Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

JAPANESE YEN FORECAST – USD/JPY TECHNICAL ANALYSIS

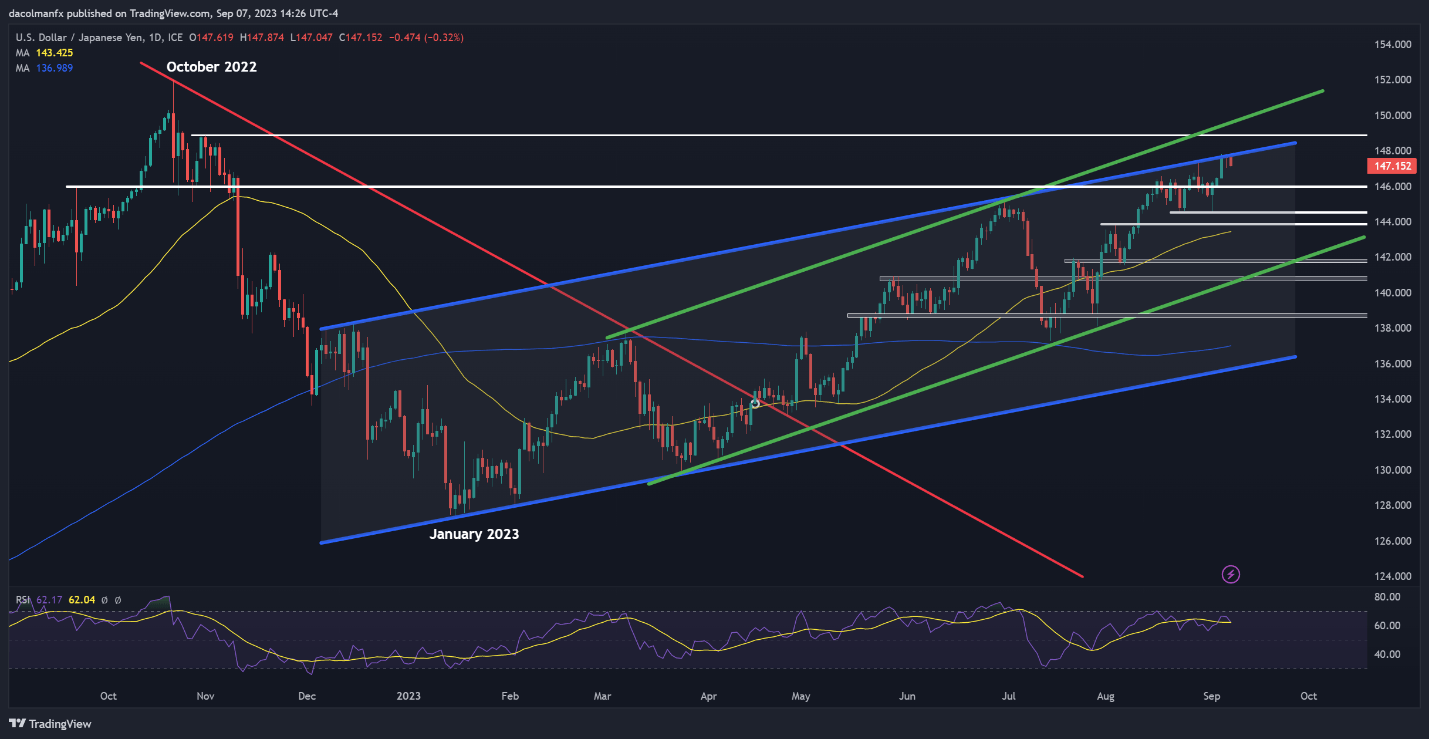

USD/JPY rallied and rose to its highest level since November 2022 earlier in the week, but began to retreat after failing to clear channel resistance in the 147.85 area. Despite this setback, it’s essential to note that the pair remains in a solid uptrend, characterized by a consistent pattern of higher highs and higher lows.

Although USD/JPY’s prevailing bias remains constructive, there is a possibility that the price could enter a consolidation phase in the near term before embarking on its next upward move. This consolidation phase may translate into a period of range trading and lower volatility.

Looking ahead to a potential resurgence, initial resistance looms near the psychological 148.00 mark, but further gains may be in store on a push above this ceiling, with the next upside target located at 148.80. On further strength, buying impetus could gather pace in FX markets, setting the stage for a possible retest of the 2022 highs around the 152.00 handle.

On the contrary, if the bullish scenario doesn’t come to fruition and sellers regain dominance, technical support rests at 145.90, and 144.55 thereafter. It’s conceivable that the price may establish a base in this region during a pullback, but in the event of a breakdown, the bears may launch an attack on 143.85. A successful breach of this floor might reinforce downward pressure, opening the door to a move to 141.75.

Decode price action and stay ahead of USD/JPY trends. Download the sentiment guide to understand how positioning can offer clues about the market direction!

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | -6% | 8% | 5% |

| Weekly | -8% | 0% | -2% |

USD/JPY TECHNICAL CHART

USD/JPY Chart Prepared Using TradingView

Download our sentiment guide for valuable insights into how positioning may influence GBP/JPY trends

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | 4% | -3% | -1% |

| Weekly | 11% | -15% | -8% |

JAPANESE YEN OUTLOOK – GBP/JPY TECHNICAL ANALYSIS

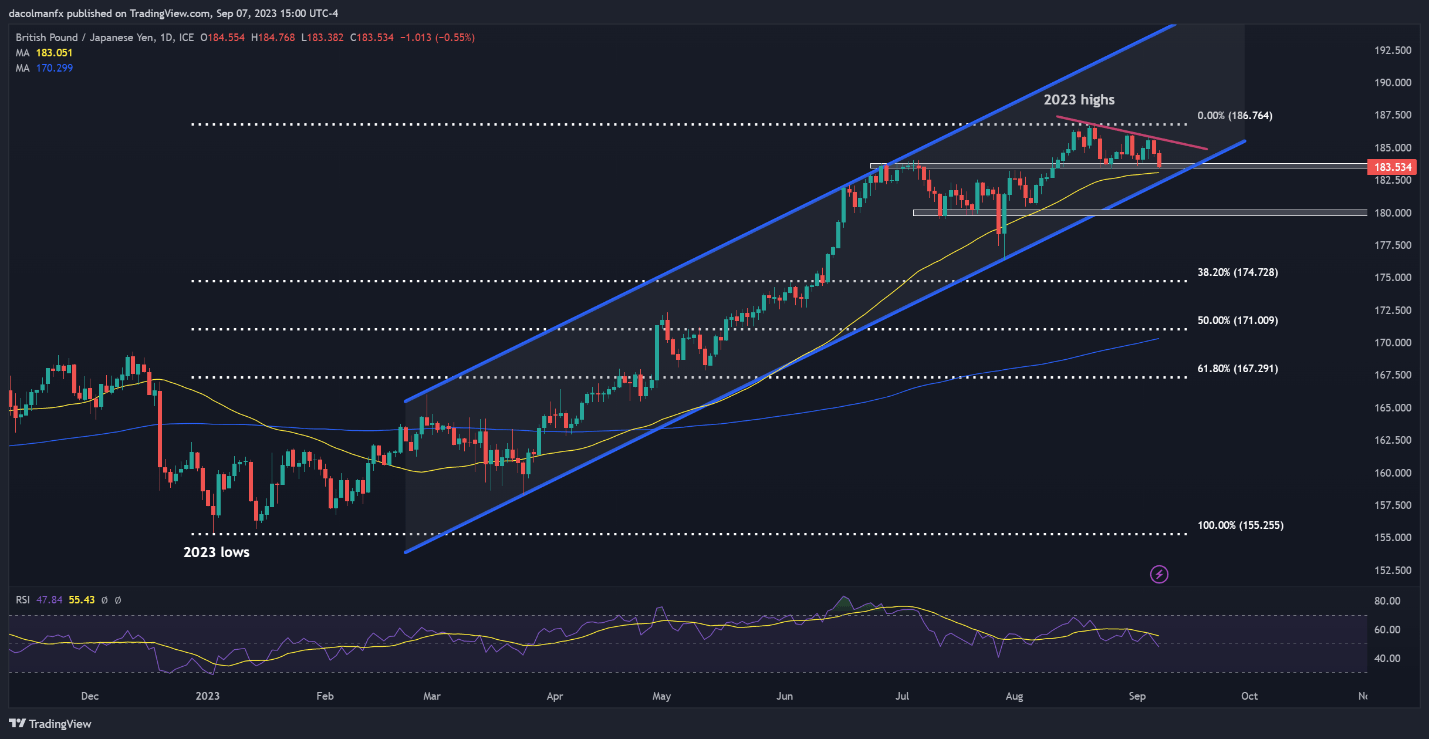

GBP/JPY displayed a robust uptrend from late July, extending well into August. However, the upward momentum began to wane after a failed attempt to break above overhead resistance in the 186.75 area, with prices retreating in recent days, guided lower by a short-term dynamic trendline extended from the 2023 high.

In the event of continued softness, initial support zone is situated at 183.30-183.00, followed by the critical level of 182.00, which aligns with the lower boundary of a medium-term ascending channel. While this region may provide a buffer against further downside, a breakdown could intensify the bearish pressure, paving the way for a decline toward the 180.00 handle.

On the flip side, if buyers regain control of the market and spark a solid rebound off current levels, trendline resistance is positioned at 185.35. Successfully piloting above this barrier could bolster bullish momentum, emboldening market participants to launch an assault on this year’s peak.

GBP/JPY TECHNICAL CHART

GBP/JPY Chart Prepared Using TradingView