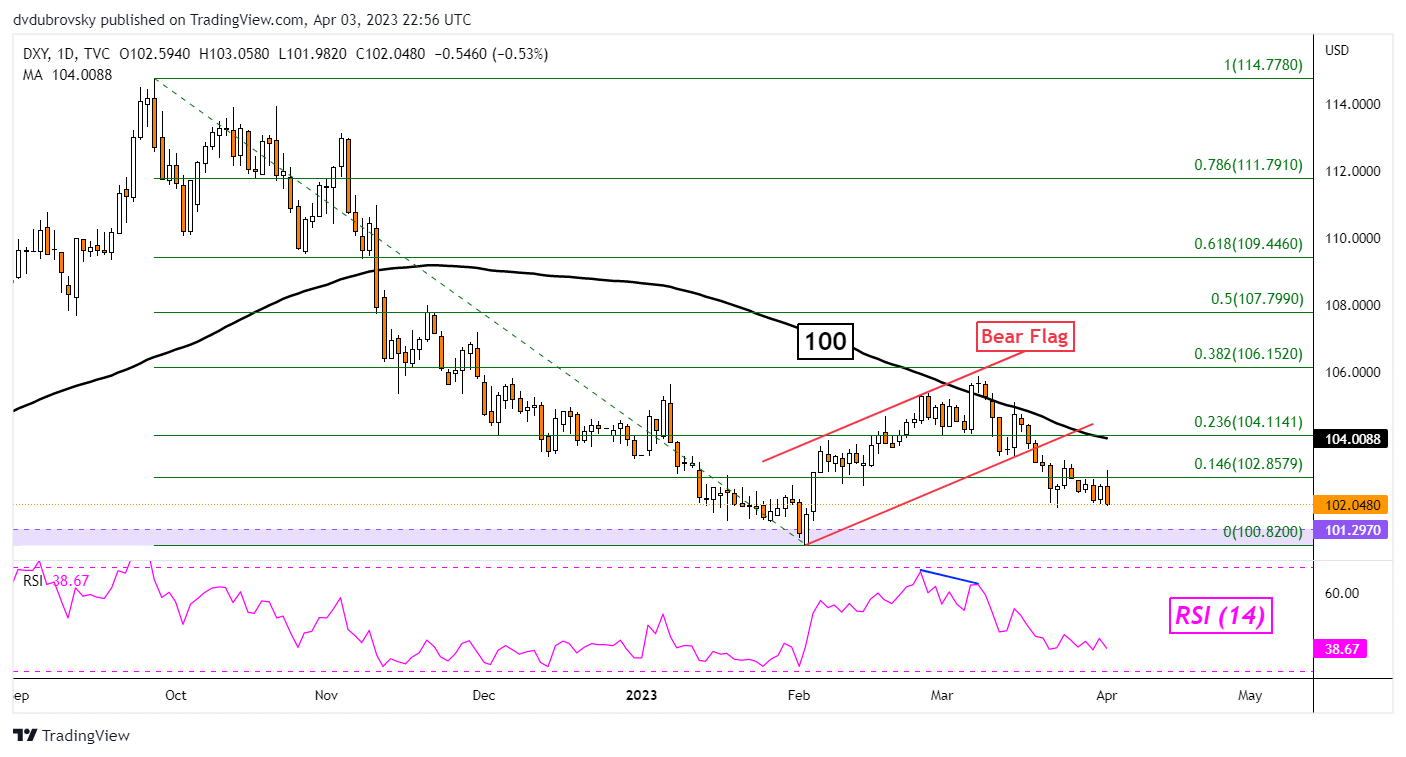

US Dollar Technical Analysis

The DXY Index continues to aim lower in the anticipated downward trajectory implied by a Bear Flag chart formation. This is because the 100-day Simple Moving Average continues to offer a downside bias. This means the US Dollar is quickly approaching what is likely going to be a pivotal momentum around the 100.82 – 101.29 support zone. Clearing this zone would open the door to extending the near-term downside bias.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX